Updated on 07.10.2025 @ 17:32 PM

Find here all the information of Fabtech Technologies IPO GMP, Price, Dates, Allotment, Review

Fabtech Technologies Limited, a global turnkey engineering solutions provider for the pharmaceutical industry, is launching its mainboard Initial Public Offering (IPO) on September 29, 2025. The company plans to raise up to ₹230.35 crores through a 100% fresh issue of shares.

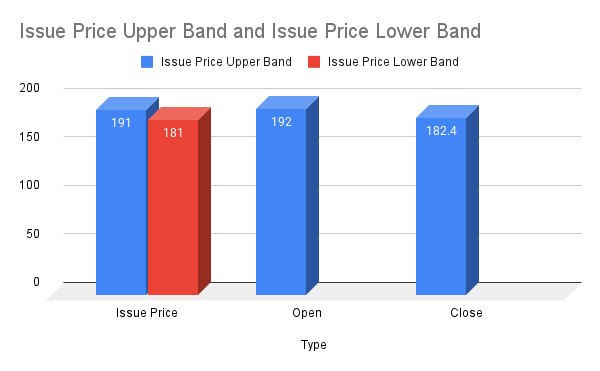

The price band for the issue has been set at ₹181 to ₹191 per share, with a minimum lot size of 75 shares.

While the company operates in a niche, high-growth sector with a strong order book, investors should be extremely cautious due to its history of negative operating cash flows and a demanding valuation.

In this article, you will find Fabtech Technologies IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Fabtech Technologies IPO Details

- Price Band: ₹181 – ₹191 per share

- IPO Open / Close Dates: September 29, 2025 – October 1, 2025

- Lot Size: 75 Shares

- Issue Size: 1,20,60,000 shares (aggregating up to ₹230.35 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Private Limited

- Listing Exchange: BSE & NSE

You can also learn about: Initial Public Offers: IPO Reviews of India

Fabtech Technologies IPO GMP Today

- GMP is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Fabtech Technologies IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 29, 2025 – October 1, 2025

- Basis of Allotment Date: October 3, 2025

- Refund Initiation Date: October 6, 2025

- Credit of Shares: October 6, 2025

- Listing Date: October 7, 2025

07.10.2025 @ 17:22 PM, Fabtech Technologies Limited listed today

| Type | Issue Price | Open | Close | Day's High | % Gain/Loss |

| Issue Price Upper Band | 191 | 192 | 182.4 | 192.5 | -4.5 |

| Issue Price Lower Band | 181 | 0.8 |

Also check: Glottis Limited IPO Allotment Status – How to Check Online

Om Metallogic IPO Allotment Status – How to Check Online

Ameenji Rubber IPO Allotment Status – How to Check Online

Zappfresh IPO Allotment Status – How to Check Online

Objectives of Fabtech Technologies IPO

The company intends to utilise the net proceeds from the public issue for the following purposes:

- Funding Working Capital Requirements: A significant portion will be used to manage its long operational cycles and fund large projects.

- Pursuing Inorganic Growth: To fund potential acquisitions and other strategic partnerships.

- General Corporate Purposes: To meet other business and operational expenditures.

