Updated on 24.01.2026 @ 8:28 AM

The Initial Public Offering (IPO) of Canara HSBC Life Insurance Company Limited, a prominent private life insurer backed by banking behemoth Canara Bank, is set to open for subscription on October 10, 2025.

This much-awaited mainboard issue is a 100% Offer for Sale (OFS), where its promoters and an investor will be offloading their stake. The price band has been fixed at ₹100 to ₹106 per share, with a minimum lot size of 140 shares.

While the company is a well-established name with strong parentage, the IPO structure, recent revenue stagnation, and negative operating cash flow are significant points for investors to consider.

In this article, you will find Canara HSBC Life Insurance IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Canara HSBC Life Insurance IPO Details

- Price Band: ₹100 – ₹106 per share

- IPO Open / Close Dates: October 10, 2025 – October 14, 2025

- Lot Size: 140 Shares

- Issue Size: 23,75,00,000 shares (aggregating up to ₹2,517.50 Crores)

- Fresh Issue / OFS: 100% Offer for Sale

- Registrar: Kfin Technologies Ltd.

- Listing Exchange: BSE & NSE

Stay updated with all Upcoming and Live IPOs to never miss a new opportunity in the primary market.

Canara HSBC Life Insurance IPO GMP Today

Check the gmp of all the ipos at a gmp today hub page which is updated regularly.

The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Check Subscription Status :Canara HSBC Life Insurance Company Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Canara HSBC Life Insurance IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 10, 2025 – October 14, 2025

- Basis of Allotment Date: October 15, 2025

- Refund Initiation Date: October 16, 2025

- Credit of Shares: October 16, 2025

- Listing Date: October 17, 2025

Listing Update:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 106 | 106 | 0.0 |

Objectives of Canara HSBC Life Insurance IPO

This is the most critical point for investors to understand. The IPO is a 100% Offer for Sale. This means:

- The company, Canara HSBC Life Insurance, will not receive any funds from the public issue.

- The entire proceeds of ₹2,517.50 crores will go directly to the selling shareholders: Canara Bank, HSBC Insurance, and Punjab National Bank, who are monetizing their investment.

Want to plan your investments smartly? Use our SIP Calculator to estimate your returns before you invest.

Financial Performance of Canara HSBC Life Insurance

(Amounts in ₹ Crores)

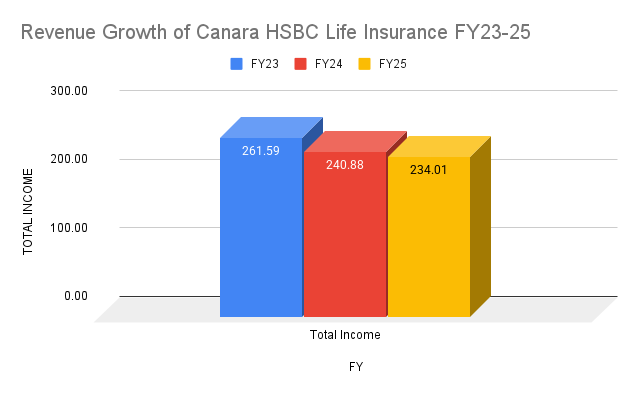

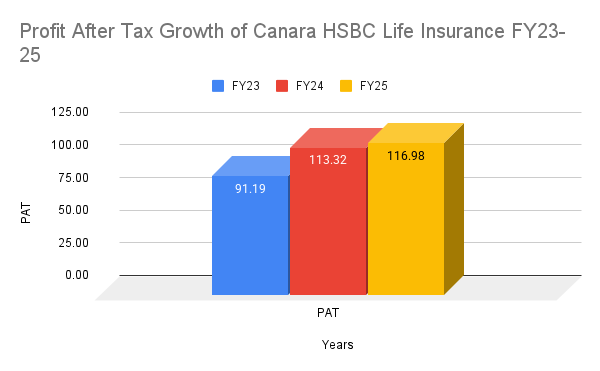

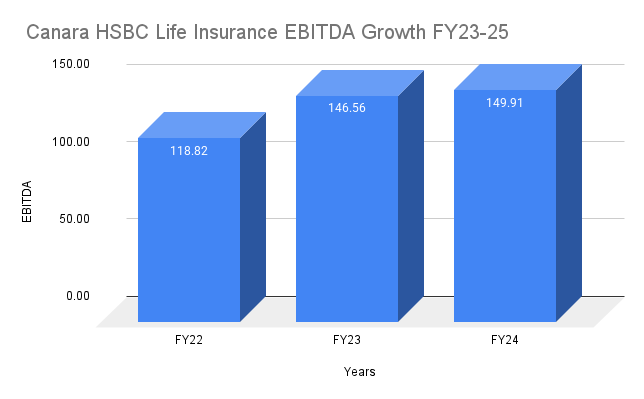

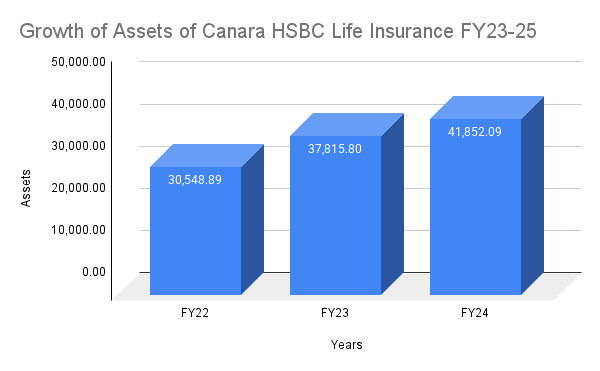

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 41,852.09 | 37,815.80 | 30,548.89 |

