Updated: 06.10.2025 @11:02 AM

Ameenji Rubber Limited, a specialized manufacturer of rubber products for the railways and infrastructure sectors, is launching its initial public offering (IPO) on September 26, 2025. The company aims to raise up to ₹30 crores through a 100% fresh issue of shares. The IPO price band has been fixed at ₹95 to ₹100 per share, with investors required to bid for a minimum lot of 1,200 shares. Currently, the shares are not trading in the grey market, indicating that investor sentiment is yet to build up around the issue.

In this article, you will find Ameenji Rubber IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Ameenji Rubber IPO Details

- Price Band: ₹95 – ₹100 per share

- IPO Open / Close Dates: September 26, 2025 – September 30, 2025

- Lot Size: 1,200 Shares

- Issue Size: 30,00,000 shares (aggregating up to ₹30.00 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Pvt. Ltd.

- Listing Exchange: BSE SME

Ameenji Rubber listed @101 rupees on 06.10.2025. Which shows the neutral sentiment of the investors. What do you think?

Source: BSE India

Ameenji Rubber IPO GMP Today

Note: The shares of Ameenji Rubber are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator and is expected to emerge closer to the IPO opening date based on market demand.

For latest update about Ameenji Rubber IPO GMP, check the GMP section.

Ameenji Rubber IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 26, 2025 – September 30, 2025

- Basis of Allotment Date: October 1, 2025

- Refund Initiation Date: October 3, 2025

- Credit of Shares: October 3, 2025

- Listing Date: October 6, 2025

Also learn: Initial Public Offers: What are IPOs?

Objectives of Ameenji Rubber IPO

The company plans to use the funds raised from the public offering for the following key purposes:

- Capital Expenditure (₹14.92 Crores): For the modernization of its existing facilities and to set up a new manufacturing unit for conveyor belting.

- Debt Repayment (₹5.00 Crores): To prepay or repay certain existing borrowings, which will help reduce finance costs and strengthen the balance sheet.

- General Corporate Purposes: The remaining amount will be used to fund the company's day-to-day operational needs and strategic initiatives.

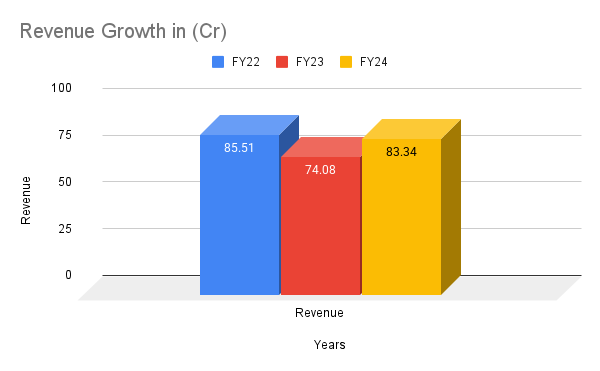

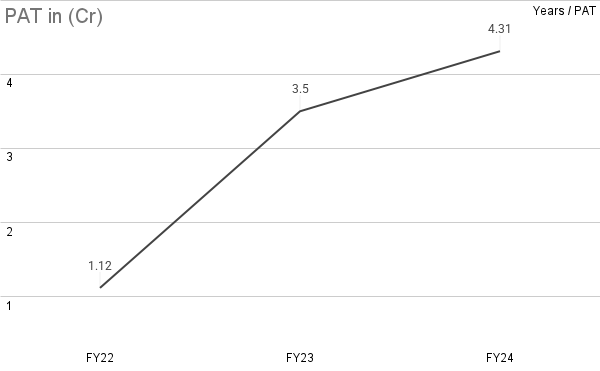

Financial Performance of Ameenji Rubber

(Amounts in ₹ Crores)

Particulars | FY24 | FY23 | FY22 |

Revenue from Operations | ₹83.34 | ₹74.08 | ₹85.51 |

Profit After Tax (PAT) | ₹4.31 | ₹3.50 | ₹1.12 |

Total Borrowings | ₹34.95 | ₹21.50 | ₹16.64 |

The company's financial performance shows a strong growth in profitability. While revenue has been somewhat inconsistent, the Profit After Tax (PAT) has nearly quadrupled between FY22 and FY24, indicating improving margins and operational efficiency. However, this growth has been fueled by a significant increase in debt, with total borrowings more than doubling in the same period.

