Valplast Technologies Limited, a civil engineering and construction company, is set to launch its Initial Public Offering (IPO) on the BSE SME platform, opening on September 30, 2025. The company aims to raise up to ₹28.09 crores through a 100% fresh issue of shares. The price band has been fixed at ₹51 to ₹54 per share, with a minimum lot size of 2,000 shares. While the company's DRHP highlighted explosive growth in FY24, the latest financials show a worrying decline. Coupled with significant litigation and high customer concentration, this IPO comes with substantial risks. The Grey Market Premium (GMP) is currently subdued, suggesting cautious market sentiment.

In this article, you will find Valplast Technologies IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Valplast Technologies IPO Details

- Price Band: ₹51 – ₹54 per share

- IPO Open / Close Dates: September 30, 2025 – October 3, 2025

- Lot Size: 2,000 Shares

- Issue Size: 52,02,000 shares (aggregating up to ₹28.09 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Pvt Ltd

- Listing Exchange: BSE SME

Check subscription status: Valplast Technologies IPO Subscription Status – Day 1, Day 2 & Day 3

Also check:

BAG convergence IPO Subscription Status – Day 1, Day 2 & Day 3

Fabtech Technologies IPO Subscription Status – Day 1, Day 2 & Day 3

Valplast Technologies IPO GMP Today

- Note: The current Grey Market Premium (GMP) of ₹3 suggests a potential listing premium of around 5-6% over the upper price band. GMP is an unofficial indicator and changes frequently based on market sentiment and subscription demand.

Valplast Technologies IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 30, 2025 – October 3, 2025

- Basis of Allotment Date: October 6, 2025

- Refund Initiation Date: October 7, 2025

- Credit of Shares: October 7, 2025

- Listing Date: October 8, 2025

Also check: B.A.G. Convergence IPO Allotment Status – How to Check Online

Fabtech Technologies IPO Allotment Status – How to Check Online

Objectives of Valplast Technologies IPO

The company intends to utilise the net proceeds from the public issue for the following purposes:

- Capital Expenditure (₹4.85 Crores): For the purchase of machinery to support its construction and engineering projects.

- Working Capital Requirements (₹16.00 Crores): A significant portion is allocated to manage its operational cycle and fund project execution.

- General Corporate Purposes: The balance amount will be used for other strategic and day-to-day business needs.

Financial Performance of Valplast Technologies

(Amounts in ₹ Crores)