Total Income | 234.01 | 240.88 | 261.59 |

Profit After Tax | 116.98 | 113.32 | 91.19 |

EBITDA | 149.91 | 146.56 | 118.82 |

NET Worth | 1,516.86 | 1,418.88 | 1,353.07 |

Reserves and Surplus | 566.86 | 468.88 | 403.07 |

The company's financial performance presents a mixed picture. While it has been consistently profitable, the latest financials for FY25 show a decline in total income, a significant concern for a growth-focused sector. The profit after tax (PAT) saw only a marginal increase of 3%.

Thinking long term? Try our Retirement Calculator to find out how much you’ll need for a secure future.

Another major red flag is that the company reported negative cash flow from operating activities of -₹181 crores for the nine months ended December 2024.

Based on its FY25 earnings, the IPO is priced at a steep P/E multiple of approximately 85x-90x, which is in line with industry leaders like HDFC Life and SBI Life.

Source: SEBI DRHP

Industry Outlook

- Canara HSBC Life is a key player in India's underpenetrated life insurance market.

- The industry is poised for long-term growth, driven by a rising middle class, increasing financial awareness, and a young demographic.

- The company primarily relies on a bancassurance model, leveraging the vast branch network of Canara Bank to distribute its products.

- This model provides a significant competitive advantage in reaching customers across the country.

Learn the basics of mutual funds, types, benefits, and how they work in our Mutual Fund Information Hub

Strengths and Risks of Canara HSBC Life Insurance IPO

Strengths:

- Strong Promoters: Backed by Canara Bank, India's fourth-largest public sector bank, and global financial giant HSBC.

- Extensive Distribution Network: Access to over 15,700 bank branches provides an unparalleled reach for selling policies.

- High Solvency Ratio: With a solvency ratio of 215%, the company is well-capitalized, far exceeding the regulatory requirement of 150%.

- Excellent Claim Settlement: A claims settlement ratio of over 99% builds strong customer trust and brand credibility.

Risks:

- 100% Offer for Sale (OFS): This is the biggest red flag. The promoters are cashing out, and no money is being raised for the company's future growth.

- Stagnant Revenue and Negative Cash Flow: The recent decline in revenue and the inability to generate cash from core operations are major fundamental weaknesses.

- Heavy Reliance on Bancassurance: Over 74% of new business premium comes from Canara Bank. Any change in this relationship could severely impact the business.

- Significant Litigation and Contingent Liabilities: The company and its promoters are involved in legal proceedings with a massive aggregate amount, and contingent liabilities stand at over ₹300 crores.

Key Considerations for Investors

The Canara HSBC Life Insurance IPO is a classic case of a great brand coming to the market with questionable timing and structure. The valuation is high, the financials are showing signs of slowing down, and the entire issue is an exit for existing shareholders.

- For Risk-Averse Investors: AVOID. The 100% OFS, negative operating cash flow, and stagnant revenue make this a risky proposition. There are better-managed, consistently growing listed peers available.

- For Brand-Conscious Investors: The pull of the Canara and HSBC brands is strong. Investors who want to own a piece of this franchise for the very long term might consider a small allocation, but should not expect significant listing gains.

- Our View: The IPO seems fully priced, with the valuation already factoring in its brand legacy rather than its recent performance. The risks, particularly the OFS structure and weak financials, are too significant to ignore. We recommend a "Subscribe with Caution" rating, leaning towards avoiding it.

Disclaimer: This article is strictly for educational purposes. Please consult a SEBI-registered investment advisor before making any investment decisions.

Key Takeaways

- IPO Price Band: ₹100 – ₹106 per share

- Lot Size: 140 Shares (Minimum Investment: ₹14,840)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 17, 2025.

- Recommendations of experts: A high-risk issue. Best to be cautious or avoid, due to the 100% Offer for Sale, stagnant financials, and a high valuation that leaves little on the table for new investors.

FAQs on Canara HSBC Life Insurance IPO

1. What is Canara HSBC Life Insurance IPO price band?

The price band for the IPO is set at ₹100 to ₹106 per equity share.

2. What is Canara HSBC Life Insurance IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Wednesday, October 15, 2025.

3. How to check Canara HSBC Life Insurance IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized. Check the IPO allotment status of all the ipos at our hub page which is updated regularly.

4. What is Canara HSBC Life Insurance IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Friday, October 17, 2025.

5. Should I apply for Canara HSBC Life Insurance IPO?

This is a high-risk proposition. Given that the entire issue is an Offer for Sale, the company's recent revenue has declined, and the valuation is steep, it is advisable for most retail investors to be cautious and possibly avoid this IPO.

Disclaimer:

This article about the Canara HSBC Life Insurance IPO is for informational and educational purposes only. It should not be considered as investment advice or a recommendation to subscribe to the IPO. Please consult your financial advisor before making any investment decisions. IPO investing is subject to market risks — read all official documents carefully before investing.