The much-anticipated Initial Public Offering (IPO) of Tata Capital Limited, the flagship financial services arm of the esteemed Tata Group, is set to hit the market on October 6, 2025. This mammoth issue, one of the largest from the Tata stable in years, comprises a fresh issue to fuel the company's growth and a significant Offer for Sale (OFS) by its promoter, Tata Sons. With the price band now fixed at ₹310 to ₹326 per share, the issue is poised to attract significant investor interest.

Early signals from the grey market, with a GMP of around ₹28, suggest a decent listing day premium is on the cards.

In this article, you will find Tata Capital IPO GMP today, subscription status, allotment date, and a detailed, unbiased review to help you make an informed decision.

Tata Capital IPO Details

- Price Band: ₹310 – ₹326 per share

- IPO Open / Close Dates: October 6, 2025 – October 8, 2025

- Lot Size: 46 Shares

- Issue Size: 47,58,24,280 shares (aggregating up to ₹15,511.87 Crores)

- Fresh Issue: ₹6,846.00 Crores

- Offer for Sale (OFS): ₹8,665.87 Crores

- Registrar: MUFG Intime India Private Limited

- Listing Exchange: BSE & NSE

Tata Capital IPO GMP Today

- The current Grey Market Premium (GMP) of ₹28 suggests a potential listing premium of around 8-9% over the upper price band. GMP is an unofficial indicator and changes frequently based on market sentiment and subscription demand.

Tata Capital IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 6, 2025 – October 8, 2025

- Basis of Allotment Date: October 9, 2025

- Refund Initiation Date: October 10, 2025

- Credit of Shares: October 10, 2025

- Listing Date: October 13, 2025

Also Check: Tata Capital IPO Allotment Status – How to Check Online

You may be interested in: Advance Agrolife IPO Allotment Status – How to Check Online

Zelio E-Mobility IPO Allotment Status – How to Check Online

Objectives of Tata Capital IPO

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Fresh Issue: The entire proceeds from the fresh issue (₹6,846 crores) will be used to augment the company's Tier-I capital base. This will strengthen its balance sheet, support future loan book growth, and ensure compliance with regulatory capital requirements.

- Offer for Sale: The proceeds from the OFS (₹8,665.87 crores) will go directly to the selling shareholders, primarily the promoter Tata Sons, and will not be received by the company.

You can check: Tata Capital IPO Subscription Status – Day 1, Day 2 & Day 3

Also check: Advance Agrolife IPO Subscription Status – Day 1, Day 2 & Day 3

Zelio E-Mobility IPO Subscription Status – Day 1, Day 2 & Day 3

Financial Performance of Tata Capital

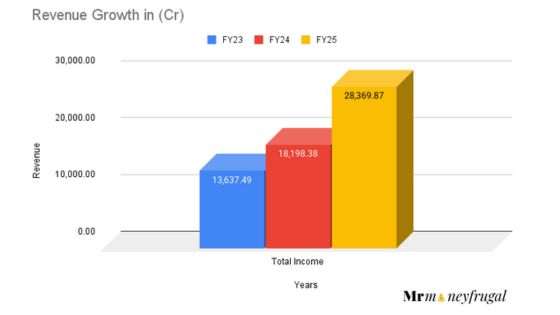

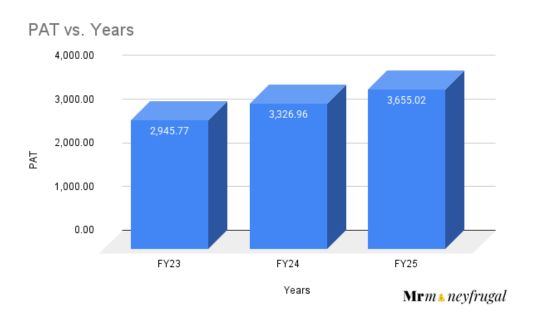

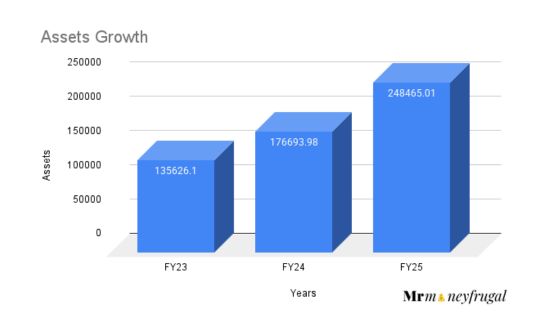

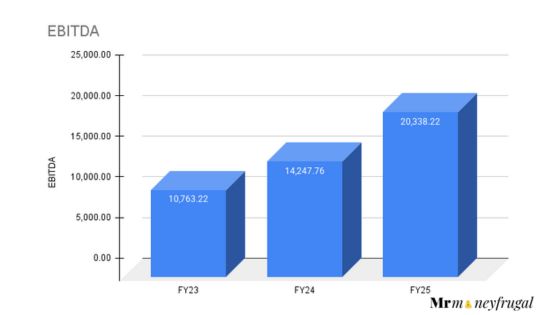

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 2,52,254.28 | 2,48,465.01 | 1,76,693.98 | 1,35,626.10 |

Total Income | 7,691.65 | 28,369.87 | 18,198.38 | 13,637.49 |

Profit After Tax | 1,040.93 | 3,655.02 | 3,326.96 | 2,945.77 |

EBITDA | 5,565.86 | 20,338.22 | 14,247.76 | 10,763.22 |

NET Worth | 32,761.73 | 32,587.82 | 23,540.19 | 17,959.06 |

Reserves and Surplus | 29,260.88 | 24,299.36 | 18,121.83 | 11,899.32 |

Total Borrowing | 2,11,851.60 | 2,08,414.93 | 1,48,185.29 | 1,13,335.91 |

Tata Capital has demonstrated a consistent and robust financial performance.

