Updated On 25.10.2025 @ 2:20 AM

Orkla India Limited, the FMCG company behind MTR and Eastern, is launching its mainboard IPO on October 29, 2025. The IPO is a 100% Offer for Sale (OFS) by promoters and existing shareholders, with a price band of ₹695–₹730 per share and a minimum lot of 20 shares.

The Grey Market Premium (GMP) is around ₹70, indicating potential 9–10% listing day gains.

In this article, you will find Orkla India IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Stay updated with the market by exploring our Latest IPOs Details section

Briefs of Orkla India IPO Details

For more insights on recent IPOs, check out our Game Changers Texfab IPO GMP, Price, Dates, Allotment, Review for detailed analysis

What is Orkla India IPO GMP Today?

What are the Orkla India IPO Dates & Allotment Schedule?

What are the Objectives of Orkla India IPO?

This is the most critical point for investors to understand. The IPO is a 100% Offer for Sale. This means:

- The company, Orkla India, will not receive any proceeds from the public issue.

- The entire amount of ₹1,667.54 crores will go directly to the selling shareholders (its promoter Orkla Asia Pacific and other shareholders), who are monetizing a part of their investment.

If you’re exploring investment options beyond IPOs, check out our Mutual Fund Learning Hub to understand how to diversify and grow your portfolio effectively.

How is The Financial Performance of Orkla India?

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

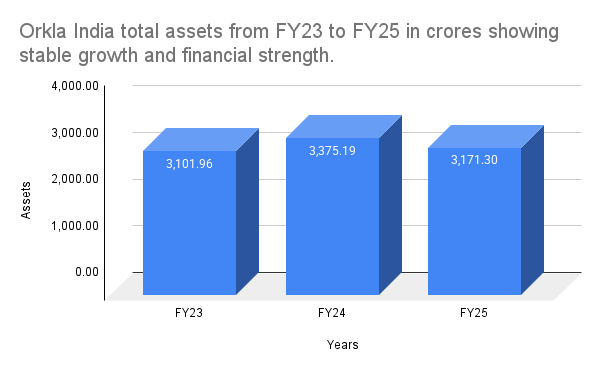

Assets | 3,171.30 | 3,375.19 | 3,101.96 |

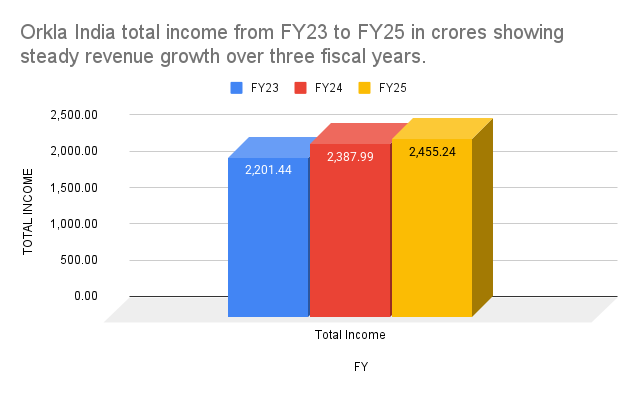

Total Income | 2,455.24 | 2,387.99 | 2,201.44 |

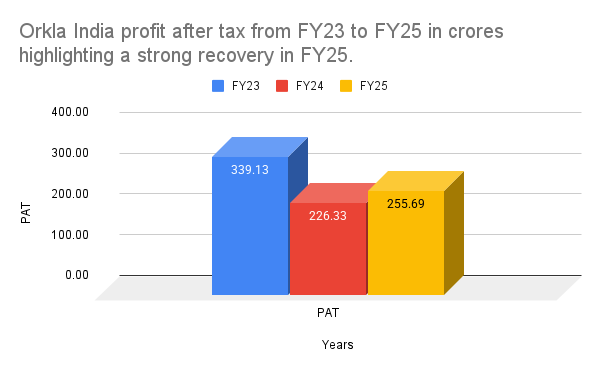

Profit After Tax | 255.69 | 226.33 | 339.13 |

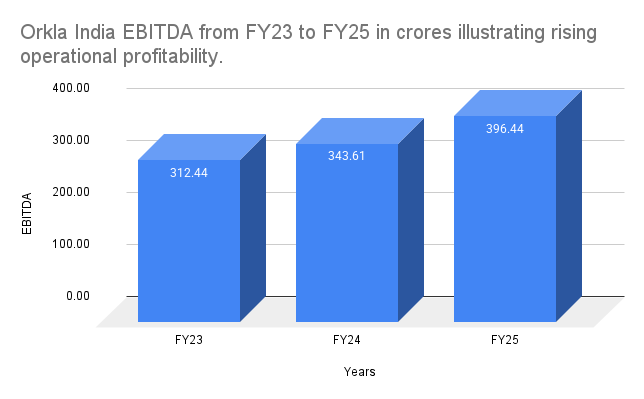

EBITDA | 396.44 | 343.61 | 312.44 |

NET Worth | 1,853.47 | 2,201.48 | 2,237.69 |

Reserves and Surplus | 2,445.80 | 2,793.35 | 2,227.28 |

Total Borrowing | 3.77 | 34.99 |

Orkla India's financial profile is very strong. The company is completely debt-free. While revenue growth has been modest, its profitability is robust.

