The IPO of Lenskart Solutions Limited, India's leading omnichannel eyewear company, is set to open on October 31, 2025. This blockbuster issue, one of the largest from a new-age consumer tech company, aims to raise over ₹7,200 crores. The IPO comprises a fresh issue to fund expansion and a significant Offer for Sale (OFS) by its existing shareholders. The price band has been fixed at ₹382 to ₹402 per share, with a lot size of 37 shares. The IPO is already creating a massive buzz in the unlisted market, with a strong Grey Market Premium (GMP) of ₹80, indicating robust investor demand and the potential for a healthy listing.

In this article, you will find Lenskart Solutions IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

You may also want to check our Latest IPOs section for updates on upcoming and recently listed public issues.

Briefs of Lenskart Solutions IPO Details

- Price Band: ₹382 – ₹402 per share

- IPO Open / Close Dates: October 31, 2025 – November 4, 2025

- Lot Size: 37 Shares

- Issue Size: ₹7,278.02 Crores (Fresh Issue of ₹2,150 Cr + OFS of ₹5,128.02 Cr)

- Fresh Issue / OFS: Both

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE & NSE

You also want to check: Lenskart Solutions LimitedIPO Subscription Status – Day 1, Day 2 & Day 3

What is the Lenskart Solutions IPO GMP Today?

- Note: The current Grey Market Premium (GMP) of ₹80 suggests a potential listing premium of around 20% over the upper price band. GMP is an unofficial indicator and changes frequently based on market sentiment and subscription demand.

What are the Lenskart Solutions IPO Dates & Allotment Schedule?

- IPO Open & Close Date: October 31, 2025 – November 4, 2025

- Basis of Allotment Date: November 6, 2025

- Refund Initiation Date: November 7, 2025

- Credit of Shares: November 7, 2025

- Listing Date: November 10, 2025

You may also want to check: Lenskart Solutions Limited IPO Allotment Status – How to Check Online

What is the Objectives of Lenskart Solutions IPO?

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Fresh Issue: The proceeds from the fresh issue (₹2,150 crores) will be primarily used for funding capital expenditure for setting up new company-owned retail stores in India.

- Offer for Sale: The proceeds from the OFS (₹5,128.02 crores) will go directly to the selling shareholders and will not be received by the company.

If you’re exploring IPOs as part of your investment planning, our Mutual Fund Learning Hub offers simple guides to help you diversify your portfolio beyond equities.

What is the Financial Performance of Lenskart Solutions?

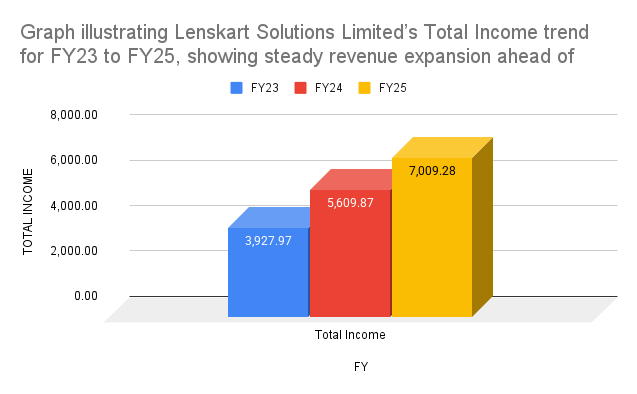

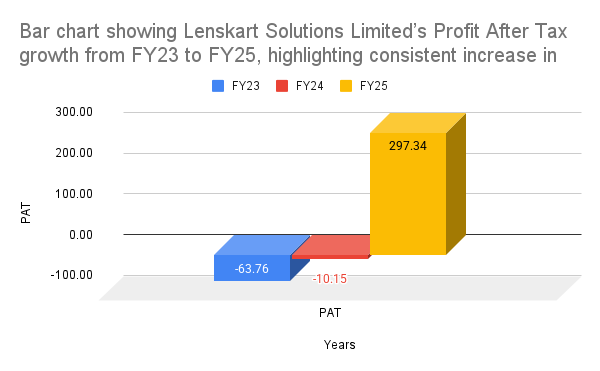

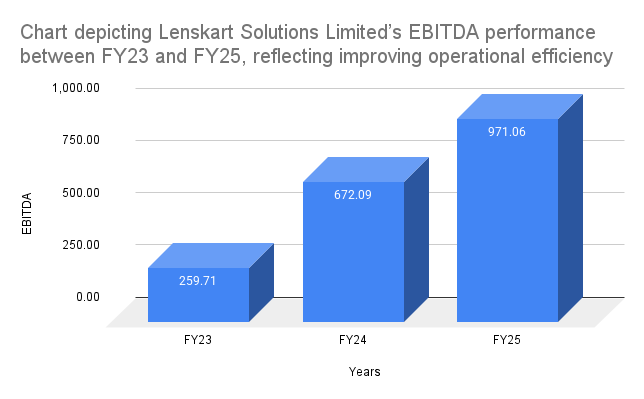

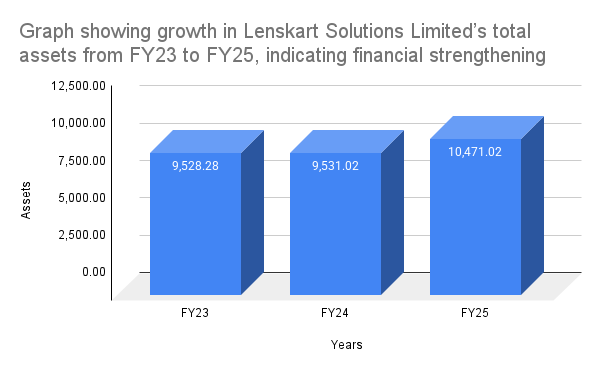

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 10,845.68 | 10,471.02 | 9,531.02 | 9,528.28 |

Total Income | 1,946.10 | 7,009.28 | 5,609.87 | 3,927.97 |

Profit After Tax | 61.17 | 297.34 | -10.15 | -63.76 |

EBITDA | 336.63 | 971.06 | 672.09 | 259.71 |

NET Worth | 6,176.87 | 6,108.30 | 5,642.38 | 5,444.48 |

Reserves and Surplus | 5,855.43 | 5,795.00 | 5,466.50 | 5,411.96 |

Total Borrowing | 335.48 | 345.94 | 497.15 | 917.21 |

The financial story of Lenskart is one of a spectacular turnaround. After reporting losses for years, the company has turned profitable in the financial year 2025, posting a solid profit of ₹297.34 crores.

