Game Changers Texfab Limited, a fabric supplier specialising in women's wear and technical textiles, is launching its Initial Public Offering (IPO) on the BSE SME platform, with the subscription period opening on October 28, 2025. The company is seeking to raise up to ₹54.84 crores through a 100% fresh issue of shares. The price band has been fixed at ₹96 to ₹102 per share, with a minimum lot size of 1,200 shares. The IPO presents a story of a spectacular turnaround in profitability, but this is accompanied by significant risks like negative cash flow and high customer dependency. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Game Changers Texfab IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Stay updated with all Upcoming and Live IPOs to explore new investment opportunities before they hit the market.

Game Changers Texfab IPO Details

- Price Band: ₹96 – ₹102 per share

- IPO Open / Close Dates: October 28, 2025 – October 30, 2025

- Lot Size: 1,200 Shares

- Issue Size: 53,76,000 shares (aggregating up to ₹54.84 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Skyline Financial Services Pvt.Ltd.

- Listing Exchange: BSE SME

Game Changers Texfab IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 28, 2025 – October 30, 2025

- Basis of Allotment Date: October 31, 2025

- Refund Initiation Date: November 3, 2025

- Credit of Shares: November 3, 2025

- Listing Date: November 4, 2025

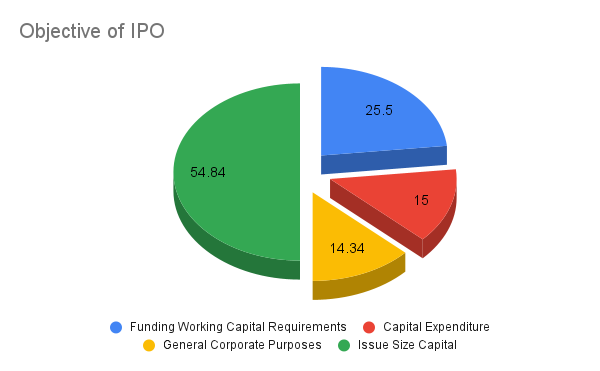

Objectives of Game Changers Texfab IPO

The company intends to utilise the net proceeds from the public offering for its retail expansion and operational needs:

- Funding Working Capital Requirements (₹25.50 Crores): To manage its operational cycle and support business growth.

- Capital Expenditure (₹15.00 Crores): For the construction and setup of six new retail experience stores across India.

- General Corporate Purposes: The balance amount will be used for other strategic and day-to-day business requirements.

Plan your mutual fund investments smartly using our SIP Calculator and see how small monthly investments can grow over time.

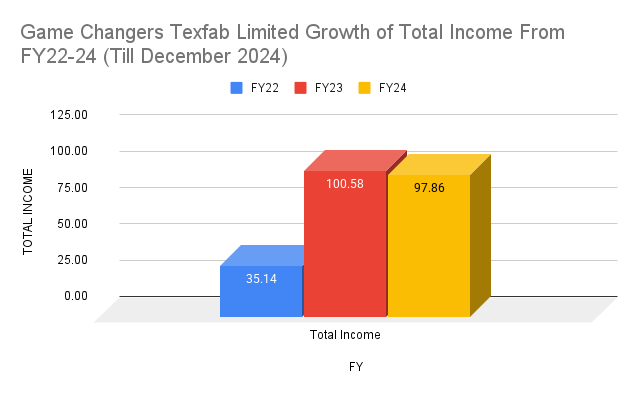

Financial Performance of Game Changers Texfab

(Amounts in ₹ Crores)

Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 49.7 | 41.37 | 21.82 | 12.2 |

Total Income | 85.88 | 97.86 | 100.58 | 35.14 |

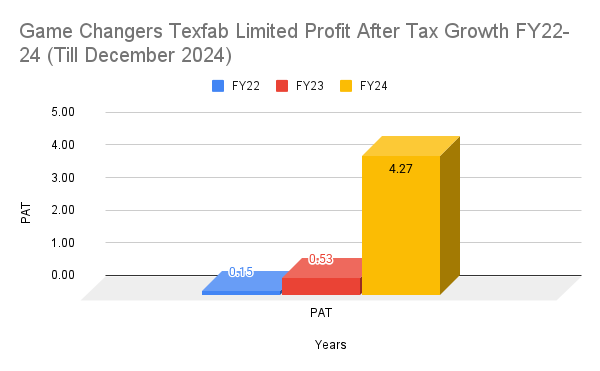

Profit After Tax | 9.14 | 4.27 | 0.53 | 0.15 |

EBITDA | 14.01 | 6.73 | 1.26 | 0.78 |

Net Worth | 18.08 | 8.94 | 4.67 | 3.39 |

Reserves and Surplus | 18.05 | 8.9 | 4.64 | 3.36 |

Total Borrowing | 9.65 | 5.54 | 6.46 | 4.76 |

The company's financials show a dramatic surge in profitability. While revenue dipped slightly in FY24, the profit after tax (PAT) increased by over 700%, and this strong performance has continued to accelerate in the current financial year.

