Om Metallogic Limited, a Haryana-based aluminium recycling company, is set to launch its Initial Public Offering (IPO) on September 29, 2025. The company aims to raise ₹22.35 crores through a 100% fresh issue of shares on the BSE SME platform. The issue is offered at a fixed price of ₹86 per share, with a minimum investment lot size of 1,600 shares. While the company has shown impressive profit growth, potential investors must scrutinise the significant risks, particularly its extreme dependence on a handful of customers. The Grey Market Premium (GMP) is yet to become active.

In this article, you will find Om Metallogic IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Om Metallogic IPO Details

- Price Band: Fixed Price of ₹86 per share

- IPO Open / Close Dates: September 29, 2025 – October 1, 2025

- Lot Size: 1,600 Shares

- Issue Size: 25,98,400 shares (aggregating up to ₹22.35 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Skyline Financial Services Pvt Ltd

- Listing Exchange: BSE SME

Om Metallogic IPO GMP Today

- The shares of Om Metallogic are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically emerges closer to the IPO opening date.

Om Metallogic IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 29, 2025 – October 1, 2025

- Basis of Allotment Date: October 3, 2025

- Refund Initiation Date: October 6, 2025

- Credit of Shares: October 6, 2025

- Listing Date: October 7, 2025

Objectives of Om Metallogic IPO

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Capital Expenditure (₹2.31 Crores): For the purchase of new machinery to enhance its manufacturing capabilities.

- Working Capital Requirements (₹8.50 Crores): To fund its day-to-day operational needs.

- Debt Repayment (₹5.50 Crores): A significant portion is allocated to reduce its borrowings, which will lower finance costs and strengthen the balance sheet.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Also learn: Initial Public Offers: IPO Reviews of India

Financial Performance of Om Metallogic

Particulars (₹ in Lakhs) | 10M Ended 31-Jan-25 | FY Ended 31-Mar-24 | FY Ended 31-Mar-23 | FY Ended 31-Mar-22 |

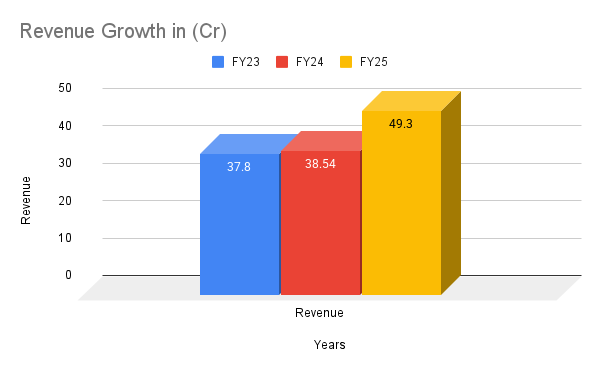

Revenue from Operations | 4,930.16 | 3,854.50 | 3,780.64 | 4,126.58 |

Other Income | 37.67 | 36.82 | 3.15 | 2.1 |

Total Income | 4,967.83 | 3,891.32 | 3,783.79 | 4,128.68 |

Total Expenses | 4,598.06 | 3,595.16 | 3,636.45 | 4,107.52 |

Profit Before Tax (PBT) | 369.77 | 296.16 | 147.33 | 21.15 |

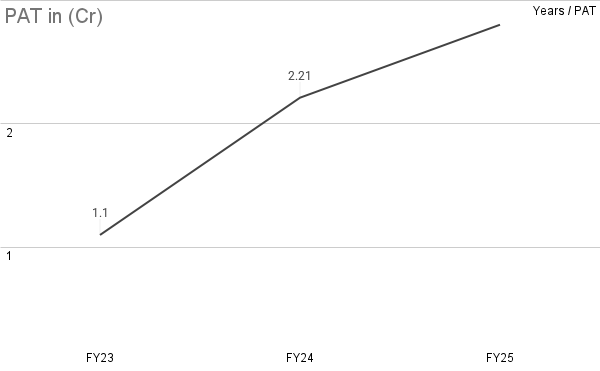

Profit After Tax (PAT) | 279.73 | 221.6 | 110.25 | 15.65 |

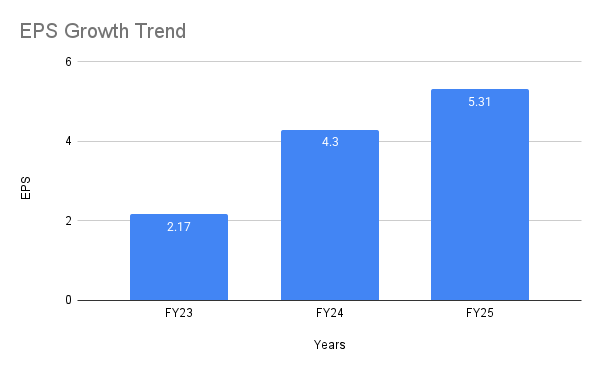

EPS (Basic & Diluted) (₹) | 5.31 | 4.3 | 2.17 | 0.31 |

While the company's revenue has been volatile, its profitability has seen a spectacular jump. The Profit After Tax (PAT) has multiplied over 13 times from FY22 to FY24, and its PAT margin has expanded from a mere 0.38% to 5.75% in the same period.