This pivot to profitability, achieved on the back of strong revenue growth and improving margins, is the central pillar of the investment thesis. The company has also significantly strengthened its balance sheet by reducing its borrowings.

Source: SEBI India

To plan your post-listing investments, try our SIP Calculator and see how small monthly contributions can grow over time.

What is the Industry Outlook in this?

- Lenskart is the undisputed leader in the Indian organized eyewear market.

- It operates a unique omnichannel model, seamlessly integrating its massive online presence (website and app) with a vast network of physical retail stores.

- The Indian eyewear industry is a high-growth market, driven by increasing awareness of vision correction, rising disposable incomes, and a growing aspiration for branded and fashionable eyewear.

- As the largest and most technologically advanced player, Lenskart is perfectly positioned to capture a disproportionate share of this growth.

Explore more personal finance guides in our Articles section, covering money-saving tips, investment strategies, and growth insights.

What are the Strengths and Risks of Lenskart Solutions IPO?

Strengths:

- Market Leader with a Disruptive Model: A dominant player that has transformed the eyewear industry in India with its omnichannel approach.

- Strong Financial Turnaround: The company has successfully pivoted from losses to profitability, demonstrating a scalable and sustainable business model.

- Technology-Driven Operations: A vertically integrated business with a strong focus on technology, from manufacturing and supply chain to customer experience.

- Massive Brand Recall: Lenskart is a household name with a very strong brand connection with young, digitally-savvy consumers.

Risks:

- Large Offer for Sale (OFS): A significant portion of the IPO is an OFS where existing investors are cashing out. This means a large part of the funds raised will not go into the company for its growth.

- History of Losses: While the company is profitable now, its past financial instability and history of losses cannot be ignored. The valuation is based on this recent turnaround.

- Intense Competition: The eyewear market is becoming increasingly competitive with the entry of other organized players and e-commerce giants.

- Promoter Holding: The post-IPO promoter holding will be relatively low at 17.52%.

If you’re focused on improving your overall income sources, don’t miss our guide on How to Make Money by ChatGPT, which explains AI-powered earning ideas

What are the Expert Recommendations – Should You Apply?

Subscribe for Listing Gains & Long-Term

The Lenskart IPO is a landmark event, offering a chance to invest in a market-defining consumer tech company that has successfully navigated the path to profitability.

- For Long-Term Investors: This is a strong candidate for a core portfolio holding. It is a bet on a market leader in a high-growth consumer category. The turnaround to profitability provides a strong validation of its business model.

- For Listing Gains: The strong Grey Market Premium of around ₹80 indicates robust investor demand and points towards a healthy listing day gain of around 20%. This makes the IPO attractive for those looking for short-term gains as well.

- Our View: The combination of a strong brand, market leadership, a successful pivot to profitability, and strong market sentiment makes this a compelling IPO. We recommend "Subscribe" for both potential listing gains and long-term holding.

Key Takeaways

- IPO Price Band: ₹382 – ₹402 per share

- Lot Size: 37 Shares (Minimum Investment: ₹14,874)

- GMP Today: ₹80 (Indicating a strong premium of ~20%)

- Allotment & Listing Dates: Tentative listing on November 10, 2025.

- Recommendations of experts: A strong "Subscribe" recommendation. A market-leading company that has turned profitable, with strong investor demand making it attractive for both listing gains and long-term investment.

If you’re exploring new income sources beyond traditional investments, learn how to build a sustainable online income with our How to Make Money Blogging Course

FAQs on Lenskart Solutions IPO

1. What is Lenskart Solutions IPO GMP today?

Currently, the GMP for the Lenskart Solutions IPO is ₹80, suggesting a potential listing premium of around 20% over the issue price.

2. What is Lenskart Solutions IPO price band?

The price band for the IPO is set at ₹382 to ₹402 per equity share.

3. What is Lenskart Solutions IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Thursday, November 6, 2025.

4. How to check Lenskart Solutions IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

5. What is Lenskart Solutions IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Monday, November 10, 2025.

6. Should I apply for Lenskart Solutions IPO?

Yes, this is a highly recommended IPO. The company is a market leader that has successfully turned profitable, and strong market sentiment, as indicated by its GMP, makes it attractive for both listing gains and long-term investment.

You may also want to check: Orkla India Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Disclaimer:

The information provided above about the IPO is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to subscribe to any public issue. All IPO details such as price band, GMP, subscription status, allotment, and listing information are sourced from reliable and publicly available data, which may change over time. Readers are advised to verify the latest updates from official sources such as the company’s Red Herring Prospectus (RHP), SEBI, stock exchanges (BSE/NSE), and registrar websites before making any investment decisions.

MrMoneyFrugal.com does not guarantee the accuracy or completeness of the data and shall not be held responsible for any financial losses arising from investment decisions based on this information. Always consult a qualified financial advisor before investing in IPOs or the stock market.