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 75.61 | 56.83 | 26.75 |

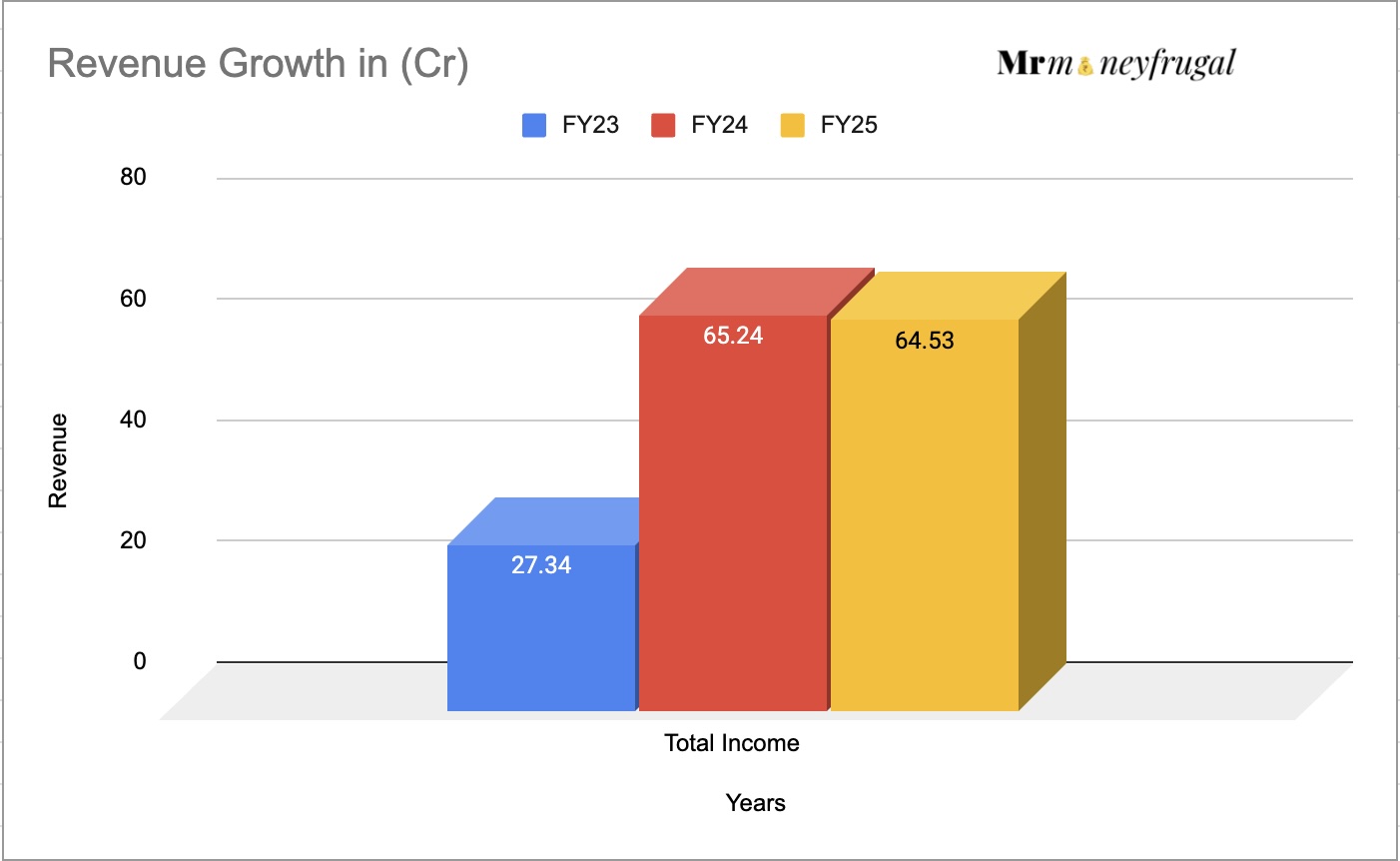

Total Income | 64.53 | 65.24 | 27.34 |

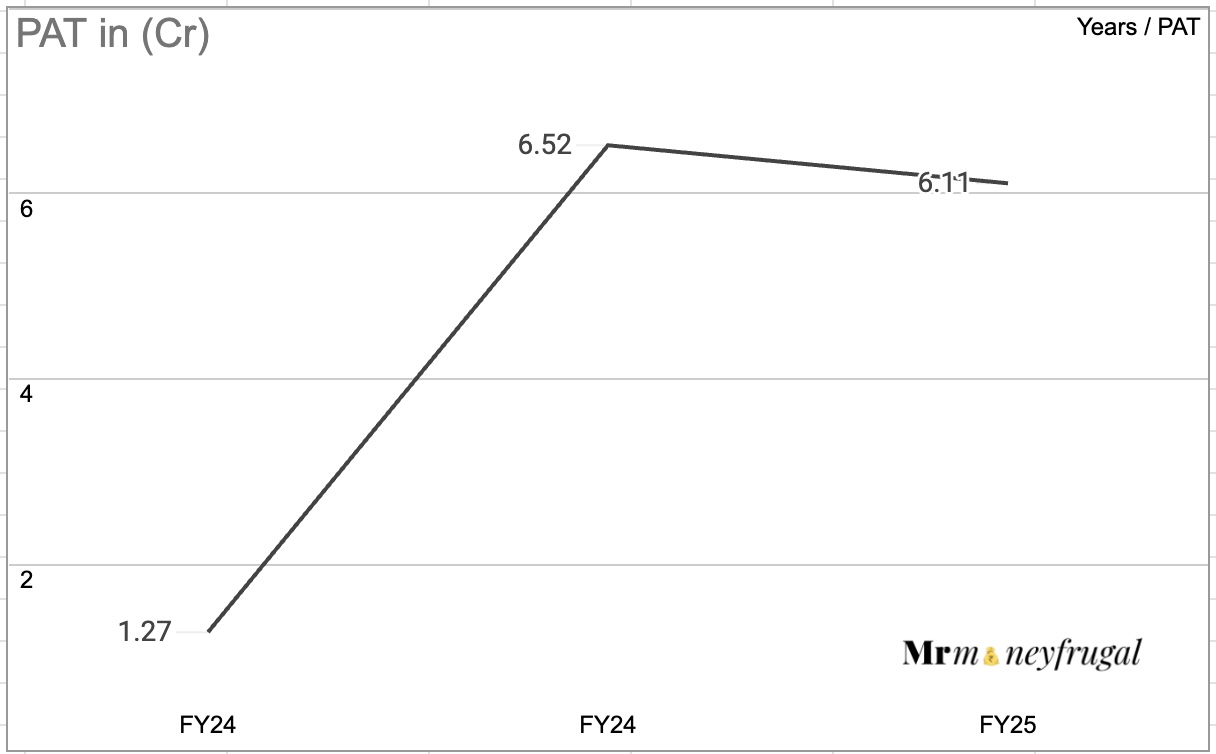

Profit After Tax | 6.11 | 6.52 | 1.27 |

EBITDA | 12.71 | 9.98 | 3.13 |

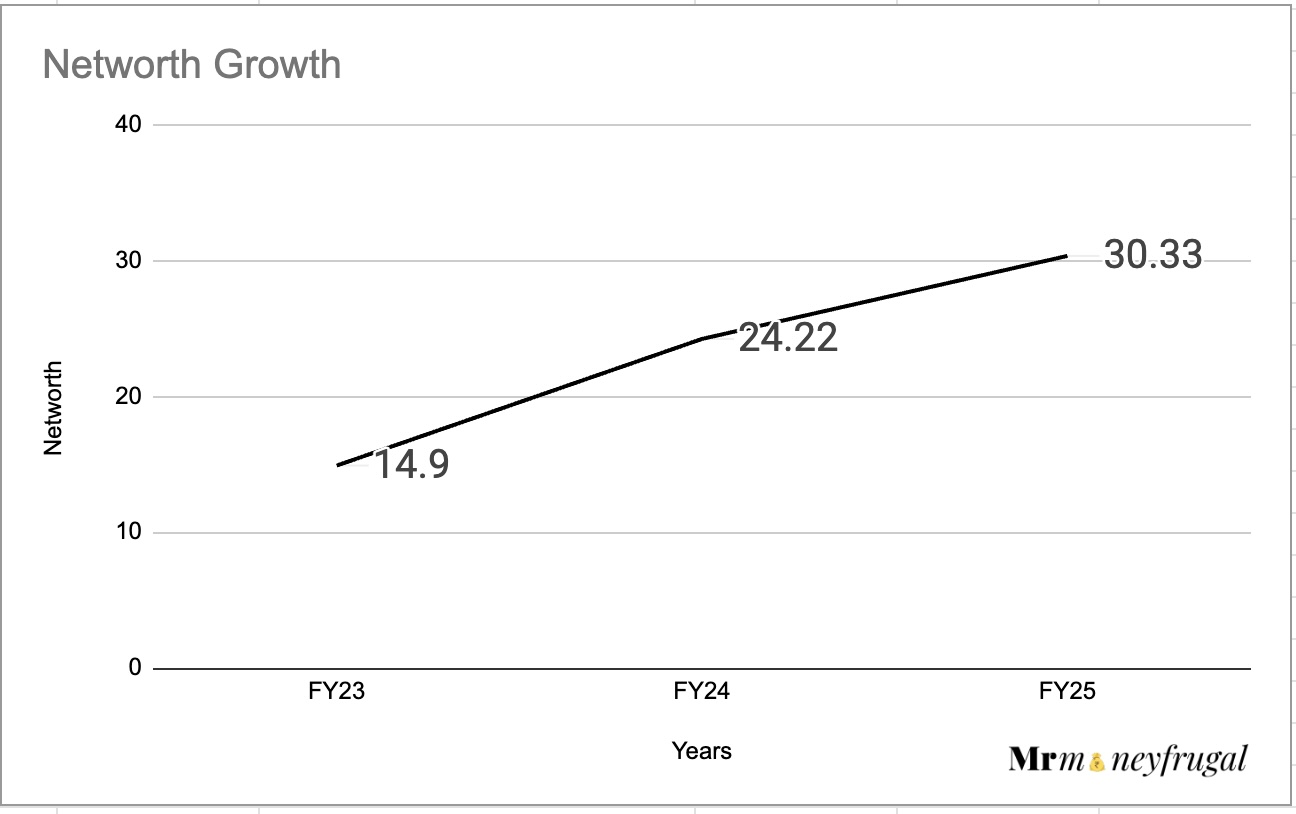

NET Worth | 30.33 | 24.22 | 14.9 |

Reserves and Surplus | 15.91 | 9.79 | 2.4 |

Total Borrowing | 22.55 | 6.2 | 3.93 |

The company's financial performance presents a concerning picture. While Valplast Technologies showcased explosive growth in FY24, with revenue surging 138% and PAT growing over 400%, the latest financials for FY25 reveal a decline in both revenue and profit. This reversal of the growth trend is a major red flag.