This indicates a significant improvement in operational efficiency. Based on its FY24 earnings, the IPO is priced at a P/E multiple of 20x, which appears reasonable if the company can sustain this growth.

Industry Outlook

- Om Metallogic operates in the aluminium recycling sector, a critical part of India's metal industry.

- The demand for recycled aluminium is on the rise, primarily driven by the automotive sector's shift towards lightweight materials, especially for electric vehicles (EVs).

- Recycling is also highly energy-efficient, using 95% less energy than primary production.

- The overall India Aluminium Market is projected to grow at a healthy CAGR of 6.27% through 2030, providing a favourable backdrop for the company's operations.

Strengths and Risks of Om Metallogic IPO

Strengths:

- Stellar Profit Growth: The company has demonstrated exceptional growth in profitability and margin expansion over the last three years.

- Favourable Industry Dynamics: Operates in a sunrise sector with strong demand drivers from the automotive and infrastructure industries.

- Prudent Use of Funds: A significant portion of the IPO proceeds will be used for debt reduction, a positive sign for financial health.

Risks:

- Extreme Customer Concentration: This is the single biggest red flag. For the 10 months ended January 2025, the top 5 customers accounted for 96.11% of the company's revenue. The loss of even one of these clients could severely cripple the business.

- Geographical Concentration: With a single manufacturing facility in Haryana and over 95% of its sales coming from the same state, the company is highly vulnerable to local economic or operational disruptions.

- History of Non-Compliance: The prospectus discloses 28 instances of delayed statutory filings with the RoC. While the penalties were minor, this points to potential weaknesses in its corporate governance and compliance culture.

- SME Segment Risks: The stock will be listed on the BSE SME platform, which typically has lower liquidity and higher price volatility compared to the mainboard.

Also check: Zappfresh IPO GMP, Price, Dates, Allotment, Review

Ameenji Rubber IPO GMP Today – Grey Market Premium Updates

Expert Recommendations – Should You Apply?

High Risk

Om Metallogic presents a high-risk, high-reward proposition. The impressive financial turnaround is tempting, but the underlying business risks are too significant to ignore.

- For Risk-Averse Investors: AVOID. The extreme customer concentration is a deal-breaker for any conservative investor. The business's stability is completely dependent on the health of just a few clients.

- For Aggressive Investors: APPLY WITH HIGH CAUTION. Investors with a very high-risk appetite, who are betting on the company's ability to diversify its client base in the future, might consider a small, speculative allocation.

- Our View: The risk profile is heavily skewed to the downside. The lack of customer diversification makes the business model fragile. A prudent approach would be to wait and watch the company's performance and client diversification efforts post-listing.

If you’re also interested in exploring long-term investment options, check out our detailed guide on Elss Mutual Funds

Key Takeaways

- IPO Price: ₹86 per share (Fixed Price)

- Lot Size: 1,600 Shares (Minimum retail investment is for 2 lots or 3,200 shares, amounting to ₹2,75,200)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Allotment on Oct 3, Listing on Oct 7, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid for most retail investors due to extreme customer dependency.

FAQs on Om Metallogic IPO

1. What is Om Metallogic IPO GMP today?

Currently, the GMP for the Om Metallogic IPO is ₹0, as it is not yet being traded in the grey market.

2. What is Om Metallogic IPO price?

The issue price for the Om Metallogic IPO is fixed at ₹86 per share.

3. What is Om Metallogic IPO allotment date?

The allotment of shares is expected to be finalized on Friday, October 3, 2025.

4. How to check Om Metallogic IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

5. What is Om Metallogic IPO listing date?

The company's shares are scheduled to be listed on the BSE SME platform on Tuesday, October 7, 2025.

6. Should I apply for Om Metallogic IPO?

This is a high-risk proposition. Given the extreme customer concentration where the top 5 clients contribute over 96% of revenue, it is advisable for most retail investors to avoid this IPO.

Also check: Glottis Limited IPO GMP, Price, Dates, Allotment, Review

Disclaimer: The information provided about IPOs, including GMP, price, dates, and allotment status, is for educational and informational purposes only. We do not provide financial advice or investment recommendations. IPO investments are subject to market risks. Please consult with your financial advisor before making any investment decisions.