Shreeji Global FMCG Limited, a Gujarat-based agro-processing company, is set to launch its Initial Public Offering (IPO) on the NSE EMERGE platform, opening on November 4, 2025. The company, which sells spices, grains, and flour under its "SHETHJI" brand, aims to raise up to ₹85 crores through a 100% fresh issue of shares. The price band has been fixed at ₹120 to ₹125 per share, with a minimum lot size of 1,000 shares. While the company has demonstrated spectacular profit growth, investors must exercise extreme caution due to its history of negative operating cash flows and high business concentration. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Shreeji Global FMCG IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

You may also want to explore more such IPO analyses, listing updates, and subscription trends, check out our IPO category hub page.

Shreeji Global FMCG IPO Details

- Price Band: ₹120 – ₹125 per share

- IPO Open / Close Dates: November 4, 2025 – November 7, 2025

- Lot Size: 1,000 Shares

- Issue Size: 68,00,000 shares (aggregating up to ₹85.00 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: NSE SME

Shreeji Global FMCG IPO GMP Today

- Update daily: ₹0

- Note: The shares of Shreeji Global FMCG are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Shreeji Global FMCG IPO Dates & Allotment Schedule

- IPO Open & Close Date: November 4, 2025 – November 7, 2025

- Basis of Allotment Date: November 10, 2025

- Refund Initiation Date: November 11, 2025

- Credit of Shares: November 11, 2025

- Listing Date: November 12, 2025

Objectives of Shreeji Global FMCG IPO

The company intends to utilise the net proceeds from the public offering for its ambitious expansion plans:

- Capital Expenditure (₹38.73 Crores): For setting up a new factory, including plant, machinery, a cold storage unit, and a solar power plant.

- Working Capital Requirement (₹33.54 Crores): A significant portion is allocated to manage the company's working capital-intensive operations.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Many investors who participate in IPOs also diversify through SIPs — our SIP calculator helps you plan that efficiently.

Financial Performance of Shreeji Global FMCG

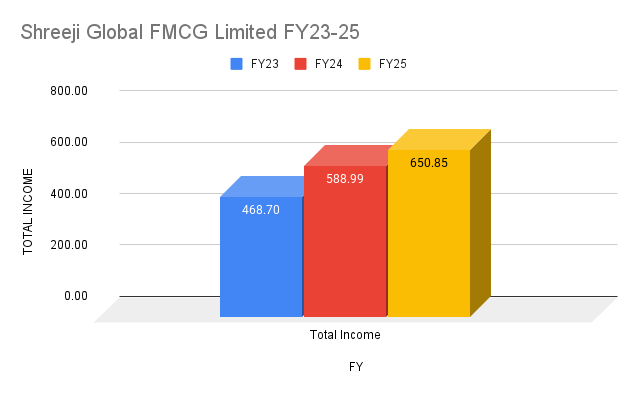

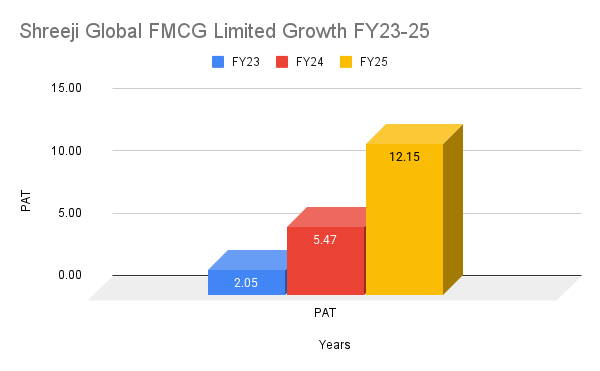

(Amounts in ₹ Crores)

Period Ended | 31 Aug 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 128.76 | 117.06 | 117.39 | 59.98 |

Total Income | 251.18 | 650.85 | 588.99 | 468.7 |

Profit After Tax | 9.2 | 12.15 | 5.47 | 2.05 |

EBITDA | 13.83 | 20.37 | 10.92 | 4 |

NET Worth | 38.76 | 29.56 | 17.22 | 9.01 |

Reserves and Surplus | 22.8 | 13.6 | 11.71 | 4.74 |

Total Borrowing | 29.55 | 30.45 | 25.51 | 19 |

Shreeji Global FMCG Limited Total Income Growth from FY23-25 Source: NSE India

The company's financial performance showcases a story of explosive profit growth. While revenue has grown steadily, the profit after tax (PAT) has surged by an impressive 122% in FY25 compared to the previous year. This indicates a significant improvement in margins and operational efficiency.