Furthermore, the company has a history of negative cash flow from operations (e.g., -₹1.69 crores in FY23), indicating struggles in converting its profits into actual cash. Based on its FY25 earnings, the IPO is priced at a P/E multiple of around 13x.

Industry Outlook

Valplast Technologies operates in the infrastructure and construction sector, with a niche focus on services like structural waterproofing, injection grouting, and Mechanical, Electrical & Plumbing (MEP) works for tunnels and metro projects.

The company is a direct beneficiary of India's massive infrastructure push, with government initiatives like PM Gati Shakti driving demand for specialized construction services. This provides a strong sectoral tailwind for the company's business.

Strengths and Risks of Valplast Technologies IPO

Strengths:

- Niche Expertise: Specialized services in waterproofing and tunnel construction create a competitive edge.

- Experienced Promoters: The management has significant experience in the civil engineering industry.

- Favourable Industry Dynamics: The company is well-positioned to benefit from India's ongoing infrastructure boom.

Risks:

- Declining Financials: The drop in revenue and profit in the latest financial year is a major concern that completely overshadows its past growth.

- Massive Outstanding Litigation: The company is involved in tax-related disputes amounting to a staggering ₹12.78 crores, and has contingent liabilities of over ₹11.51 crores. For a company raising ₹28 crores, this level of potential liability is a huge risk.

- Extreme Customer and Geographic Concentration: In FY24, the top customer contributed 67% of revenue, and the state of Jammu & Kashmir accounted for 71% of revenue. This makes the business extremely vulnerable to any disruption from a single client or region.

- History of Non-Compliance: The company has a history of delayed statutory filings, which raises questions about its internal controls and corporate governance.

Expert Recommendations – Should You Apply?

High Risk / Avoid

The Valplast Technologies IPO is riddled with significant red flags that make it a highly risky proposition. The initial growth story has been undone by the latest financial results, and the mountain of potential liabilities from litigation is too large to ignore.

- For Risk-Averse Investors: AVOID. This is a clear avoid. The combination of declining financials, massive litigation, and extreme concentration risk is not suitable for any conservative portfolio.

- For Aggressive Investors: Even for investors with a high-risk appetite, the risks appear to far outweigh the potential rewards. The recent dip in performance makes it very difficult to justify an investment.

- Our View: The risks are simply too high. The weak GMP reflects the market's justified caution. We recommend that investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹51 – ₹54 per share

- Lot Size: 2,000 Shares (Minimum retail investment is for 2 lots or 4,000 shares, amounting to ₹2,16,000, which falls under the sHNI category)

- GMP Today: ₹3 (Suggesting weak demand)

- Allotment & Listing Dates: Tentative listing on October 8, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to declining financials, huge litigation, and extreme concentration risks.

FAQs on Valplast Technologies IPO

1. What is Valplast Technologies IPO GMP today?

Currently, the GMP for the Valplast Technologies IPO is ₹3, indicating very mild interest in the grey market.

2. What is Valplast Technologies IPO price band?

The price band for the IPO is set at ₹51 to ₹54 per equity share.

3. What is Valplast Technologies IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, October 6, 2025.

4. How to check Valplast Technologies IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

5. What is Valplast Technologies IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Wednesday, October 8, 2025.

6. Should I apply for Valplast Technologies IPO?

Given the significant red flags, including a recent decline in revenue and profit, massive outstanding litigation, and extreme customer concentration, it is advisable for most retail investors to avoid this IPO.

Useful Links: VALPLAST TECHNOLOGIES LIMITED

Also check other latest prime IPOs: B.A.G. Convergence IPO GMP, Price, Dates, Allotment, Review

Fabtech Technologies IPO GMP, Price, Dates, Allotment, Review

Disclaimer: IPO details, GMP, and reviews shared here are for informational purposes only. Please read official documents and consult your financial advisor before investing.