The company's total income grew by an impressive 56% in FY25, while its profit after tax (PAT) rose by 10%.

The loan book has expanded significantly, reflecting strong business momentum.

However, investors should note that the Return on Equity (RoE) has seen a declining trend, from 20.6% in FY23 to 12.6% in FY25, which could be a result of a rapidly expanding equity base. Asset quality remains stable, with a Gross Stage 3 (NPA) ratio of 1.9% as of March 2025. Based on its FY25 earnings, the IPO is priced at a P/E multiple of around 33x-35x.

Industry Outlook

- As the third-largest diversified NBFC in India, Tata Capital is a behemoth in the country's financial landscape.

- The Indian NBFC sector is poised for continued growth, driven by rising credit demand from both retail and corporate segments, government focus on infrastructure, and increasing financial inclusion.

- Large, well-capitalized, and trusted brands like Tata Capital are expected to be the biggest beneficiaries of this trend, capturing market share from smaller players.

Looking to save tax while investing? Check our detailed guide on ELSS Mutual Funds here

Strengths and Risks of Tata Capital IPO

Strengths:

- Unmatched Brand and Parentage: Backed by the Tata Group, the company enjoys unparalleled brand trust and credibility, which is a massive advantage in the financial services sector.

- Market Leadership and Scale: Its position as a top-3 diversified NBFC with a comprehensive product suite provides a strong competitive moat.

- Strong Financial Track Record: The company has been consistently profitable since its inception, with a resilient and growing business model.

- Highest Credit Rating: A "AAA/Stable" domestic rating allows the company to access funds at a competitive cost, protecting its margins.

- Robust Risk Management: The company has maintained stable asset quality, which is a testament to its prudent underwriting and risk management framework.

Risks:

- Large Offer for Sale (OFS): A significant portion of the IPO is an OFS where the promoter is selling its stake. While common in large IPOs, this means a substantial part of the funds raised will not go into the company.

- Declining Profitability Ratios: While absolute profits are growing, key metrics like Return on Equity (RoE) and Provision Coverage Ratio have declined in recent years.

- Interest Rate Sensitivity: As an NBFC, the company's margins are susceptible to changes in the interest rate environment.

- Significant Litigation: The prospectus details outstanding litigation against the company and its promoter involving substantial amounts, which investors should be aware of.

Expert Recommendations – Should You Apply?

Subscribe for Long-Term

The Tata Capital IPO is one of the most awaited public issues in recent times, and for good reason. It offers retail investors a chance to own a piece of a blue-chip financial powerhouse backed by India's most trusted corporate group.

- For All Investors: This is a "must-have" for any long-term portfolio. The combination of strong parentage, market leadership, and consistent financial performance makes it a relatively safe bet in the volatile market. The valuation, at a P/E multiple of around 35x based on FY25 earnings, appears fairly priced for a market leader of this scale.

- Listing Gains vs. Long-Term: The current GMP of ₹28 indicates a modest listing day premium of around 8-9%. Investors should not expect explosive, multi-bagger gains. The real value lies in holding the stock for the long term and participating in India's financial growth story.

- Our View: We recommend a "Subscribe for Long-Term" rating. Investors should apply for this issue with the intention of holding it for several years to unlock its true potential.

Key Takeaways

- IPO Price Band: ₹310 – ₹326 per share

- Lot Size: 46 Shares (Minimum Investment: ₹14,996)

- GMP Today: ₹28 (Indicating a decent premium of ~8-9%)

- Allotment & Listing Dates: Tentative listing on October 13, 2025.

- Recommendations of experts: A strong "Subscribe" recommendation for long-term investors.

FAQs on Tata Capital IPO

1. What is Tata Capital IPO price band?

The price band for the IPO has been set at ₹310 to ₹326 per share.

2. What is Tata Capital IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Thursday, October 9, 2025.

3. How to check Tata Capital IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Tata Capital IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Monday, October 13, 2025.

5. Should I apply for Tata Capital IPO?

Yes, this is a highly recommended IPO for long-term investment. Given the company's strong fundamentals, fair valuation, and the backing of the Tata Group, it is a quality addition to any investment portfolio.

You may be interested in other IPOs: Advance Agrolife IPO GMP, Price, Dates, Allotment, Review

Disclaimer:

"The information provided on this page is for informational and educational purposes only and should not be considered as financial advice, recommendation, or solicitation to buy or sell any securities, including IPOs. Investing in IPOs involves risks, including the potential loss of capital. Readers should conduct their own research, consult with a qualified financial advisor, and make investment decisions based on their individual financial situation and risk tolerance. MrMoneyFrugal.com does not guarantee the accuracy, completeness, or timeliness of the information provided."