WeWork India Management Limited, the country's largest premium flexible workspace operator, is set to launch its mainboard Initial Public Offering (IPO) on October 3, 2025.

The company, which operates under the globally recognized "WeWork" brand, is looking to raise up to ₹3,000 crores.

However, investors must note that this is a 100% Offer for Sale (OFS), meaning the company will not receive any funds from the issue. The price band has been fixed at ₹615 to ₹648 per share, with a lot size of 23 shares.

After years of losses, the company has recently turned profitable, making this a classic turnaround story. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find WeWork India IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

WeWork India IPO Details

- Price Band: ₹615 – ₹648 per share

- IPO Open / Close Dates: October 3, 2025 – October 7, 2025

- Lot Size: 23 Shares

- Issue Size: 4,62,96,296 shares (aggregating up to ₹3,000 Crores)

- Fresh Issue / OFS: 100% Offer for Sale (OFS)

- Registrar: [To be updated]

- Listing Exchange: BSE & NSE

WeWork India IPO GMP Today

- Note: The shares of WeWork India are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

WeWork India IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 3, 2025 – October 7, 2025

- Basis of Allotment Date: October 8, 2025

- Refund Initiation Date: October 9, 2025

- Credit of Shares: October 9, 2025

- Listing Date: October 10, 2025

Also Check: Initial Public Offers: IPO Reviews of India

Objectives of WeWork India IPO

Since the IPO is a 100% Offer for Sale, the company will not receive any proceeds from the public issue. The primary objectives are:

- To allow the existing shareholders (Promoter Embassy Group and an investor) to sell their stake and monetize their investment.

- To achieve the benefits of listing the company's shares on the stock exchanges, which enhances brand visibility and provides liquidity for shareholders.

If you’re interested in investing in specific sectors, check out our sectoral mutual funds for diversified opportunities across industries.

Financial Performance of WeWork India

(Amounts in ₹ Crores)

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

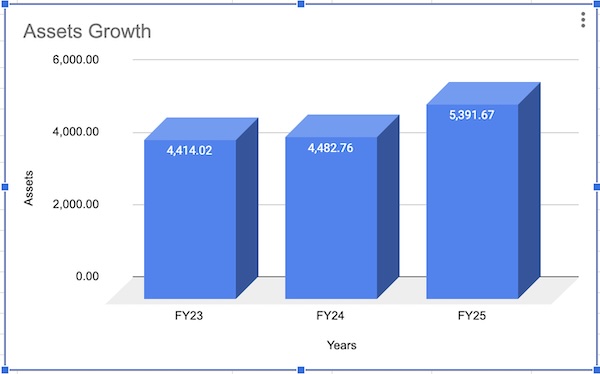

Assets | 5,391.67 | 4,482.76 | 4,414.02 |

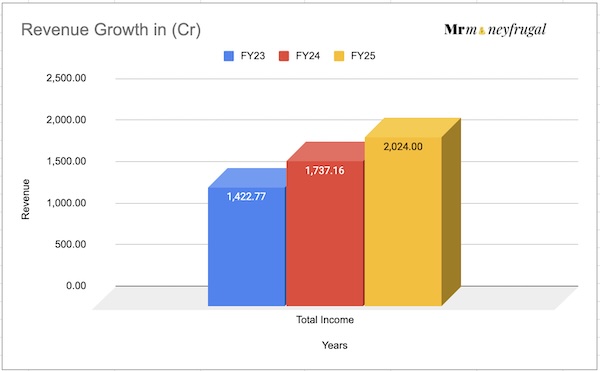

Total Income | 2,024.00 | 1,737.16 | 1,422.77 |

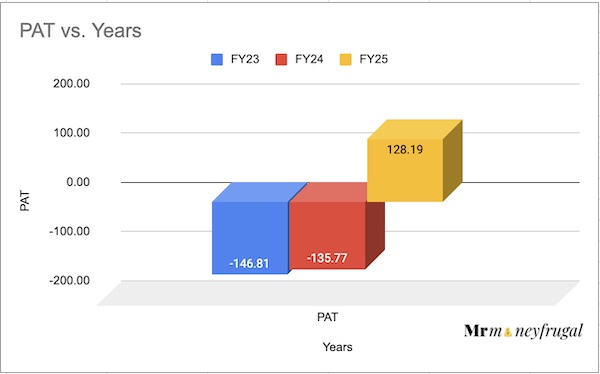

Profit After Tax | 128.19 | -135.77 | -146.81 |

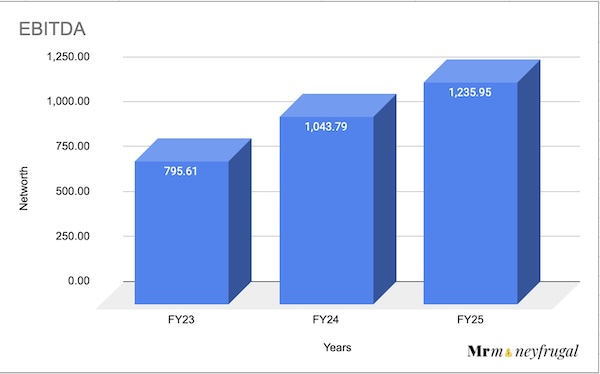

EBITDA | 1,235.95 | 1,043.79 | 795.61 |

NET Worth | 199.7 | -437.45 | -292.11 |

Reserves and Surplus | 65.68 | -634.75 | -346.92 |

Total Borrowing | 310.22 | 625.83 | 485.61 |

Revenue Growth FY23-25 In Crores

The financial story of WeWork India is one of a dramatic turnaround. After posting significant losses and carrying a negative net worth for years, the company has turned profitable in the financial year 2025, with a PAT of ₹128.19 crores. Its net worth has also turned positive.

