Zelio E-Mobility Limited, a Hisar-based manufacturer of electric two-wheelers and three-wheelers, is set to launch its Initial Public Offering (IPO) on September 30, 2025.

The company aims to raise up to ₹78.34 crores through an issue that includes both a fresh issue of shares and an Offer for Sale (OFS) by promoters.

The price band has been fixed at ₹129 to ₹136 per share, with a lot size of 1,000 shares.

While Zelio operates in the high-growth EV sector and has shown explosive financial growth, investors must take note of its short operating history and negative operating cash flows. The Grey Market Premium (GMP) is yet to indicate any market sentiment.

In this article, you will find Zelio E-Mobility IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Zelio E-Mobility IPO Details

- Price Band: ₹129 – ₹136 per share

- IPO Open / Close Dates: September 30, 2025 – October 3, 2025

- Lot Size: 1,000 Shares

- Issue Size: ₹78.34 Crores (Fresh Issue of ₹58.83 Cr + OFS of ₹15.50 Cr)

- Fresh Issue / OFS: Both

- Registrar: Maashitla Securities Private Limited

- Listing Exchange: BSE SME

Check here: Zelio E-Mobility IPO Subscription Status – Day 1, Day 2 & Day 3

Zelio E-Mobility IPO GMP Today

Note: The shares of Zelio E-Mobility are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Zelio E-Mobility IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 30, 2025 – October 3, 2025

- Basis of Allotment Date: October 6, 2025

- Refund Initiation Date: October 7, 2025

- Credit of Shares: October 7, 2025

- Listing Date: October 8, 2025

Check Zelio E-Mobility IPO Allotment Status – How to Check Online

Some other important IPOs allotment status: Valplast Technologies IPO Allotment Status – How to Check Online

B.A.G. Convergence IPO Allotment Status – How to Check Online

Objectives of Zelio E-Mobility IPO

The net proceeds from the Fresh Issue will be utilised for:

- Repayment of Borrowings (₹24.50 Crores): To reduce debt and strengthen the balance sheet.

- Capital Expenditure (₹23.89 Crores): For setting up a new manufacturing unit to expand capacity.

- Working Capital Requirements: To fund the company's growing operational needs.

- General Corporate Purposes: For other strategic and business requirements.

- Note: The proceeds from the Offer for Sale (OFS) component of ₹15.50 crores will go directly to the selling promoters and will not be received by the company.

