Jayesh Logistics Limited, a logistics and supply chain provider with a special focus on the Indo-Nepal corridor, is set to launch its Initial Public Offering (IPO) on the NSE EMERGE platform, opening on October 27, 2025.

The company aims to raise up to ₹28.64 crores through a 100% fresh issue of shares to fund its expansion.

The price band has been fixed at ₹116 to ₹122 per share, with a minimum lot size of 1,000 shares. While the company has demonstrated strong growth in its financial performance, investors should be cautious of its high debt levels and significant customer concentration. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Jayesh Logistics IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Explore our IPO Hub — your one-stop destination for all upcoming, ongoing, and past IPOs

Jayesh Logistics IPO Details

- Price Band: ₹116 – ₹122 per share

- IPO Open / Close Dates: October 27, 2025 – October 29, 2025

- Lot Size: 1,000 Shares

- Issue Size: 23,47,200 shares (aggregating up to ₹28.64 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Kfin Technologies Ltd.

- Listing Exchange: NSE SME

Jayesh Logistics IPO GMP Today

- Note: The shares of Jayesh Logistics are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Jayesh Logistics IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 27, 2025 – October 29, 2025

- Basis of Allotment Date: October 30, 2025

- Refund Initiation Date: October 31, 2025

- Credit of Shares: October 31, 2025

- Listing Date: November 3, 2025

You may also want to check the Jayesh Logistics Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Objectives of Jayesh Logistics IPO

The company intends to utilise the net proceeds from the public offering for its expansion and technological upgradation:

- Purchase of Vehicles (₹8.85 Crores): To acquire side wall trailers to expand its owned fleet.

- Working Capital Requirements (₹11.24 Crores): A significant portion is allocated to manage its working capital-intensive operations.

- Technology Development (₹0.72 Crores): For the development of Phase 2 of its "SMART-SYS" logistics application.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Plan smarter investments with our SIP Calculator — a free tool that helps you calculate potential returns, adjust investment duration, and make informed mutual fund decisions.

Financial Performance of Jayesh Logistics

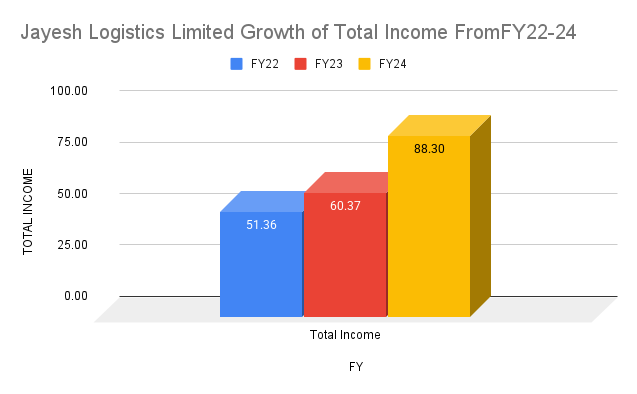

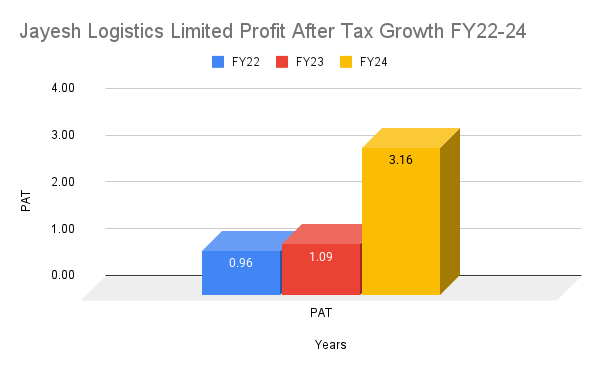

(Amounts in ₹ Crores)

Period Ended | 31 Jan 2025 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 59.45 | 47.52 | 21.86 | 21.36 |

Total Income | 79.6 | 88.3 | 60.37 | 51.36 |

Profit After Tax | 3.73 | 3.16 | 1.09 | 0.96 |

Net Worth | 12.97 | 8.02 | 4.86 | 3.77 |

Reserves and Surplus | 6.69 | 7.46 | 4.3 | 3.2 |

Total Borrowing | 29.77 | 27.1 | 12.19 | 13.2 |

Jayesh Logistics has shown a strong growth trajectory. Its revenue from operations grew by an impressive 46% in FY24, and this momentum has continued into the current fiscal year. The company's profitability has been even more remarkable, with its profit after tax (PAT) nearly tripling in FY24 compared to the previous year.