PAT Growth in Crores FY23-25

This pivot to profitability is the central pillar of the investment thesis. However, the company is seeking a valuation based on this single year of profit, which follows a history of substantial losses.

Want to explore new ways to grow your income? Check out our guide on how to make money with ChatGPT for practical tips and ideas.

Industry Outlook

WeWork India is the market leader in India's booming flexible workspace industry. The demand for co-working and managed office spaces is surging, driven by large enterprises and startups seeking flexibility, cost efficiency, and premium amenities without long-term capital commitment. The market is projected to grow at a strong CAGR of 18-19% until 2027, and as the largest player, WeWork India is well-positioned to capture a significant share of this growth.

Strengths and Risks of WeWork India IPO

Strengths:

- Market Leader with a Global Brand: The "WeWork" brand is a powerful asset, and the company is the largest player in a high-growth sector in India.

- Recent Turnaround to Profitability: The company has successfully pivoted from heavy losses to profitability, demonstrating improved operational efficiency.

- Strong Promoter Backing: Promoted by the Embassy Group, a leading real estate developer in India.

- High-Quality Asset Portfolio: Approximately 93% of its workspaces are in premium Grade A properties in prime locations.

Risks:

- 100% Offer for Sale (OFS): This is the biggest red flag. The company is not raising any money for its own growth; the entire ₹3,000 crores will go to the selling promoters. This indicates the primary motive is to provide an exit route for existing shareholders.

- History of Losses and Negative Net Worth: While the company is profitable now, its past financial instability cannot be ignored. The valuation is based on a single year of profit.

- High Fixed Costs: The business model relies on long-term, fixed-cost lease agreements, making it vulnerable during economic downturns if occupancy rates fall.

- Doesn't Meet Standard IPO Norms: The company is coming to the market under a special provision (Regulation 6(2)) because it doesn't meet the standard profitability and net worth criteria, mandating a 75% allocation to institutional investors (QIBs).

Expert Recommendations – Should You Apply?

High Risk

The WeWork India IPO is a classic high-risk, high-reward bet on a turnaround story in a sunrise sector. The recent shift to profitability is a major positive, but the structure of the IPO is a significant concern.

- For Risk-Averse Investors: AVOID. The 100% Offer for Sale, coupled with a history of losses, makes this a clear avoid for conservative investors. There is no money going into the company for future growth.

- For Aggressive Investors: This is a bet on the sustainability of the recent turnaround. If you believe that the profitability is here to stay and the flexible workspace trend will continue to strengthen, you might consider applying. However, you must be comfortable with the fact that the promoters are cashing out.

- Our View: The "all-OFS" nature of the issue is a major deterrent. It signals that the promoters are prioritizing their own exit over raising growth capital for the company. While the business has turned a corner, the risks are substantial. We recommend a "Cautious" approach.

Key Takeaways

- IPO Price Band: ₹615 – ₹648 per share

- Lot Size: 23 Shares (Minimum Investment: ₹14,904)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 10, 2025.

- Recommendations of experts: High Risk. The IPO is a 100% Offer for Sale, which is a major concern. Recommended only for high-risk investors who are confident in the sustainability of the recent financial turnaround.

FAQs on WeWork India IPO

1. What is WeWork India IPO price band?

The price band for the IPO is set at ₹615 to ₹648 per equity share.

2. What is WeWork India IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Wednesday, October 8, 2025.

3. How to check WeWork India IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is WeWork India IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Friday, October 10, 2025.

5. Should I apply for WeWork India IPO?

This is a high-risk proposition. The company has recently become profitable after years of losses, but the entire IPO is an Offer for Sale (OFS), meaning no money will go to the company for growth. It is recommended only for investors with a very high-risk appetite.

Some important IPOs that my interest you: Tata Capital IPO GMP, Price, Dates, Allotment, Review

Tata Capital IPO GMP, Price, Dates, Allotment, Review

Disclaimer:

All content related to Initial Public Offerings (IPOs) published on MrMoneyFrugal is intended solely for informational and educational purposes. While we strive to provide accurate data such as Grey Market Premiums (GMP), issue price, subscription status, allotment details, and company reviews, we do not guarantee the accuracy, reliability, or completeness of this information.

Investing in IPOs and the stock market carries inherent risks, including the potential loss of capital. The views, analyses, and updates shared on this website should not be construed as investment advice or recommendations. We strongly advise readers to consult a SEBI-registered financial advisor or professional before making any investment decisions.

MrMoneyFrugal, its authors, and affiliates are not responsible or liable for any financial losses, damages, or decisions made based on the information presented here.