Financial Performance of Zelio E-Mobility

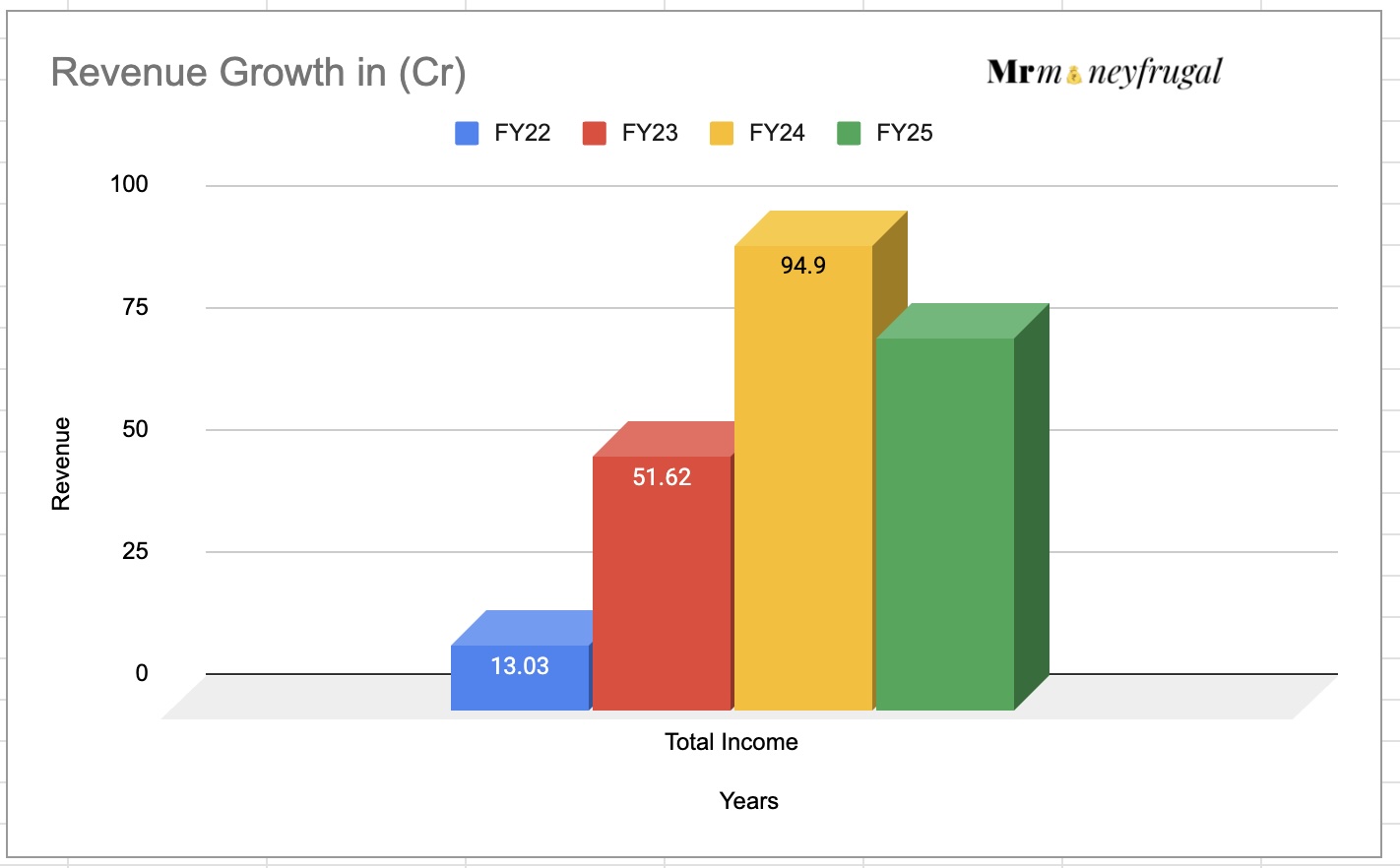

(Amounts in ₹ Crores)

Period Ended | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 53.89 | 29.08 | 15.47 | 8.57 |

