Updated on 16.11.2025 @ 7:01 PM

Sihora Industries Limited, a Surat-based manufacturer of narrow woven fabrics and textiles, is launching its Initial Public Offering (IPO) on the BSE SME platform, with the subscription period opening on October 10, 2025. The company is seeking to raise ₹10.56 crores through a 100% fresh issue of shares.

The issue is offered at a fixed price of ₹66 per share, with a minimum lot size of 2,000 shares. While Sihora Industries has demonstrated a spectacular jump in profitability and is attractively priced, investors must exercise extreme caution due to its history of negative operating cash flows and high business concentration. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Sihora Industries IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Sihora Industries IPO Details

- Price Band: ₹66 per share (Fixed Price)

- IPO Open / Close Dates: October 10, 2025 – October 14, 2025

- Lot Size: 2,000 Shares

- Issue Size: 16,00,000 shares (aggregating up to ₹10.56 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Pvt.Ltd.

- Listing Exchange: BSE SME

You can also check the list of upcoming and live IPOs to stay updated on the latest market opportunities.

Sihora Industries IPO GMP Today

- Note: The shares of Sihora Industries are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Sihora Industries IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 10, 2025 – October 14, 2025

- Basis of Allotment Date: October 15, 2025

- Refund Initiation Date: October 16, 2025

- Credit of Shares: October 16, 2025

- Listing Date: October 17, 2025

Planning your long-term investments? Use our SIP Calculator to calculate potential returns and build a disciplined investment plan.

Objectives of Sihora Industries IPO

The company intends to utilise the net proceeds from the public offering for its growth and to strengthen its financial position:

- Capital Expenditure (₹2.00 Crores): For purchasing new machinery to expand the production of elastic tapes and zippers.

- Debt Repayment (₹2.58 Crores): A significant portion will be used to reduce borrowings, which will lower finance costs.

- Working Capital Requirements (₹3.50 Crores): To fund its operational needs.

- General Corporate Purposes: The balance amount will be used for other strategic and day-to-day business requirements.

Plan your financial future wisely by estimating how much you need for a comfortable retirement using our retirement calculator.

Financial Performance of Sihora Industries

(Amounts in ₹ Lakhs)

Particulars (₹ in Lakhs) | Period ended Aug 31, 2025 (SIL) | FY 2025 (SIL) | FY 2024 (Combined SNF/SIL) | FY 2023 (SNF) |

