Advance Agrolife Limited, a Rajasthan-based manufacturer of agrochemical products, is launching its mainboard Initial Public Offering (IPO) on September 30, 2025. The company aims to raise up to ₹192.86 crores through a 100% fresh issue of shares.

The price band for the IPO has been set at ₹95 to ₹100 per share, with a minimum lot size of 150 shares.

While the company has demonstrated impressive financial growth and strong return ratios, investors should carefully weigh the significant risks associated with its high customer concentration. The Grey Market Premium (GMP) for the issue is ₹10 as of 26th Sep 2025.

In this article, you will find Advance Agrolife IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Advance Agrolife IPO Details

- Price Band: ₹95 – ₹100 per share

- IPO Open / Close Dates: September 30, 2025 – October 3, 2025

- Lot Size: 150 Shares

- Issue Size: 1,92,85,720 shares (aggregating up to ₹192.86 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: KFin Technologies Limited

- Listing Exchange: BSE & NSE

Also check: Advance Agrolife IPO Subscription Status – Day 1, Day 2 & Day 3

Other important IPOs subscription data:Zelio E-Mobility IPO Subscription Status – Day 1, Day 2 & Day 3

Valplast Technologies IPO Subscription Status – Day 1, Day 2 & Day 3

Advance Agrolife IPO GMP Today

- Update daily: ₹10

- Note:.The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Advance Agrolife IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 30, 2025 – October 3, 2025

- Basis of Allotment Date: October 6, 2025

- Refund Initiation Date: October 7, 2025

- Credit of Shares: October 7, 2025

- Listing Date: October 8, 2025

Also check: Advance Agrolife IPO Allotment Status – How to Check Online

Allotment status of other important IPOs: Zelio E-Mobility IPO Allotment Status – How to Check Online

Valplast Technologies IPO Allotment Status – How to Check Online

Objectives of Advance Agrolife IPO

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Funding Working Capital Requirements (₹135 Crores): A major portion will be used to fund the company's working capital needs, driven by raw material procurement and credit extended to its B2B clients.

- General Corporate Purposes: The balance amount will be used for other strategic initiatives and day-to-day business operations.

