Updated 27.12.2025 @ 3:00 PM

Rubicon Research Limited, a pharmaceutical formulations company with a sharp focus on the US market, is launching its mainboard Initial Public Offering (IPO) on October 9, 2025.

The company is looking to raise up to ₹1,377.50 crores through an issue that includes a fresh issue of shares and a significant Offer for Sale (OFS) by its private equity investor, General Atlantic.

The price band has been fixed at ₹461 to ₹485 per share, with a lot size of 30 shares. After a period of losses, the company has staged an impressive financial turnaround, but the IPO comes with a steep valuation.

In this article, you will find Rubicon Research IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Rubicon Research IPO Details

- Price Band: ₹461 – ₹485 per share

- IPO Open / Close Dates: October 9, 2025 – October 13, 2025

- Lot Size: 30 Shares

- Issue Size: ₹1,377.50 Crores (Fresh Issue of ₹500 Cr + OFS of ₹877.50 Cr)

- Fresh Issue / OFS: Both

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE & NSE

Rubicon Research IPO GMP Today

You can search for gmp of this and other IPOs at our gmp hub page. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Rubicon Research IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 9, 2025 – October 13, 2025

- Basis of Allotment Date: October 14, 2025

- Refund Initiation Date: October 15, 2025

- Credit of Shares: October 15, 2025

- Listing Date: October 16, 2025

You may also interested in : WeWork India IPO Allotment Status – How to Check Online, Tata Capital IPO Allotment Status – How to Check Online

Listing Update:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 485 | 620.1 | 28 |

Objectives of Rubicon Research IPO

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Prepayment/Repayment of Borrowings (₹310 Crores): A significant portion of the fresh issue proceeds will be used to reduce the company's debt.

- Inorganic Growth and General Corporate Purposes: The balance amount will be used to fund potential acquisitions and other strategic initiatives.

- Note: The proceeds from the Offer for Sale (OFS) component of ₹877.50 crores will go directly to the selling shareholder, General Atlantic, and will not be received by the company.

Financial Performance of Rubicon Research

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 1,647.60 | 1,451.43 | 1,109.49 | 749.7 |

