Updated on 07.11.2025 @ 11:07 AM

Studds Accessories Limited, is launching its mainboard Initial Public Offering (IPO) on October 30, 2025. The issue is a 100% Offer for Sale (OFS) by its promoters. The price band has been fixed at ₹557 to ₹585 per share, with a minimum lot size of 25 shares. The IPO has already garnered significant attention in the unlisted market, with a strong Grey Market Premium (GMP) of ₹85, indicating robust investor demand and the potential for a healthy listing.

In this article, you will find Studds Accessories IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Stay ahead in the market with our regularly updated section on Upcoming and Latest IPOs — track new listings, grey market premiums, and allotment dates in one place.

Briefs of Studds Accessories IPO Details

- Price Band: ₹557 – ₹585 per share

- IPO Open / Close Dates: October 30, 2025 – November 3, 2025

- Lot Size: 25 Shares

- Issue Size: 77,86,120 shares (aggregating up to ₹455.49 Crores)

- Fresh Issue / OFS: 100% Offer for Sale

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE & NSE

You may also want to check: Studds Accessories LimitedIPO Subscription Status – Day 1, Day 2 & Day 3

What is The Studds Accessories IPO GMP Today?

- Note: The current Grey Market Premium (GMP) of ₹85 suggests a potential listing premium of around 14-15% over the upper price band. GMP is an unofficial indicator and changes frequently based on market sentiment and subscription demand.

Listing Updates:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 585 | 565 | -3.4 |

What are the Studds Accessories IPO Dates & Allotment Schedule?

- IPO Open & Close Date: October 30, 2025 – November 3, 2025

- Basis of Allotment Date: November 4, 2025

- Refund Initiation Date: November 6, 2025

- Credit of Shares: November 6, 2025

- Listing Date: November 7, 2025

What are the Objectives of Studds Accessories IPO?

This is a critical point for investors. The IPO is a 100% Offer for Sale, which means:

- The company, Studds Accessories, will not receive any funds from the public issue.

- The entire proceeds of ₹455.49 crores will go directly to the selling promoters, who are monetizing a part of their stake in the company.

Want to understand mutual funds better? Visit our Mutual Fund Learning Hub to explore guides that simplify investing for beginners.

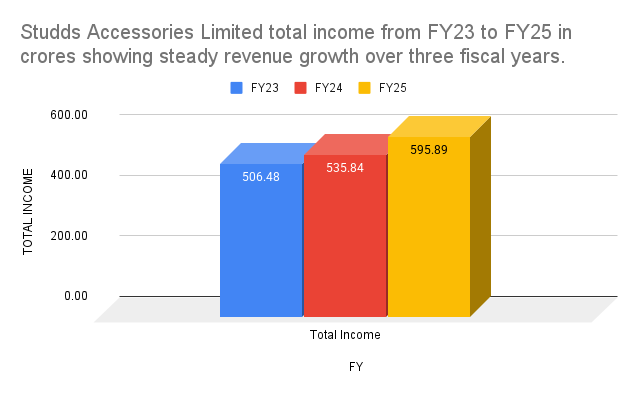

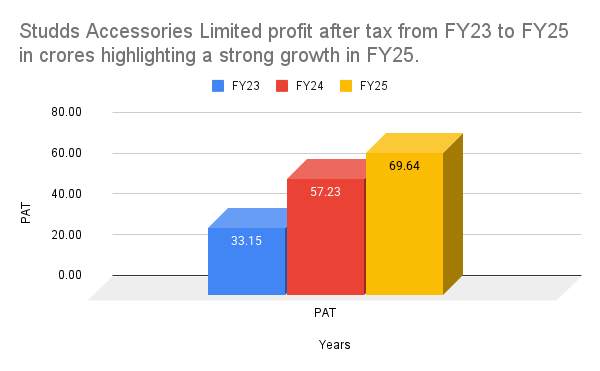

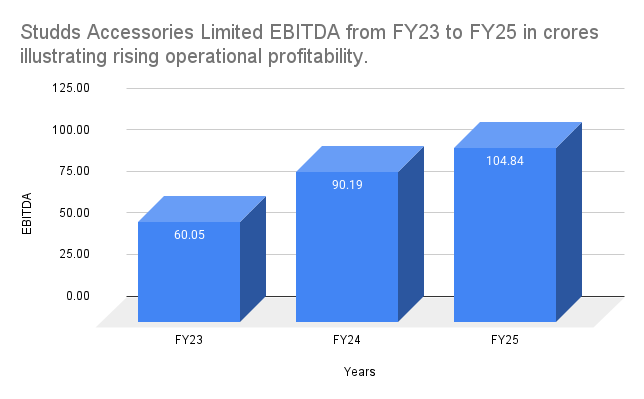

What is the Financial Performance of Studds Accessories?