Source: BSE India

However, this impressive profit growth is overshadowed by a history of negative cash flow from operations, a major red flag indicating that the company has struggled to convert its paper profits into actual cash.

Based on its FY24 earnings, the IPO is priced at a P/E multiple of nearly 30x. However, if the stellar performance of the current fiscal year is annualised, the forward P/E drops to a much more attractive level of around 10.5x.

Industry Outlook

- Game Changers Texfab operates with an asset-light "Deemed Manufacturing Model," sourcing and supplying a wide range of fabrics without owning large manufacturing plants. This allows for scalability and flexibility.

- The company caters to both B2B clients (manufacturers, designers) and a B2C segment through its retail brand "Fall in Love."

- A key growth area is its focus on high-margin technical textiles, like outdoor and PVC-coated fabrics, for which it holds exclusive distribution agreements.

- The IPO funds will be used to expand its physical retail footprint, a strategic move to strengthen its B2C presence.

Secure your future early — estimate your ideal retirement corpus with our Retirement Calculator

Strengths and Risks of Game Changers Texfab IPO

Strengths:

- Spectacular Profit Growth: The company has demonstrated a phenomenal improvement in its profitability and margins.

- Asset-Light Business Model: Provides operational flexibility and reduces the need for heavy capital investment.

- Experienced Promoters: The leadership team has a strong background in the textile industry.

- Focus on High-Margin Technical Textiles: Specialization in a niche, high-demand product category.

Risks:

- Negative Operating Cash Flow: This is the most critical risk. The company's past inability to generate cash from its core operations raises serious questions about its working capital management.

- High Customer Concentration: The top five customers contributed over 52% of sales in the recent period, making the business highly dependent on a few large clients.

- Pending Tax Litigation: The company is facing an income tax demand of approximately ₹3.94 crores, which is a significant amount relative to its profits.

- History of Non-Compliance: The prospectus notes past instances of delays and procedural lapses in statutory filings, which could indicate weaknesses in internal controls.

Want to learn how mutual funds really work? Explore our Mutual Fund Hub for easy guides, FAQs, and beginner tips.

Expert Recommendations – Should You Apply?

High Risk

The Game Changers Texfab IPO is a tale of two conflicting stories: one of spectacular profit growth and an attractive forward valuation, and another of fundamental weaknesses like negative cash flow and high concentration.

- For Risk-Averse Investors: AVOID. The history of negative cash flows and the pending tax litigation are significant red flags that make this unsuitable for conservative investors.

- For Aggressive Investors: SUBSCRIBE WITH CAUTION. This is a high-risk bet on the sustainability of the company's recent high-margin business model. The valuation is very attractive if the company can maintain its current performance and, more importantly, fix its cash flow issues.

- Our View: The IPO is a high-risk, high-reward proposition. The disconnect between reported profits and cash generation is a major concern. We recommend this only for high-risk investors who are comfortable with the underlying operational and financial risks.

Key Takeaways

- IPO Price Band: ₹96 – ₹102 per share

- Lot Size: 1,200 Shares (Note: The minimum application for retail investors is for 2 lots or 2,400 shares, costing ₹2,44,800, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on November 4, 2025.

- Recommendations of experts: A high-risk issue. Suitable only for aggressive investors who are willing to bet on the company's ability to sustain its recent performance and improve its cash flows.

FAQs on Game Changers Texfab IPO

1. What is Game Changers Texfab IPO price band?

The price band for the IPO is set at ₹96 to ₹102 per equity share.

2. What is Game Changers Texfab IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Friday, October 31, 2025.

3. How to check Game Changers Texfab IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Game Changers Texfab IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Tuesday, November 4, 2025.

5. Should I apply for Game Changers Texfab IPO?

This is a high-risk proposition. While the company's recent profit growth is impressive, its history of negative operating cash flow and other risks suggest that only investors with a very high-risk appetite should consider it.

You may also be interested in our latest IPO: Jayesh Logistics Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Disclaimer:

Information shared about IPOs is for educational purposes only. It’s not financial advice. Please research and consult a professional before investing.