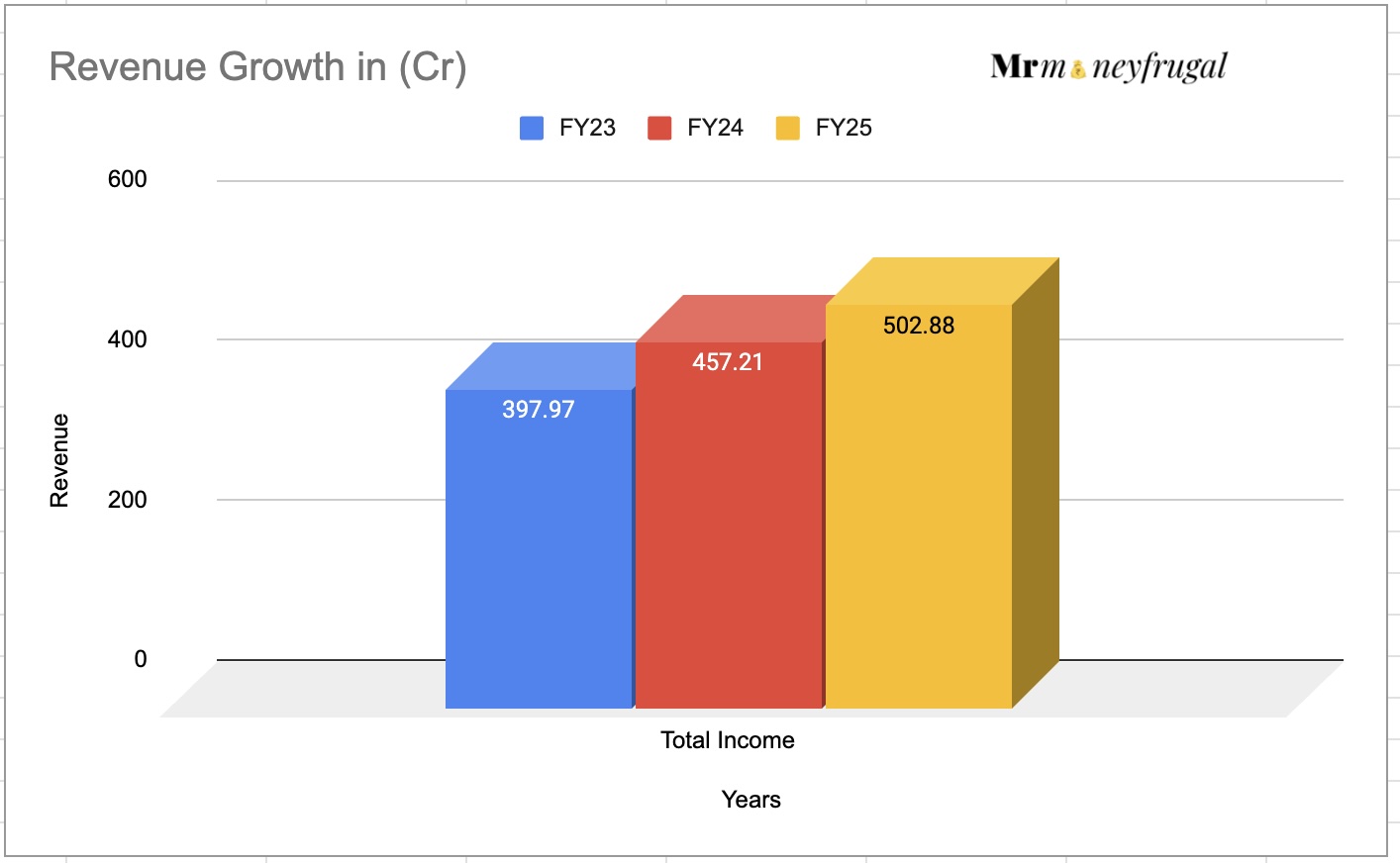

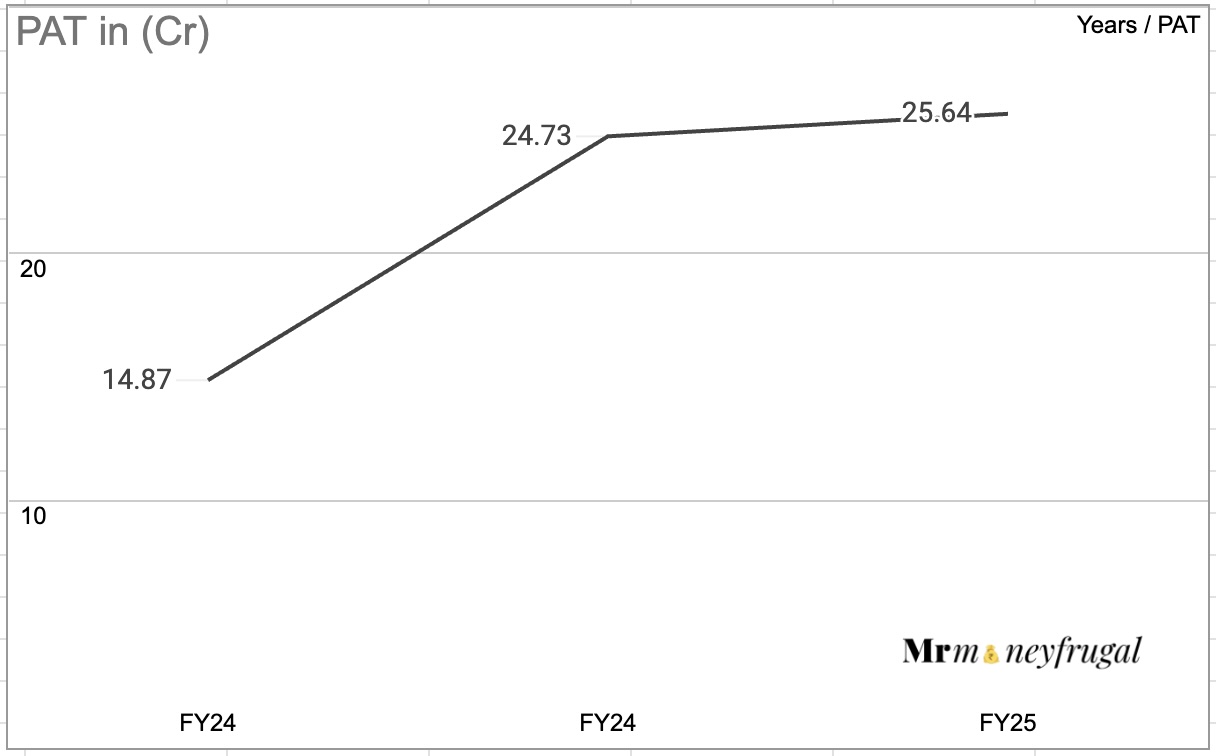

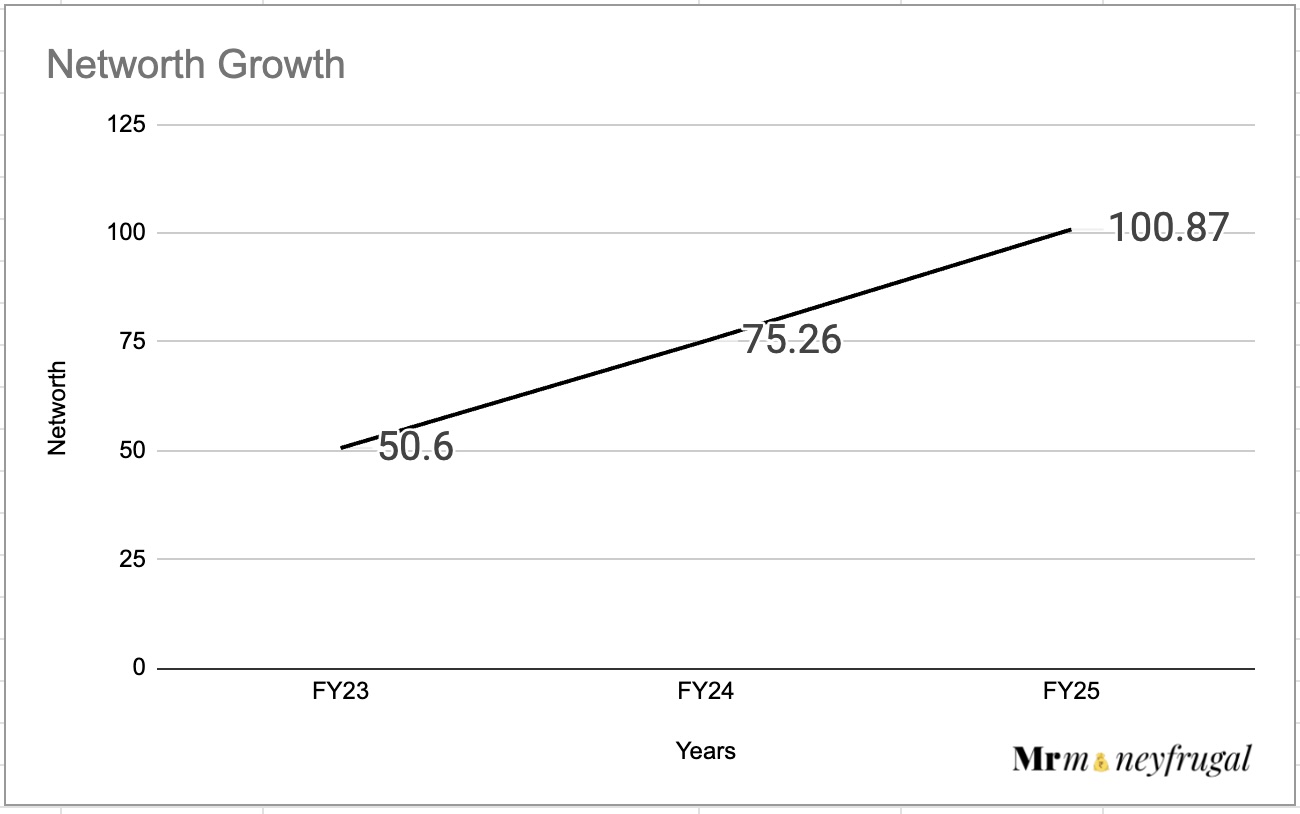

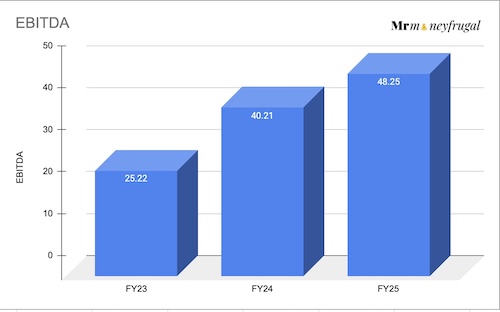

Financial Performance of Advance Agrolife

Amount in ₹ Crore

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 351.47 | 259.56 | 179.47 |

Total Income | 502.88 | 457.21 | 397.97 |

Profit After Tax | 25.64 | 24.73 | 14.87 |

EBITDA | 48.25 | 40.21 | 25.22 |

NET Worth | 100.87 | 75.26 | 50.6 |

Reserves and Surplus | 55.87 | 70.76 | 46.1 |

Total Borrowing | 80.45 | 45.46 | 25.29 |

Advance Agrolife has showcased a stellar financial track record. From March 31, 2024, to March 31, 2025, Advance Agrolife Ltd.'s sales went up by 10% and its profit after tax (PAT) went up by 4%.

