Updated: 05.10.2025 @ 12:00 PM IST

The initial public offering (IPO) of DSM Fresh Foods Limited, which operates under the popular brand name Zappfresh, is scheduled to open for public subscription on September 26, 2025.

This online meat delivery platform, with a strong focus on the Delhi-NCR market, is looking to raise up to ₹59.65 crores through a complete fresh issue of shares. The price for the IPO has been set in the range of ₹96 to ₹101 per share.

Investors will need to bid for a minimum lot size of 1,200 shares. Initial trends from the grey market indicate a moderate demand for the issue, reflecting both investor interest in the direct-to-consumer sector and caution regarding the company's financial health.

This article provides a detailed analysis of the Zappfresh IPO, covering its grey market premium (GMP), subscription status, key dates, price band, and an unbiased review to guide your investment decision.

Zappfresh IPO Details

- Price Band: ₹96 – ₹101 per share

- IPO Open / Close Dates: September 26, 2025 – Oct 06, 2025

- Lot Size: 1,200 Shares

- Issue Size: 59,06,400 shares (aggregating up to ₹59.65 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Maashitla Securities Private Limited

- Listing Exchange: BSE SME

Zappfresh IPO GMP Today

GMP is an unofficial indicator and can change rapidly based on market sentiment and subscription demand once trading begins.

Zappfresh IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 26, 2025 – September 30, 2025

- Basis of Allotment Date: October 1, 2025

- Refund Initiation Date: October 3, 2025

- Credit of Shares: October 3, 2025

- Listing Date: October 6, 2025

Objectives of Zappfresh IPO

Use of IPO Funds

Zappfresh plans to use the money raised from the IPO primarily for expansion and strengthening its operations.

- The company has earmarked ₹13.50 crores for capital expenditure, which includes setting up new cold storage and processing units.

- A sum of ₹15 crores will be allocated for marketing and brand-building activities to attract new customers.

- A substantial portion, ₹25 crores, is designated for meeting the working capital requirements, a critical need given the company's current cash flow situation.

- The balance of the proceeds will be used for potential strategic acquisitions and other general corporate purposes.

Also Learn: Initial Public Offers: IPO Reviews of India

Also check here: Zappfresh IPO Subscription Status – Day 1, Day 2 & Day 3

Financial Performance of Zappfresh

(Amount in Lakhs)