Total Income | 76.04 | 94.9 | 51.62 | 13.03 |

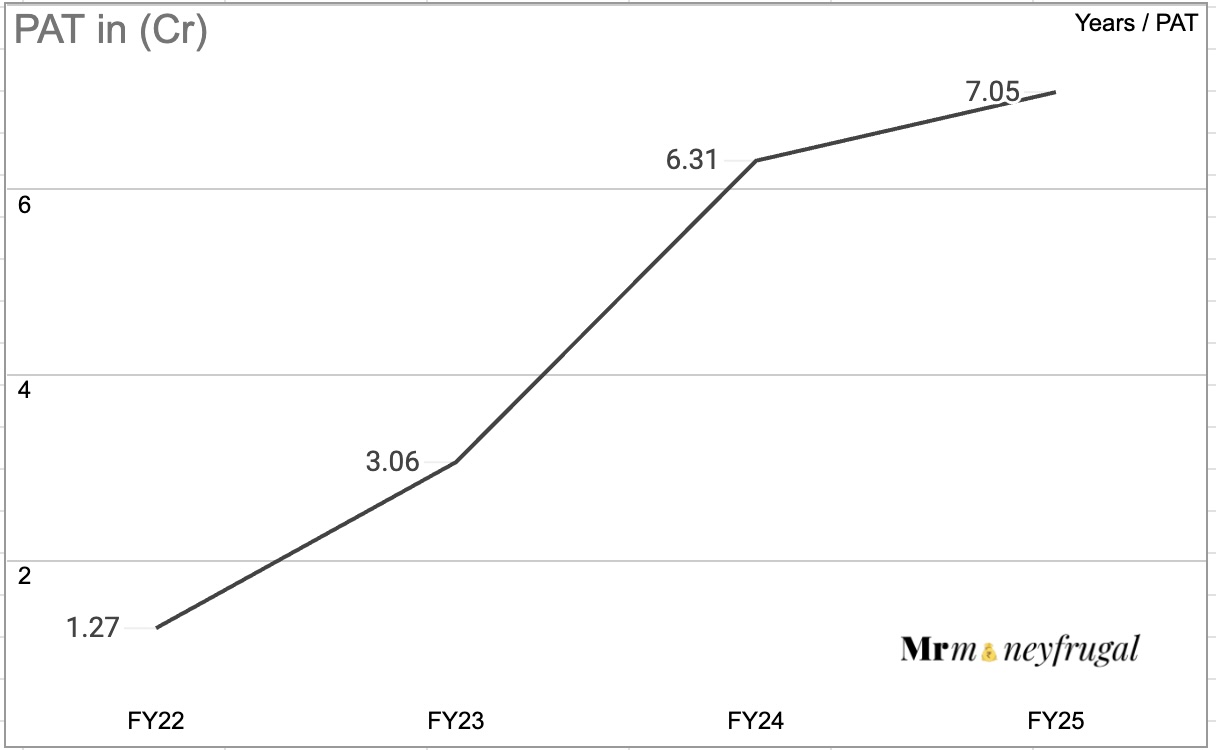

Profit After Tax | 7.05 | 6.31 | 3.06 | 1.27 |

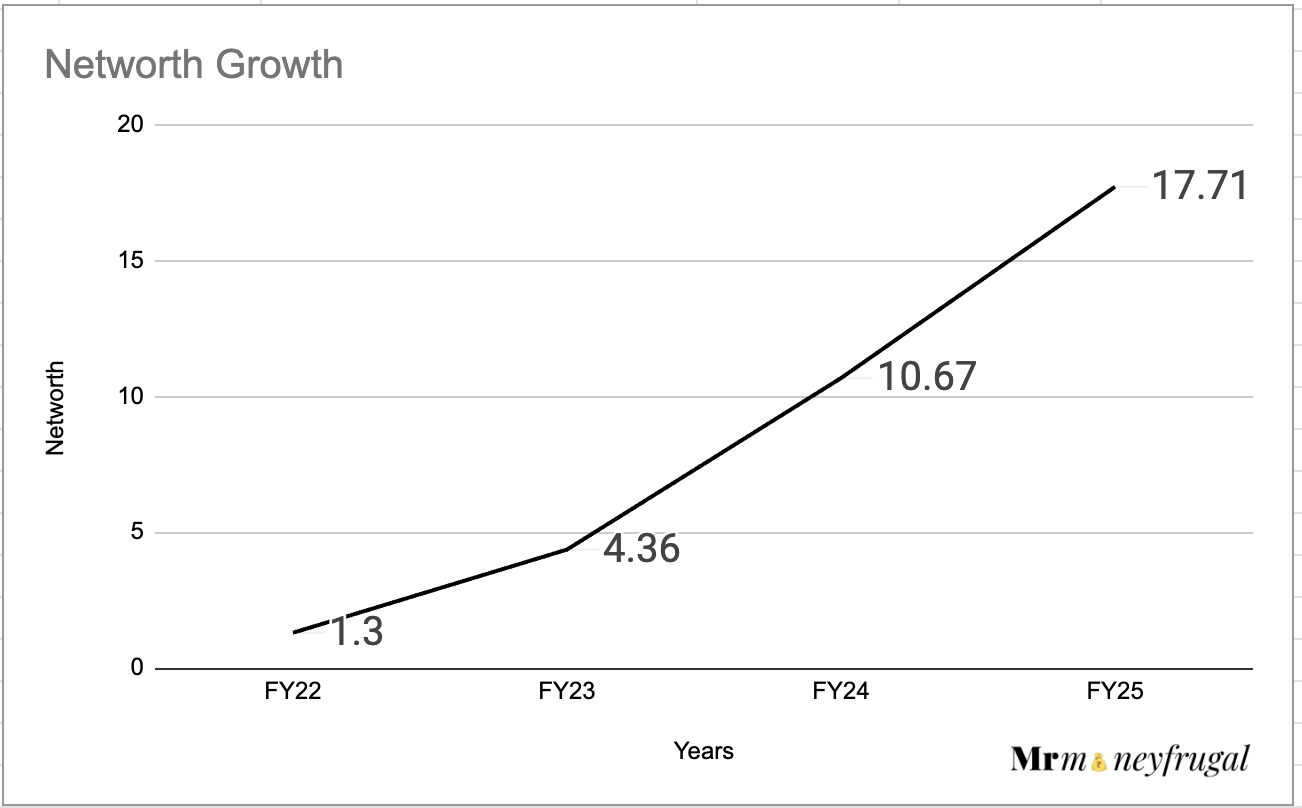

Net Worth | 17.71 | 10.67 | 4.36 | 1.3 |

Reserves and Surplus | 17.68 | 10.64 | 4.33 | 1.27 |

Total Borrowing | 21.97 | 14.11 | 9.59 | 3.73 |

Zelio E-Mobility has been on a high-growth trajectory since its inception in 2021. Its income has grown at an explosive CAGR of 170%, with profits also multiplying rapidly. The company’s profit in the first six months of FY25 (₹7.05 crores) has already surpassed the entire FY24 profit, indicating strong momentum.