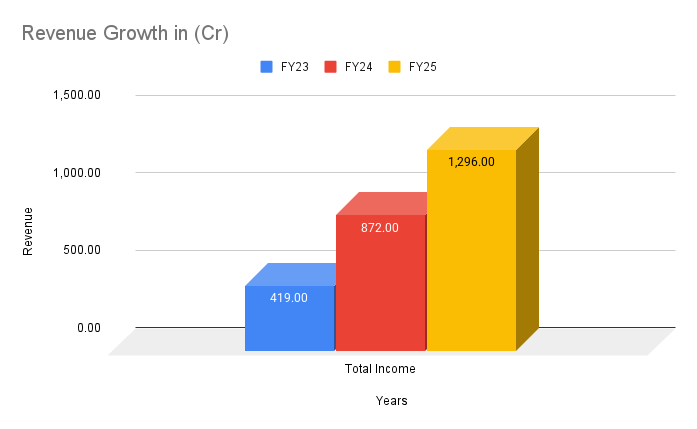

Total Income | 356.95 | 1,296.22 | 872.39 | 419 |

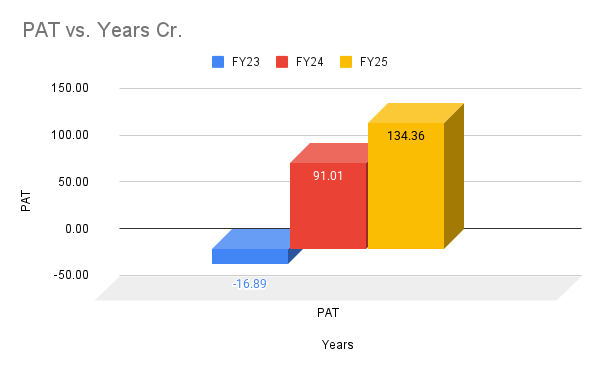

Profit After Tax | 43.3 | 134.36 | 91.01 | -16.89 |

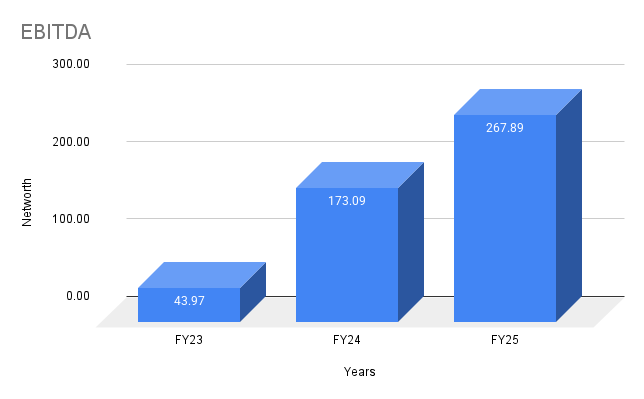

EBITDA | 79.74 | 267.89 | 173.09 | 43.97 |

NET Worth | 593.67 | 540.98 | 385 | 286.38 |

Reserves and Surplus | 397.5 | 525.57 | 369.79 | 281.31 |

Total Borrowing | 495.78 | 393.17 | 396.41 | 317.91 |

Rubicon Research has staged a remarkable financial turnaround. After reporting a loss in FY23, the company turned profitable in FY24 and has shown strong growth in FY25, with revenue increasing by 49% and profit by 48%. This pivot to profitability, driven by its focus on the high-margin US market, is a key highlight.

However, investors should be aware that the company had negative operating cash flows in FY22 and FY23. Based on its FY25 earnings, the IPO is priced at a demanding P/E multiple of over 55x.

If you’re planning to invest in IPOs or start a new business, ensure your finances and taxes are in order. You can easily file your ITR, register your business, or handle GST filing online at FileAbhi.com — trusted for quick and affordable compliance services.

Industry Outlook

- Rubicon Research operates with a singular focus on regulated markets, primarily the United States, which accounts for over 97% of its revenue.

- The US is the world's largest pharmaceutical market, driven by high healthcare spending, a strong R&D ecosystem, and a favorable regulatory environment for new drugs.

- Rubicon’s strategy of developing specialty and complex products, such as drug-device combinations, positions it to tap into high-value segments of this lucrative market.

Strengths and Risks of Rubicon Research IPO

Strengths:

- Impressive Financial Turnaround: The company has successfully pivoted from losses to strong profitability.

- US-Focused Business Model: Complete focus on the high-margin and largest pharmaceutical market in the world.

- Strong R&D and Product Portfolio: Expertise in developing complex and specialty products that can command better pricing.

- Marquee Investor Backing: Backed by global private equity major General Atlantic.

Risks:

- Large Offer for Sale (OFS): A significant portion of the IPO (₹877.50 crores) is an OFS, providing an exit to its PE investor. This means a large chunk of the money raised is not going to the company for growth.

- Steep Valuation: At a P/E of over 55x, the IPO is priced at a premium, factoring in significant future growth and leaving little margin for error.

- Heavy Dependence on the US Market: Any adverse regulatory changes, pricing pressures, or economic slowdown in the US could severely impact the business.

- High Customer Concentration: In FY24, the top five customers accounted for over 65% of the company's revenue, making it vulnerable to the loss of a key client.

Expert Recommendations – Should You Apply?

High Risk / Cautious

The Rubicon Research IPO is a classic case of a high-growth turnaround story coming at a very high price. While the recent financial performance is commendable, the valuation and the large OFS are major concerns.

- For Risk-Averse Investors: AVOID. The steep valuation, history of losses, and the large exit by a private equity investor make this a high-risk proposition not suitable for conservative investors.

- For Aggressive Investors: This is a bet on the sustainability of the company's high-growth trajectory. If you believe Rubicon can continue to grow rapidly to justify the premium valuation, you might consider it. However, the price leaves very little on the table for listing gains.

- Our View: The IPO seems fully priced, if not overpriced. The risks associated with the high valuation and the large OFS outweigh the positives of the recent turnaround. We recommend a "Cautious" approach, suggesting that most retail investors could give this a miss.

Key Takeaways

- IPO Price Band: ₹461 – ₹485 per share

- Lot Size: 30 Shares (Minimum Investment: ₹14,550)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 16, 2025.

- Recommendations of experts: High Risk. The IPO is very expensive, and the large Offer for Sale is a significant concern. A cautious approach is advised.

FAQs on Rubicon Research IPO

1. What is Rubicon Research IPO price band?

The price band for the IPO is set at ₹461 to ₹485 per equity share.

2. What is Rubicon Research IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Tuesday, October 14, 2025.

3. How to check Rubicon Research IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Rubicon Research IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Thursday, October 16, 2025.

5. Should I apply for Rubicon Research IPO?

This is a high-risk proposition. Given the very demanding valuation and the large stake sale by its private equity investor, it is advisable for most retail investors to be cautious and possibly avoid this IPO.

You may be interested in: Mittal Sections IPO GMP, Price, Dates, Allotment, Review

Find here all the Live and Upcoming IPOs.

Disclaimer

The information provided above about the IPO is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to subscribe to or avoid any IPO. Investors are advised to read the Red Herring Prospectus (RHP) and consult with their financial advisor before making any investment decisions.

Market investments are subject to risks, including loss of capital. Past performance is not indicative of future results.