Its revenue from operations grew at a strong CAGR of 34.84% between FY22 and FY24. Profitability has been even more impressive, with PAT nearly tripling in the same period.

The company boasts excellent return ratios, with a Return on Net Worth (RoNW) of 39.30% and a Return on Capital Employed (RoCE) of 37.62% in FY24. The debt-to-equity ratio stood at a comfortable 0.60.

Advance Agrolife EBITDA Growth FY23-25

You will also want to check: Initial Public Offers: IPO Reviews of India

Industry Outlook

Advance Agrolife operates in the crucial Indian agrochemical sector.

- The company follows a B2B model, manufacturing a wide range of products like insecticides, herbicides, and fungicides for large corporate clients who then sell them under their own brands.

- With a portfolio of over 400 generic registrations, the company caters to the entire crop lifecycle.

- The Indian agrochemical market is driven by the need for food security, increasing crop yields, and a formalizing agricultural supply chain, providing a stable growth environment for established players.

Strengths and Risks of Advance Agrolife IPO

Strengths:

- Strong Financial Growth: The company has a proven track record of robust revenue and profit growth.

- Excellent Return Ratios: High RoNW and RoCE indicate efficient use of capital and shareholder funds.

- Integrated Manufacturing: Three manufacturing facilities in Jaipur provide control over production and quality.

- Diversified Product Portfolio: A wide range of product registrations reduces dependency on a single product.

- Reasonable Valuation: The IPO appears to be fairly priced compared to its listed peers.

Risks:

- Extreme Customer Concentration: This is the most significant red flag. In the first half of FY25, the top 10 customers accounted for over 72% of revenue. The loss of a single major client could severely impact the business.

- Geographical Concentration: All three manufacturing facilities are located in Jaipur, Rajasthan. This exposes the company to risks from any local or regional disruptions.

- Litigation: The company and its promoters are involved in legal proceedings, including criminal cases related to "misbranding" of products, which could pose reputational risks.

- Seasonality: The business is inherently dependent on weather patterns and agricultural seasons, which can lead to demand fluctuations.

Expert Recommendations – Should You Apply?

Subscribe with Caution

Advance Agrolife's IPO presents a compelling growth story at a reasonable valuation. The company's financial performance and high return ratios are impressive. However, the investment is not without significant risks.

- For Risk-Averse Investors: The extreme customer concentration is a major concern. It would be prudent to wait and watch the company's performance and client diversification efforts post-listing.

- For Aggressive Investors: The attractive valuation, combined with a strong growth trajectory, makes this a tempting proposition. Investors with a high-risk appetite could consider applying, but they must be fully aware that they are betting on the stability of a handful of key customer relationships.

- Our View: The IPO is a classic case of high growth versus high risk. Given the fair pricing, it offers a potential upside if the company can maintain its key contracts and continue its growth path. We recommend a "Subscribe with Caution" rating, primarily for investors who understand and are comfortable with the concentration risks.

Key Takeaways

- IPO Price Band: ₹95 – ₹100 per share

- Lot Size: 150 Shares (Minimum Investment: ₹15,000)

- GMP Today: ₹10

- Allotment & Listing Dates: Tentative listing on October 8, 2025.

- Recommendations of experts: Subscribe with Caution. The IPO is attractively priced for a high-growth company but comes with significant customer concentration risk.

FAQs on Advance Agrolife IPO

1. What is Advance Agrolife IPO price band?

The price band for the IPO is set at ₹95 to ₹100 per equity share.

2. What is Advance Agrolife IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, October 6, 2025.

3. How to check Advance Agrolife IPO allotment status?

You can check the allotment status on the website of the IPO registrar, KFin Technologies Limited, after the basis of allotment is finalized.

4. What is Advance Agrolife IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Wednesday, October 8, 2025.

5.Should I apply for Advance Agrolife IPO?

This is a high-risk, high-reward opportunity. The company has strong financials and is offered at a reasonable valuation. However, its heavy dependence on a few clients is a major risk. A subscription is recommended only for investors with a high-risk appetite.

Useful links: Advance Agrolife Limited

Some more Important IPOs of your Interest:Zelio E-Mobility IPO GMP, Price, Dates, Allotment, Review

Valplast Technologies IPO GMP, Price, Dates, Allotment, Review

Disclaimer: IPO details, GMP, and reviews shared here are for informational purposes only. Please read official documents and consult your financial advisor before investing.