However, a major point of concern is its history of negative operating cash flows, including in the latest six-month period. This suggests that while the company is profitable on paper, its operations are consuming more cash than they generate. Based on its FY24 earnings, the IPO is priced at a P/E multiple of 33x-35x, which is steep for an SME company.

Screenshot

Industry Outlook

- Zelio operates in India's booming electric vehicle (EV) sector, which is a key focus area for the government.

- With rising fuel prices and a strong push for green mobility through schemes like FAME, the demand for electric two-wheelers and three-wheelers is expected to grow robustly.

- The market is, however, intensely competitive, with numerous organized and unorganized players vying for market share.

- Zelio’s B2B model, supplying to a wide network of dealers, allows it to scale its presence across the country.

You may also have interest in :Initial Public Offers: IPO Reviews of India

Strengths and Risks of Zelio E-Mobility IPO

Strengths:

- Explosive Financial Growth: A proven track record of rapidly growing revenues and profits.

- Extensive Dealer Network: A wide network of 280 dealers across 20+ states provides a strong market reach.

- Experienced Management: The promoters have significant experience in the EV and battery solutions industry.

- Sunrise Sector: Operates in the high-growth EV industry with strong government support.

Risks:

- Negative Operating Cash Flows: The company's inability to generate cash from its core operations is a major red flag and raises questions about its working capital management.

- Limited Operating History: The company was founded only in 2021, making it difficult to assess its performance across different business cycles.

- Promoter Stake Sale (OFS): A part of the IPO is an OFS where promoters are selling their stake. The extremely low acquisition cost of promoters (₹0.02/share) compared to the IPO price is also a point of concern.

- High Competition and Supplier Dependence: The EV market is highly competitive, and the company has a high dependence on a few suppliers, primarily from China.

Expert Recommendations – Should You Apply?

High Risk

Zelio E-Mobility's IPO is a classic high-risk, high-reward bet on the Indian EV story. The growth numbers are phenomenal, but the underlying risks, particularly the negative cash flow, cannot be ignored.

- For Risk-Averse Investors: AVOID. The combination of a short operating history, negative cash flows, and a high valuation makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: Investors with a high-risk appetite might be tempted by the explosive growth in a sunrise sector. However, they must be aware that they are paying a premium valuation for a company with fundamental weaknesses.

- Our View: The negative cash flow is a critical issue that overshadows the impressive profit growth. A cautious approach is warranted. It would be prudent to see if the company can fix its cash flow issues post-listing.

Key Takeaways

- IPO Price Band: ₹129 – ₹136 per share

- Lot Size: 1,000 Shares (Minimum retail investment is for 2 lots or 2,000 shares, amounting to ₹2,72,000, which is above the typical retail limit of ₹2 lakhs)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 8, 2025.

- Recommendations of experts: A high-risk issue. Best to approach with caution due to negative cash flows and a short operational history.

FAQs on Zelio E-Mobility IPO

1. What is Zelio E-Mobility IPO price band?

The price band for the IPO is set at ₹129 to ₹136 per equity share.

2. What is Zelio E-Mobility IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, October 6, 2025.

3. How to check Zelio E-Mobility IPO allotment status?

You can check the allotment status on the website of the IPO registrar, Maashitla Securities Private Limited, after the basis of allotment is finalized.

4. What is Zelio E-Mobility IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Wednesday, October 8, 2025.

5. Should I apply for Zelio E-Mobility IPO?

This is a high-risk proposition. While the company is in a high-growth sector, its negative operating cash flow, short history, and high valuation suggest that only investors with a very high-risk appetite should consider it.

Useful links: SME_IPOZelio_E-Mobility_Limited_20250404152412.pdf

You may also want to check some other important IPOs:

Valplast Technologies IPO GMP, Price, Dates, Allotment, Review

Disclaimer: IPO details, GMP, and reviews shared here are for informational purposes only. Please read official documents and consult your financial advisor before investing.