Want to diversify beyond IPOs? Check out our Invest Money category

Financial Performance of Fabtech Technologies

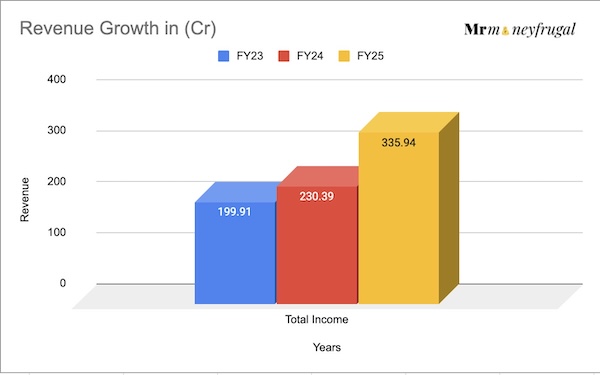

(Amounts in ₹ Crores

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 426.56 | 269.24 | 213.86 |

Total Income | 335.94 | 230.39 | 199.91 |

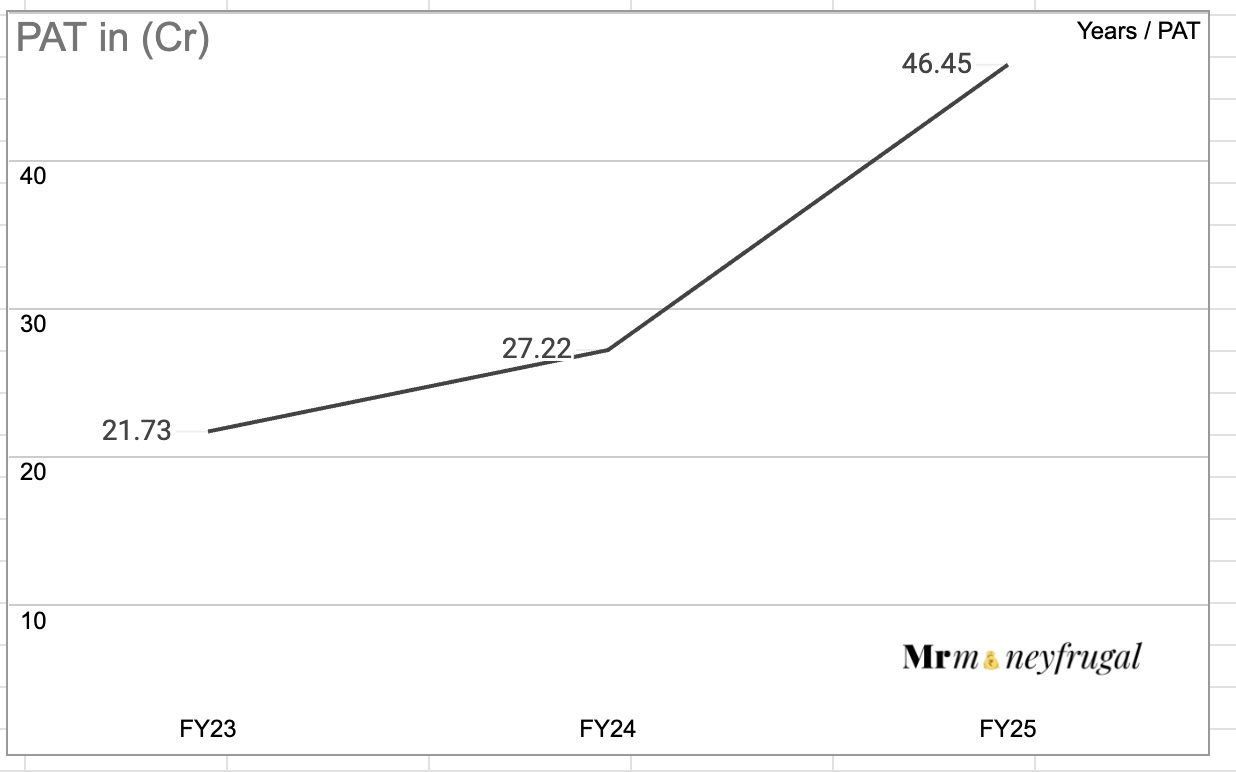

Profit After Tax | 46.45 | 27.22 | 21.73 |

EBITDA | 47.28 | 40.69 | 34.86 |

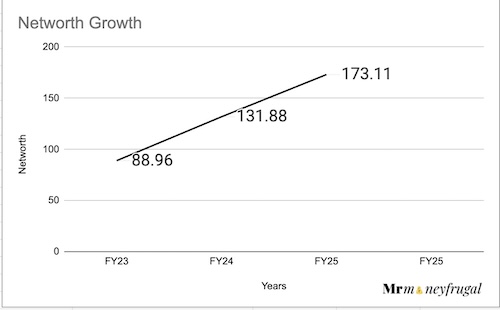

NET Worth | 173.11 | 131.88 | 88.96 |

Reserves and Surplus | 140.72 | 128.94 | 86.18 |

Total Borrowing | 54.62 | 9.88 | 34.29 |

Revenue momentum is strong, showcasing Fabtech Technologies’ business expansion ahead of IPO.

Fabtech's financial scorecard shows a company with a profitable track record and improving margins. Its profit after tax stood at a healthy ₹27.22 crores in FY24, with a PAT margin of around 12%.