Revenue from operations | 580.14 | 1,456.20 | 1,156.09 | 1,209.77 |

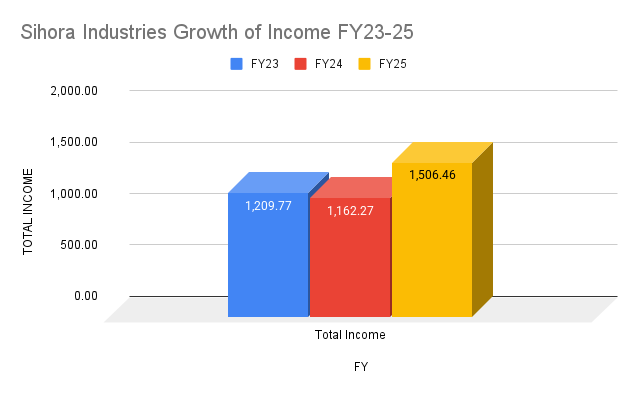

| Total Income | 586.37 | 1,506.46 | 1,162.27 | 1,209.77 |

| Total expenses | 526.61 | 1,256.22 | 1,084.86 | 1,192.23 |

Profit Before Tax (PBT) | 59.75 | 250.24 | 77.42 | 17.55 |

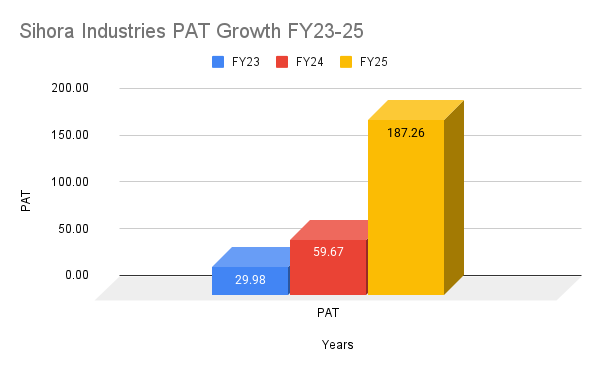

Profit After Tax (PAT) | 44.71 | 187.26 | 59.67 | 29.98 |

EBITDA | 112.6 | 329.21 | 172.3 | 116.65 |

| EBITDA Margin (%) | 19.41% | 22.61% | 14.90% | 9.64% |

| PAT Margin (%) | 7.71% | 12.86% | 5.16% | 2.48% |

| EPS (₹, Post Bonus Impact) | 1.2 | 5.02 | 0.86 | 1.09 |

| RoE (%) | 7.83% | 35.60% | 17.61% | 222.38% |

| NAV per Share (₹, Post Bonus Impact) | 15.31 | 14.11 | 11.02 | 0.49 |

The company's financial story is one of dramatic improvement in profitability. While revenue has been somewhat volatile, the profit after tax (PAT) has skyrocketed, more than tripling in FY25 compared to FY24. The PAT margin has expanded from just 2.48% in FY23 to a very healthy 12.86% in FY25.

Source: BSE India

This indicates a successful shift towards higher-margin products. However, this impressive profit growth is completely overshadowed by its history of negative cash flow from operations, a major red flag indicating that the company is burning cash in its day-to-day business despite being profitable on paper.

Check the subscription status of IPO: Sihora Industries Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Mutual fund can be your another investment option, in our mutual fund learning hub learn everything about it from beginning

Industry Outlook

- Sihora Industries operates from Surat, the textile heartland of India.

- It manufactures narrow woven fabrics like laces, tapes, and elastics, which have extensive applications in the garment and fashion industries.

- The company is strategically diversifying into higher-value products like specialized zippers and industrial textiles, aiming to tap into a wider market beyond fashion.

- The Indian textile industry is a mature but competitive space, where innovation and operational efficiency are key to success.

Strengths and Risks of Sihora Industries IPO

Strengths:

- Explosive Profit Growth: The company has demonstrated a phenomenal improvement in its profitability and margins in the most recent fiscal year.

- Attractive Valuation: Based on its FY25 earnings, the IPO is priced at a reasonable P/E multiple of approximately 13x.

- Debt Reduction: The IPO proceeds will be used to significantly deleverage the balance sheet, reducing financial risk.

- Strategic Expansion: The company has clear plans to expand its capacity in higher-margin product segments.

Risks:

- Negative Operating Cash Flow: This is the most critical risk. The company's consistent inability to generate cash from its core operations raises serious questions about its working capital management and long-term financial health.

- Extreme Business Concentration: The company suffers from high concentration risk, with its top five customers contributing nearly 50% of revenue. Furthermore, all its operations are based in a single location (Surat).

- High Supplier Dependence: The top five suppliers account for over 67% of its purchases, making it vulnerable to supply chain disruptions.

- Short Operating History: The company was incorporated in its current form only in 2023, though it took over an existing proprietorship business.

Expert Recommendations – Should You Apply?

High Risk

The Sihora Industries IPO is a classic high-risk proposition where the impressive profit numbers are at odds with the weak cash flow statement.

- For Risk-Averse Investors: AVOID. The chronic negative operating cash flow is a fundamental weakness that makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: This is a high-risk, high-reward bet. The attractive valuation and spectacular profit growth are tempting. However, investors would be betting on the company's ability to fix its cash flow problem, which is a significant gamble.

- Our View: A company that is consistently profitable but burns cash is a risky investment. The disconnect between reported profits and actual cash generation is a major red flag. We recommend that most investors avoid this IPO.

Key Takeaways

- IPO Price: ₹66 per share (Fixed Price)

- Lot Size: 2,000 Shares (Note: The minimum application for retail investors is for 2 lots or 4,000 shares, costing ₹2,64,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 17, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to chronic negative operating cash flows and high concentration risks, despite the attractive profitability numbers.

FAQs on Sihora Industries IPO

1. What is Sihora Industries IPO price?

The issue price for the Sihora Industries IPO is fixed at ₹66 per share.

2. What is Sihora Industries IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Wednesday, October 15, 2025.

3. How to check Sihora Industries IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Sihora Industries IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Friday, October 17, 2025.

5. Should I apply for Sihora Industries IPO?

This is a high-risk proposition. Given the company's persistent inability to generate cash from its core operations, coupled with high concentration risks, it is advisable for most investors to avoid this IPO.

Useful links: SIHORADP_20250811202736.pdf