Source: NSE India

This growth has been driven by an expanding fleet and an improved service mix, leading to better margins. However, this expansion has come at the cost of increased debt.

Secure your future using our Retirement Calculator — calculate your retirement corpus, adjust investment timelines, and plan ahead to achieve long-term financial stability.

Industry Outlook

- JLL operates in the vital Indian logistics sector, a key enabler of economic growth.

- The company has carved out a niche for itself by specializing in the Indo-Nepal trade corridor, a crucial route for bilateral trade.

- The logistics industry is undergoing a technological transformation, and JLL's investment in its proprietary "SMART-SYS" platform is a strategic move to enhance efficiency, transparency, and customer service in a competitive market.

Visit our Mutual Fund Hub to understand mutual funds step by step. Get answers to common questions and build your knowledge before investing.

Strengths and Risks of Jayesh Logistics IPO

Strengths:

- Strong Financial Growth: The company has a proven track record of rapidly growing revenues and profits.

- Experienced Promoters: The leadership team has over 13 years of experience in the logistics industry.

- Niche Market Focus: Specialized expertise in the high-potential Indo-Nepal logistics corridor.

- Technology-Driven Approach: Investment in a proprietary logistics management system to improve operational efficiency.

Risks:

- High Debt: The company has a high debt-to-equity ratio (3.38 in FY24), which poses a significant financial risk and increases its interest burden.

- Extreme Customer Concentration: This is a major red flag. The top 10 customers account for over 71% of the company's revenue, making it highly dependent on a few large clients.

- Geographical Concentration: A substantial portion of the business (over 57%) is concentrated on the India-Nepal route, making it vulnerable to any political or economic instability in the region.

- Working Capital Intensive: The business requires significant working capital, as reflected by its high number of receivable days, which can strain liquidity.

Expert Recommendations – Should You Apply?

High Risk

The Jayesh Logistics IPO is a classic case of a high-growth company burdened by high risk factors. The impressive financial performance is countered by a weak balance sheet and significant business concentration.

- For Risk-Averse Investors: AVOID. The high debt and extreme customer concentration are significant risks that make this IPO unsuitable for conservative investors.

- For Aggressive Investors: The valuation appears a bit stretched. Based on FY24 earnings, the P/E ratio is around 24x, and even after factoring in the strong growth in the current year, it remains on the higher side for an SME with such a high-risk profile. This is a high-risk bet on the company's ability to manage its debt and diversify its client base.

- Our View: The risks, particularly the high leverage and customer dependency, are too substantial to ignore. We recommend that most investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹116 – ₹122 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,44,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on November 3, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to high debt, extreme customer concentration, and a stretched valuation.

FAQs on Jayesh Logistics IPO

1. What is Jayesh Logistics IPO price band?

The price band for the IPO is set at ₹116 to ₹122 per equity share.

2. What is Jayesh Logistics IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Thursday, October 30, 2025.

3. How to check Jayesh Logistics IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Jayesh Logistics IPO listing date?

The company's shares are tentatively scheduled to be listed on the NSE SME platform on Monday, November 3, 2025.

5. Should I apply for Jayesh Logistics IPO?

This is a high-risk proposition. Given the company's high debt and extreme customer dependency, coupled with a demanding valuation, it is advisable for most investors to avoid this IPO.

You would also want to check out our review of the Shreeji Global FMCG Limited IPO

Disclaimer:

This article on Jayesh Logistics IPO is for informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any securities. Please consult your financial advisor before making any investment decisions.