After a dip in FY24, the Profit After Tax (PAT) made a strong comeback in FY25. The company boasts excellent capital efficiency with a high Return on Capital Employed (ROCE) of 32.7% and has managed its working capital brilliantly.

Based on its FY25 earnings, the IPO is priced at a P/E multiple of approximately 39x, which is a premium valuation but justifiable for a market leader.

Source: Sebi India

For those interested in building an income stream online, read our How to Make Money Blogging series to learn practical tips and strategies.

What is the Industry Outlook?

- Orkla India is a dominant force in the Indian packaged food and spices market.

- Through its brands MTR and Eastern, it holds the number one market share in packaged spices in Karnataka and Kerala, respectively.

- The Indian packaged foods industry is a high-growth sector, driven by rising disposable incomes, urbanisation, and a consumer shift towards trusted, branded products for convenience and quality.

- As a market leader with deep distribution, Orkla is a prime beneficiary of this long-term trend.

To plan your systematic investments, try our SIP Calculator and see how small monthly contributions can grow over time.

What are the Strengths and Risks of Orkla India IPO?

Strengths:

- Market Leader with Iconic Brands: MTR and Eastern are household names with immense brand loyalty and market leadership in their core regions.

- Debt-Free and Highly Profitable: A stellar financial profile with no debt, strong cash conversion, and high return ratios.

- Extensive Distribution Network: A deep and wide distribution network across India, reaching over 70% of relevant retail outlets in its stronghold states.

- Capital-Efficient Model: An asset-light strategy combining owned and contract manufacturing facilities ensures operational efficiency.

Risks:

- 100% Offer for Sale (OFS): This is the biggest red flag. The promoters are cashing out, and no money is being raised for the company's future growth.

- Raw Material Price Volatility: The business is highly dependent on agricultural commodity prices like chillies and coriander, which can be volatile and impact margins.

- Significant Contingent Liabilities: The company has contingent liabilities of over ₹126 crores, primarily related to indirect tax disputes, which could pose a financial risk.

- Intense Competition: The FMCG space is highly competitive, with pressure from both large national players and smaller regional brands.

For long-term financial planning, use our Retirement Calculator to estimate your corpus and plan your retirement comfortably.

Expert Recommendations – Should You Apply?

Subscribe for Listing Gains & Long-Term

The Orkla India IPO is a classic case of a great business coming to the market with a less-than-ideal IPO structure. The underlying company is a gem, but the fact that it's a 100% OFS at a premium valuation requires careful consideration.

- For Long-Term Investors: This is a chance to own a piece of a high-quality, debt-free FMCG leader. If you are willing to look past the OFS structure and hold for the long term, this is a strong candidate for your portfolio.

- For Listing Gains: The current Grey Market Premium of around ₹70 indicates strong investor demand and suggests the possibility of decent listing gains of 9-10%. This makes the IPO attractive for those looking for short-term gains as well.

- Our View: The business fundamentals are exceptional, but the IPO is purely an exit route for existing shareholders. However, the strong market sentiment and healthy GMP cannot be ignored. We recommend "Subscribe" for both potential listing gains and long-term holding, while being mindful of the premium valuation and OFS structure.

Key Takeaways

- IPO Price Band: ₹695 – ₹730 per share

- Lot Size: 20 Shares (Minimum Investment: ₹14,600)

- GMP Today: ₹70 (Indicating a healthy premium of ~9-10%)

- Allotment & Listing Dates: Tentative listing on November 6, 2025.

- Recommendations of experts: Subscribe. A fundamentally strong, debt-free company with strong market interest, making it attractive for both listing gains and long-term investment.

FAQs on Orkla India IPO

What is Orkla India IPO GMP today?

Currently, the GMP for the Orkla India IPO is ₹70, suggesting a potential listing premium of around 9-10% over the issue price.

What is Orkla India IPO price band?

The price band for the IPO is set at ₹695 to ₹730 per equity share.

What is Orkla India IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, November 3, 2025.

How to check Orkla India IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

What is Orkla India IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Thursday, November 6, 2025.

Should I apply for Orkla India IPO?

This is a high-quality business with strong fundamentals and significant market interest, as indicated by its GMP. It is recommended for both long-term investors and those seeking listing gains, although the 100% Offer for Sale and premium valuation are points to consider.

Disclaimer

The information provided in this article is for general informational and educational purposes only and should not be considered as financial or investment advice. Investing in an IPO involves risks, including the potential loss of capital. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Orkla India IPO details, Grey Market Premium (GMP), subscription status, and other data mentioned here are based on publicly available sources and are subject to change. The author or website does not guarantee the accuracy, completeness, or timeliness of this information and is not responsible for any financial losses incurred as a result of relying on it.