Updated on 17.10.2025 @ 14:15 PM

SK Minerals & Additives Limited, a specialty chemicals company focused on food and feed additives, is set to launch its Initial Public Offering (IPO) on the BSE SME platform, opening on October 10, 2025. The companSKy plans to raise up to ₹41.15 crores through a 100% fresh issue of shares.

The price band has been fixed at ₹120 to ₹127 per share, with a minimum lot size of 1,000 shares. While SK Minerals is on a strategic path to enhance its higher-margin manufacturing business, investors must be extremely cautious due to its history of negative operating cash flows and other significant risks.

The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find SK Minerals & Additives IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

SK Minerals & Additives IPO Details

- Price Band: ₹120 – ₹127 per share

- IPO Open / Close Dates: October 10, 2025 – October 14, 2025

- Lot Size: 1,000 Shares

- Issue Size: 32,40,000 shares (aggregating up to ₹41.15 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Maashitla Securities Pvt.Ltd.

- Listing Exchange: BSE SME

Stay updated with Upcoming IPOs and Live IPOs in one place.

SK Minerals & Additives IPO GMP Today

- Note: The shares of SK Minerals & Additives are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Listing Updates:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 127 | 145 | 14.2 |

SK Minerals & Additives IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 10, 2025 – October 14, 2025

- Basis of Allotment Date: October 15, 2025

- Refund Initiation Date: October 16, 2025

- Credit of Shares: October 16, 2025

- Listing Date: October 17, 2025

Objectives of SK Minerals & Additives IPO

The company intends to utilise the net proceeds from the public issue for the following key purposes:

- Working Capital Requirement (₹31.00 Crores): A substantial portion is allocated to manage the company's working capital-intensive operations.

- Capital Expenditure (₹5.55 Crores): To fund the expansion of its manufacturing capacity from 3,600 MTPA to 5,400 MTPA.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Want to estimate your mutual fund returns before investing? Use our SIP Calculator to plan smartly

Financial Performance of SK Minerals & Additives

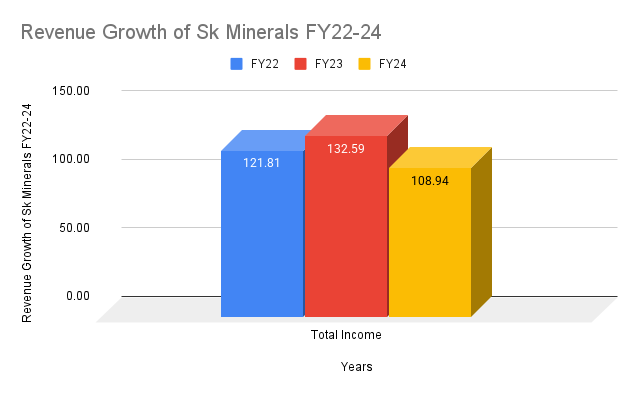

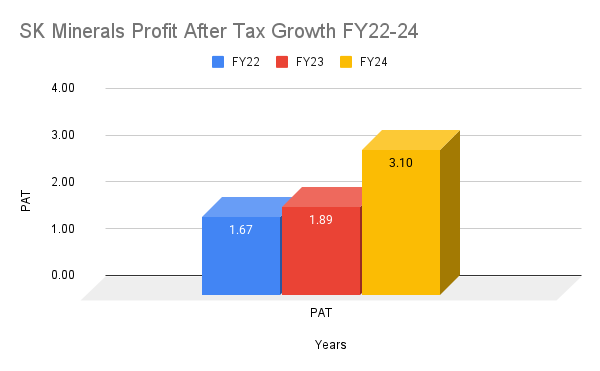

(Amounts in ₹ Crores)

Period Ended | 31 Oct 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 61.72 | 54.05 | 37.54 | 25.47 |

Total Income | 114.28 | 108.94 | 132.59 | 121.81 |

Profit After Tax | 5.01 | 3.1 | 1.89 | 1.67 |

Net Worth | 17.73 | 12.72 | 6.23 | 2.79 |

Reserves and Surplus | 12.73 | 7.72 | 4.63 | 2.78 |

The company's financials present a very mixed picture. While revenue has been volatile, profitability has shown a marked improvement, with PAT growing by 63% in FY24.