Between the fiscal years ending March 31, 2025 and March 31, 2024, Fabtech Technologies Ltd had a 46% increase in sales and a 71% increase in profit after tax (PAT).

.Fabtech Technologies’ PAT has shown consistent growth over the last 3 years — a positive sign for profitability.

However, the most glaring issue is its history of negative cash flow from operations in previous years (e.g., -₹13.88 crores in FY23).

This indicates that while profits are being booked, the company has struggled to convert them into hard cash, a critical red flag for any investor.

Net Worth steadily rising from FY23 to FY25, reflecting stronger financial stability.

Industry Outlook

Fabtech Technologies operates in a specialised, high-entry barrier segment: providing end-to-end engineering solutions for setting up pharmaceutical, biotech, and healthcare facilities.

Its asset-light model, where it focuses on design, procurement, and project management rather than manufacturing, allows for scalability.

With a strong global footprint, particularly in emerging markets across the Middle East, Africa, and Asia, the company is well-positioned to capitalize on the increasing global investment in healthcare infrastructure.

Also check some prime IPOs: Glottis Limited IPO GMP, Price, Dates, Allotment, Review,

Om Metallogic IPO GMP, Price, Dates, Allotment, Review, Zappfresh IPO GMP, Price, Dates, Allotment, Review

Strengths and Risks of Fabtech Technologies IPO

Strengths:

- Niche Market Leadership: Strong expertise in the specialized pharma capex sector.

- Robust Order Book: An order book of over ₹904 crores (as of July 31) provides strong revenue visibility.

- Mainboard Listing: Listing on BSE & NSE enhances credibility and provides better liquidity.

- Experienced Promoters: The management team has decades of experience in the industry.

Risks:

- Negative Operating Cash Flows: This is the most significant risk. A history of burning cash in its core operations raises serious questions about working capital management and the sustainability of its business model.

- Significant Related-Party Transactions: Around 35% of its procurement is sourced from promoter-owned companies, creating potential conflicts of interest.

- High Customer Concentration: With the top 5 projects contributing over 63% of its FY24 revenue, the business is highly dependent on a few large contracts.

Also check: Glottis Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Zappfresh IPO Subscription Status – Day 1, Day 2 & Day 3

Ameenji Rubber IPO Subscription Status – Day 1, Day 2 & Day 3

Expert Recommendations – Should You Apply?

High Risk / Avoid

The IPO of Fabtech Technologies is a high-risk proposition where the negatives appear to outweigh the positives at the current valuation. The company is asking for a premium price without having resolved its fundamental cash flow problems.

- For Risk-Averse Investors: AVOID. The history of negative cash flows, coupled with high customer concentration and related-party transactions, makes this a clear no-go for conservative investors.

- For Aggressive Investors: The valuation seems to have priced in all the future growth, leaving very little on the table for investors. Given the risks, even aggressive investors should approach this with extreme caution.

- Our View: The IPO seems fully priced, if not overpriced. The most prudent strategy would be to "Wait and Watch." It is advisable to let the company list and observe its performance for a few quarters, especially its ability to generate positive operating cash flow, before considering an investment.

Key Takeaways

- IPO Price Band: ₹181 – ₹191 per share

- Lot Size: 75 Shares (Minimum Investment: ₹13,575)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 7, 2025.

- Recommendations of experts: A high-risk issue. It is best to avoid it at this valuation due to critical concerns about its cash flows and governance.

FAQs on Fabtech Technologies IPO

1. What is Fabtech Technologies IPO price band?

The price band for the Fabtech Technologies IPO is set at ₹181 to ₹191 per share.

2. What is Fabtech Technologies IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Friday, October 3, 2025.

3. How to check Fabtech Technologies IPO allotment status?

You can check the allotment status on the website of the IPO registrar (to be announced) once the basis of allotment is finalized.

4. What is Fabtech Technologies IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Tuesday, October 7, 2025.

5. Should I apply for Fabtech Technologies IPO?

This is a high-risk proposition. Given the demanding valuation and serious concerns regarding the company's past inability to generate cash from its operations, it is advisable for most retail investors to avoid this IPO.

Disclaimer:

"This article is for informational purposes only and should not be considered as investment advice. IPO investments are subject to market risks. Please consult your financial advisor before making any investment decisions."