A major point of concern is the negative operating cash flow of -₹3.36 crores reported in FY24 despite being profitable, suggesting that profits are getting stuck in working capital.

Industry Outlook

Ameenji Rubber operates in a niche segment, supplying critical components like elastomeric bridge bearings and rubber sole plates to India's railway and infrastructure sectors. This positions the company to benefit directly from the government's sustained push towards modernizing railways and expanding national highways.

The Indian rubber industry is a mature market, but specialized players with strong client relationships, particularly with government entities like the Indian Railways, have a competitive advantage. The company's expansion into conveyor belts opens up a new industrial market for them.

Ameenji Rubber IPO Subscription Status – Day 1, Day 2 & Day 3

Strengths and Risks of Ameenji Rubber IPO

Strengths:

- Niche Market Player: Strong foothold in the high-entry barrier market of railway and infrastructure rubber components.

- Experienced Promoters: Over 18 years of experience in the rubber manufacturing industry.

- Strong Client Base: Established relationships with key clients, including the Indian Railways.

- Aligned with National Growth: Directly benefits from the government's focus on infrastructure development.

Risks:

- Negative Operating Cash Flow: A significant red flag. The company is not generating cash from its core business operations, despite reporting profits.

- High Debt Burden: The company is heavily leveraged, which increases financial risk and puts pressure on profitability due to high interest costs.

- High Customer Concentration: The top 10 customers contribute over 60% of revenue, making the company vulnerable to the loss of a major client.

- History of Non-Compliance: The company has admitted to several past corporate governance lapses, including failures in statutory filings and incorrect auditor appointments, which raises concerns about its internal control systems.

- Pending Litigations: The company is involved in tax-related legal cases amounting to over ₹2.88 crores.

Ameenji Rubber IPO Listing Date, Price & Market Debut

Expert Recommendations – Should You Apply?

High Risk

Ameenji Rubber's IPO is a classic "High-Risk, High-Potential-Reward" offering. The company's strong profit growth and niche market positioning are attractive. However, the underlying financial weaknesses and governance issues cannot be ignored.

- For Risk-Averse Investors: AVOID. The combination of negative cash flow, high debt, and a history of corporate governance lapses makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: APPLY WITH CAUTION. Investors with a high-risk appetite could consider this IPO, banking on the infrastructure growth story. However, a decision should only be made after carefully evaluating the price and its valuation (P/E ratio) compared to industry peers.

- For Long-Term Investors: A "wait and watch" approach is recommended. It would be prudent to see if the company can fix its cash flow issues and demonstrate consistent performance after listing.

Also check: IPO Review: Propshare Titiana, IPO Review: Swastika Castal Limited ,, IPO Review: Chemkart India Limited

Key Takeaways

- IPO Price Band: ₹95 – ₹100 per share

- Lot Size: 1,200 Shares (Minimum investment: ₹1,20,000)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Allotment on Oct 1, Listing on Oct 6, 2025.

- Recommendations of experts: A high-risk issue. Caution is advised for all investors.

Zappfresh IPO GMP, Price, Dates, Allotment, Review

FAQs on Ameenji Rubber IPO

1. What is Ameenji Rubber IPO GMP today?

Currently, the GMP for Ameenji Rubber IPO is ₹0 as its shares are not being traded in the grey market.

2. What is Ameenji Rubber IPO price band?

The price band for the IPO is set at ₹95 to ₹100 per equity share.

3. What is Ameenji Rubber IPO allotment date?

The tentative date for the finalization of share allotment is Wednesday, October 1, 2025.

4. How to check Ameenji Rubber IPO allotment status?

You can check the allotment status on the website of the IPO registrar, Bigshare Services Pvt. Ltd., after the basis of allotment is finalized.

What is Ameenji Rubber IPO listing date?

The company's shares are expected to be listed on the BSE SME platform on Monday, October 6, 2025.

Should I apply for Ameenji Rubber IPO?

This is a high-risk IPO. While it operates in a growth sector, the company has significant financial and governance red flags. Conservative investors should avoid it, while aggressive investors should apply with caution.

References:

1. DRHP_Ameenji_BSE_29.03.2025_20250329184903.pdf

Disclaimer:

This is for informational purposes only, not investment advice. IPO investments are subject to market risks—please consult your financial advisor before investing.