SK Minerals Profit After Tax Growth FY22-24: SOURCE: BSE INDIA

The profit momentum has continued into the first half of FY25.

However, this is completely overshadowed by a major red flag: the company has reported negative cash flow from operating activities for FY22, FY23, FY24, and the first seven months of FY25. This indicates a severe struggle to convert its profits into actual cash, a fundamental weakness in any business.

Industry Outlook

- SK Minerals operates in the growing Indian food and feed additives market. Its products cater to diverse industries like animal feed, petroleum, food processing, and leather.

- The company is strategically shifting its focus from lower-margin trading to higher-margin manufacturing, which aligns with the 'Make in India' theme.

- With a DSIR-certified R&D unit, the company aims to develop niche products to capture a larger share of this expanding market.

You can also read about Canara Robeco Asset Management Company Limited IPO for detailed insights.

Strengths and Risks of SK Minerals & Additives IPO

Strengths:

- Shift to Higher-Margin Manufacturing: The company's strategic focus is on increasing the share of its manufacturing business, which offers better profitability.

- Improving Profit Margins: PAT margins have shown a significant upward trend in recent periods.

- Diversified Industry Clientele: Caters to non-seasonal industries like feed, food, petroleum, and leather.

- Strong Government Customer Base: Over 35% of revenue comes from government entities and PSUs, providing revenue stability.

Risks:

- Chronic Negative Operating Cash Flow: This is the biggest risk. The company has consistently failed to generate cash from its core operations, making it highly dependent on external funding to survive and grow.

- High Customer and Supplier Concentration: The business is highly vulnerable, with the top 10 customers contributing 66% of revenue and the top 5 suppliers accounting for 70% of purchases.

- Blocked Funds and Regulatory Issues: Approximately ₹1.93 crores are blocked by the US Office of Foreign Assets Control (OFAC). The company has also faced non-compliance issues regarding environmental clearances for its facility.

- High Debt: The company has a high debt-to-equity ratio, and a significant portion of the IPO proceeds will go towards managing working capital rather than aggressive debt reduction.

If you’re exploring other investment avenues beyond IPOs, check out our Mutual Funds section for guides, comparisons, and insights.

Expert Recommendations – Should You Apply?

High Risk / Avoid

The IPO of SK Minerals & Additives is a high-risk proposition where the red flags significantly outweigh the positives. The persistent inability to generate cash from operations is a fundamental flaw that cannot be overlooked.

- For Risk-Averse Investors: AVOID. This is a clear avoid. The negative cash flow, high concentration, and regulatory issues make it entirely unsuitable for conservative investors.

- For Aggressive Investors: While the forward P/E based on recent performance might look reasonable, the underlying business is not generating cash. Betting on a turnaround in this fundamental metric is a very high-risk strategy.

- Our View: A company that is consistently profitable on paper but continuously burns cash in its operations is a risky investment. We recommend that investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹120 – ₹127 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,54,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 17, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to chronic negative operating cash flows and other significant risks.

FAQs on SK Minerals & Additives IPO

1. What is SK Minerals & Additives IPO price band?

The price band for the IPO is set at ₹120 to ₹127 per equity share.

2. What is SK Minerals & Additives IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Wednesday, October 15, 2025.

3.How to check SK Minerals & Additives IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is SK Minerals & Additives IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Friday, October 17, 2025.

5. Should I apply for SK Minerals & Additives IPO?

This is a high-risk proposition. Given the company's consistent inability to generate cash from its core operations, coupled with high concentration and regulatory risks, it is advisable for most investors to avoid this IPO.

IPO Disclaimer:

"The IPO details, including price band, dates, allotment status, and Grey Market Premium (GMP), are sourced from publicly available information and are subject to change. We do not provide any investment recommendations. Investors are advised to do their own research or consult a financial advisor before investing in any IPO. We are not liable for any loss or damage arising from reliance on the information provided here."