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 586.61 | 556.71 | 485.56 | 461.07 |

Total Income | 152.01 | 595.89 | 535.84 | 506.48 |

Profit After Tax | 20.25 | 69.64 | 57.23 | 33.15 |

EBITDA | 30.26 | 104.84 | 90.19 | 60.05 |

NET Worth | 469.77 | 449.48 | 387.41 | 338.02 |

Reserves and Surplus | 450.09 | 429.8 | 377.57 | 328.18 |

Total Borrowing | 2.91 | 2.91 | 0.61 | 30.58 |

Studds Accessories has a strong and consistent financial track record. The company is virtually debt-free. Its revenue has grown steadily, and its profitability has been on a remarkable upward trajectory, with profit after tax (PAT) more than doubling between FY23 and FY25. The company's margins have also shown significant improvement, reflecting operational efficiency.

Based on its FY25 earnings, the IPO is priced at a P/E multiple of approximately 27x, which appears reasonable for a market leader with a strong brand and financial profile.

Source: BSE India

You might also want to know: What is the Bombay Stock Exchange (BSE) in 2025? History, Indices & How It Works

Industry Outlook

- Studds is the undisputed leader in the Indian two-wheeler helmet market.

- With the government's increasing focus on road safety and mandatory helmet laws, the demand for quality, branded helmets is set to grow consistently.

- The company operates in a market with high entry barriers due to the need for brand trust, an extensive distribution network, and stringent safety certifications.

- As the largest player with a global footprint in over 70 countries, Studds is perfectly positioned to capitalize on this growing demand.

If you’re looking to grow an income source online, check our Make Money by Blogging section — practical tips and real strategies for bloggers and creators.

What are the Strengths and Risks of Studds Accessories IPO?

Strengths:

- Global Market Leader: The world's largest two-wheeler helmet manufacturer by volume and India's largest by revenue.

- Iconic Brands: "Studds" and "SMK" are powerful brands with high consumer recall and loyalty.

- Virtually Debt-Free with Strong Financials: A clean balance sheet with consistent growth in revenue and profits.

- Vertically Integrated Operations: Strong control over the entire value chain, from design and manufacturing to distribution.

Risks:

- 100% Offer for Sale (OFS): This is the biggest red flag. The promoters are cashing out, and no money is being raised for the company's future growth.

- High Product Concentration: The business is heavily dependent on the sale of helmets, which contribute over 92% of its revenue.

- Manufacturing Concentration: All manufacturing facilities are located in a single region (Faridabad, Haryana), exposing the company to localized risks.

- Raw Material Price Volatility: The company's margins can be affected by fluctuations in the prices of key raw materials.

Learn smart ways to leverage AI tools — our guide on How to Use ChatGPT to Make Money shows how to turn creativity and automation into income.

What are the Expert Recommendations – Should You Apply?

Subscribe for Listing Gains & Long-Term

The Studds Accessories IPO offers a rare opportunity to invest in a clear market leader with a powerful brand and excellent financials. While the 100% OFS structure is a concern, the underlying business is of very high quality.

- For Long-Term Investors: This is a strong candidate for a core portfolio. It is a debt-free company with a dominant market position in a growing industry. The valuation is also reasonable.

- For Listing Gains: The strong Grey Market Premium of around ₹85 indicates robust investor demand and suggests a healthy listing day gain of around 14-15% is possible. This makes the IPO attractive for those seeking short-term gains as well.

- Our View: The business fundamentals are exceptional, and the brand is a household name. While the OFS is a drawback, the strong market sentiment and reasonable valuation make it a compelling opportunity. We recommend "Subscribe" for both potential listing gains and long-term holding.

Key Takeaways

- IPO Price Band: ₹557 – ₹585 per share

- Lot Size: 25 Shares (Minimum Investment: ₹14,625)

- GMP Today: ₹85 (Indicating a healthy premium of ~14-15%)

- Allotment & Listing Dates: Tentative listing on November 7, 2025.

- Recommendations of experts: Subscribe. A fundamentally strong, debt-free market leader with strong investor demand, making it attractive for both listing gains and long-term investment.

FAQs on Studds Accessories IPO

1. What is Studds Accessories IPO price band?

The price band for the IPO is set at ₹557 to ₹585 per equity share.

2. What is Studds Accessories IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Tuesday, November 4, 2025.

3. How to check Studds Accessories IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Studds Accessories IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Friday, November 7, 2025.

5. Should I apply for Studds Accessories IPO?

Yes, this is a highly recommended IPO. The company is a debt-free market leader with strong fundamentals and significant investor interest, as indicated by its GMP. It is attractive for both listing gains and long-term investment, despite being a 100% Offer for Sale.

You may also want to check: Lenskart Solutions IPO GMP, Price, Dates, Allotment, Review

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. IPO investments are subject to market risks. Please consult your financial advisor before making any investment decisions. Information such as IPO dates, price, and GMP is based on publicly available data and may change without prior notice.