Particulars | 31-Mar-24 | 31-Mar-23 | 31-Mar-22 |

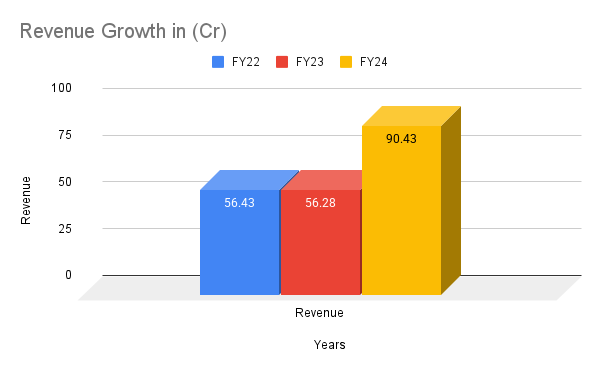

Revenue from Operations | 9,043.92 | 5,628.39 | 5,642.86 |

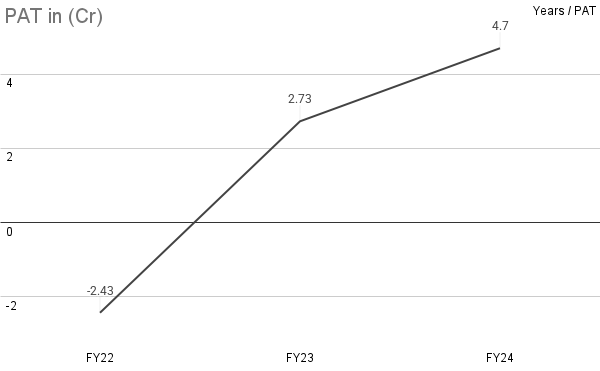

Profit After Tax (PAT) | 466.65 | 273.85 | -248.87 |

Total Borrowings | 764.84 | 206.8 | 87.2 |

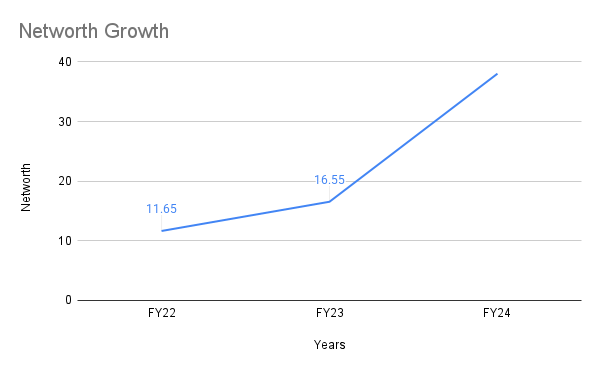

Net Worth | 3,803.53 | 1,654.33 | 1,165.38 |

EPS (Basic) (₹) | 4.54 | 2.69 | -2.44 |

Cash Flow from Operations | -1,303.96 | -241.84 | -233.28 |

Zappfresh's financial performance presents a mixed picture. The company has shown impressive top-line growth, with its revenue from operations jumping by 61% in the financial year 2024 to ₹90.44 crores. More importantly, it has successfully turned profitable, recording a net profit of ₹4.67 crores in FY24, a significant improvement from the loss of ₹2.49 crores in FY22.

However, this growth has been capital-intensive. The company's borrowings have increased sharply, and the most significant concern is its severe negative cash flow from operations, which stood at a staggering -₹130.40 crores in FY24. This indicates that while profitable on paper, the company's core operations are consuming a large amount of cash, making it dependent on external funding to run its day-to-day business.

Zappfresh operates in the high-growth direct-to-consumer (D2C) market for fresh meat and ready-to-cook products, a sector benefiting from increased urbanisation and a consumer shift towards hygienic and convenient food options.

Some other Key IPOs you may have interest in:Ameenji Rubber IPO Listing Date, Price & Market Debut, IPO Review: Propshare Titiana, IPO Review: Swastika Castal Limited

Analysis of Strengths of Zappfresh

The primary strengths of Zappfresh lie in its strong brand recall in the Delhi-NCR market and its position within a sunrise sector with favourable long-term trends. The company has proven its ability to scale its business and achieve profitability.

However, potential investors must weigh these positives against significant risks. The most glaring red flag is the negative operating cash flow, which raises questions about the sustainability of its business model without continuous funding.

Another major concern is the low promoter holding, which will fall to just 28.11% after the IPO. Such a low stake can sometimes lead to a misalignment of interests between the promoters and public shareholders.

Furthermore, the business has a high geographical concentration risk, with over 60% of its revenue coming from just two states. The company’s past record also includes instances of delayed regulatory filings, which points to potential weaknesses in its internal governance.

While investing in IPOs like Zappfresh can be exciting, long-term tax-saving options like ELSS mutual funds can help grow wealth with added tax benefits.

Expert Recommendation: Should You Apply?

Given the analysis, the Zappfresh IPO is best suited for investors with a very high-risk appetite.

For conservative or risk-averse investors, it would be prudent to avoid this IPO. The negative cash flow and low promoter holding are fundamental weaknesses that cannot be overlooked.

For aggressive investors who are comfortable with high risk, this IPO could be a speculative opportunity for listing gains, driven by the positive sentiment around D2C brands.

For those looking at a long-term investment, the most sensible strategy would be to wait and watch. It is advisable to let the company list and then track its quarterly performance to see if it can improve its cash flows and prove the sustainability of its growth model.

Key Takeaways

IPO Price Band: ₹96 – ₹101 per share.

- Lot Size: A minimum investment of ₹2,42,400 for 2,400 shares.

- GMP Today: ₹0, as it is not yet trading.

- Key Dates: The IPO is from September 26 to September 30, with a listing date of October 6, 2025.

- Overall View: A high-risk, high-potential-reward issue.

Frequently Asked Questions (FAQs) on the Zappfresh IPO

What is the Zappfresh IPO GMP today?

The current Grey Market Premium for the Zappfresh IPO is ₹0 as it has not started trading yet.

What is the price band for the Zappfresh IPO?

The price band has been fixed at ₹96 to ₹101 per share.

When is the allotment date for the Zappfresh IPO?

The allotment of shares is tentatively scheduled for October 1, 2025.

How can I check the allotment status for the Zappfresh IPO?

The allotment status can be checked on the website of the official registrar, Maashitla Securities Private Limited, after the allotment is finalized.

What is the listing date for the Zappfresh IPO?

The company is expected to list on the BSE SME platform on October 6, 2025.

Should I invest in the Zappfresh IPO?

This is a high-risk IPO. It is recommended that conservative investors avoid it. Aggressive investors may consider it for listing gains but must be aware of the significant underlying financial risks.

Useful Links: DSM Fresh Foods IPO DRHP

Also check: Om Metallogic IPO GMP, Price, Dates, Allotment, Review

This article is for informational purposes only and does not constitute financial advice or a recommendation to invest. Please consult a qualified financial advisor before making any investment decisions. Investment in IPOs carries risks, including the potential loss of capital.