However, this stellar profit growth is completely overshadowed by a major red flag: the company has reported negative cash flow from operating activities for three of the last four reported periods. This suggests a severe struggle to convert its profits into actual cash.

Understanding long-term compounding is key — try our retirement planning calculator to see how regular investing can secure your future.

Industry Outlook

- Shreeji Global operates in the resilient and ever-growing Indian FMCG and agro-processing sector.

- Based in Gujarat, the company enjoys strategic proximity to major agricultural markets (APMCs) and the Mundra port, facilitating both domestic sourcing and exports.

- The company's plan to diversify into high-margin products like blended spices and multigrain flours, along with its focus on D2C channels, aligns well with current consumer trends towards convenience and health-conscious food products.

Strengths and Risks of Shreeji Global FMCG IPO

Strengths:

- Spectacular Profit Growth: The company has demonstrated a phenomenal improvement in its profitability and margins in the most recent fiscal year.

- Experienced Promoters: The leadership team has over a decade of experience in the agro-processing industry.

- Strategic Location: Proximity to raw material sources and a major port provides a strong competitive advantage.

- Clear Expansion Plans: The IPO funds are earmarked for significant capacity expansion and forward integration into cold storage.

Risks:

- Chronic Negative Operating Cash Flow: This is the biggest risk. The company's consistent inability to generate cash from its core operations raises serious questions about its working capital management and long-term financial health.

- High Product and Customer Concentration: The business is heavily dependent on the whole seeds segment (over 95% of revenue) and a few key customers.

- High Dependence on Related Parties: A significant portion of its logistics and warehousing is handled by a promoter group company, and key premises are leased from promoters, creating potential conflicts of interest.

- History of Non-Compliance: The company has a record of delays in various statutory filings, which could indicate weaknesses in its internal control systems.

Alongside IPOs, many investors balance their portfolios with mutual funds — visit our mutual fund section to learn how.

Expert Recommendations – Should You Apply?

High Risk / Avoid

The Shreeji Global FMCG IPO is a high-risk proposition where the impressive profit numbers are at odds with the weak cash flow statement.

- For Risk-Averse Investors: AVOID. The chronic negative operating cash flow is a fundamental weakness that makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: The valuation appears very stretched. Based on FY25 earnings, the P/E ratio is nearly 60x. This is an extremely high price to pay for an SME company, especially one with serious cash flow issues.

- Our View: A company that is consistently profitable on paper but continuously burns cash in its operations is a risky investment. Coupled with a very demanding valuation, the risks far outweigh the potential rewards. We recommend that investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹120 – ₹125 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,50,000, which falls into the HNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on November 12, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to chronic negative operating cash flows and a very expensive valuation.

Whether you’re investing in IPOs or mutual funds, consistent saving habits make a big difference. Check out our practical money saving tips to strengthen your financial foundation.

FAQs on Shreeji Global FMCG IPO

1. What is Shreeji Global FMCG IPO price band?

The price band for the IPO is set at ₹120 to ₹125 per equity share.

2. What is Shreeji Global FMCG IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, November 10, 2025.

3. How to check Shreeji Global FMCG IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Shreeji Global FMCG IPO listing date?

The company's shares are tentatively scheduled to be listed on the NSE SME platform on Wednesday, November 12, 2025.

5. Should I apply for Shreeji Global FMCG IPO?

This is a high-risk proposition. Given the company's persistent inability to generate cash from its core operations, coupled with an extremely high valuation, it is advisable for most investors to avoid this IPO.

Disclaimer:

The information provided about the IPO is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to subscribe. Investors are advised to carefully read the Red Herring Prospectus (RHP) and consult their financial advisor before making any investment decisions. Market conditions and Grey Market Premium (GMP) values are subject to change and may not accurately predict listing performance.