Updated on 08.10.2025 @ 9:55 AM

B.A.G. Convergence Limited, the digital media company behind popular brands like News24 and E24, is set to launch its Initial Public Offering (IPO) on the NSE SME platform, opening on September 30, 2025. The company, promoted by renowned media personality Anuradha Prasad Shukla, aims to raise up to ₹48.72 crores through a 100% fresh issue of shares.

The price band for the IPO is fixed at ₹82 to ₹87 per share, with a minimum lot size of 1,600 shares. While the company has demonstrated spectacular growth in profitability and boasts a reasonable valuation, investors must carefully consider the extreme customer concentration risk.

The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find B.A.G. Convergence IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

B.A.G. Convergence IPO Details

- Price Band: ₹82 – ₹87 per share

- IPO Open / Close Dates: September 30, 2025 – October 3, 2025

- Lot Size: 1,600 Shares

- Issue Size: 56,00,000 shares (aggregating up to ₹48.72 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Maashitla Securities Pvt Ltd

- Listing Exchange: NSE SME

Check out the subscription status of BAG Convergence:

B.A.G. Convergence IPO GMP Today

- The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

B.A.G. Convergence IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 30, 2025 – October 3, 2025

- Basis of Allotment Date: October 6, 2025

- Refund Initiation Date: October 7, 2025

- Credit of Shares: October 7, 2025

- Listing Date: October 8, 2025

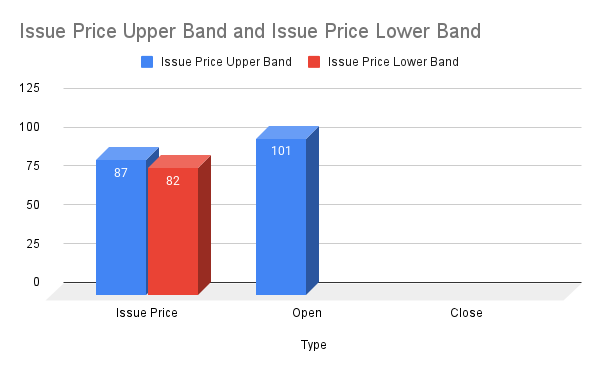

Listing details of B.A.G Convergence: Updated @ 9:55 AM

| Type | Issue Price | Open |

| Issue Price Upper Band | 87 | 101 |

| Issue Price Lower Band | 82 |

Source: NSE India

Check the allotment status:B.A.G. Convergence IPO Allotment Status – How to Check Online

Also check: Fabtech Technologies IPO Allotment Status – How to Check Online

Glottis Limited IPO Allotment Status – How to Check Online

Objectives of B.A.G. Convergence IPO

The company intends to utilise the net proceeds from the public offering for the following key purposes:

- Expansion of Existing Business (₹13.49 Crores): To scale up its digital media operations and reach.

- Acquisition/Production of Content (₹13.29 Crores): To invest in creating new and engaging content for its platforms.

- Brand Building Expenses (₹5.00 Crores): To enhance the visibility and brand equity of its digital properties.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Financial Performance of B.A.G. Convergence

(Amounts in ₹ Crores)

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 43.84 | 18.33 | 11.57 |

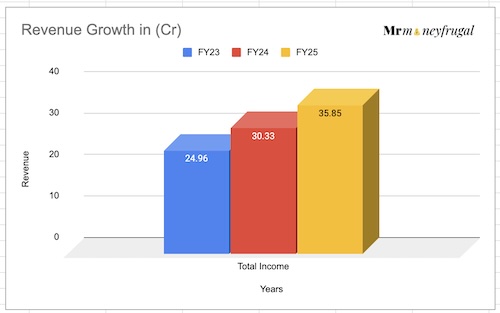

Total Income | 35.85 | 30.33 | 24.96 |

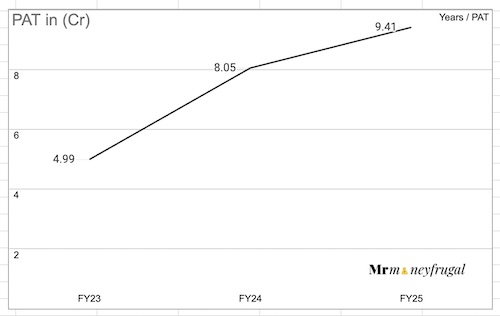

Profit After Tax | 9.41 | 8.05 | 4.99 |

EBITDA | 13.99 | 10.88 | 6.49 |

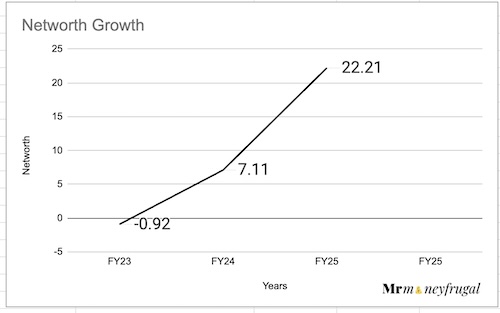

NET Worth | 22.21 | 7.11 | -0.92 |

Reserves and Surplus | 6.59 | 7.1 | -0.93 |

The financial performance of B.A.G. Convergence has been exceptional. The company has shown consistent revenue growth, but the real story is in its profitability.

B.A.G. Convergence IPO Profit After Tax Growth FY23-25

The Profit After Tax (PAT) has more than tripled between FY22 and FY24, and the PAT margin has expanded dramatically from 11.29% to a very healthy 26.48% in the same period.

The company also boasts an impressive Return on Net Worth (RoNW) of 112.94% for FY24. Based on its FY24 earnings, the IPO is priced at an attractive P/E multiple of approximately 16x.

Industry Outlook

B.A.G. Convergence operates in India's rapidly growing digital media landscape.

- With increasing internet penetration and a massive shift in content consumption from traditional television to digital platforms like YouTube, social media, and mobile apps, the market is ripe for expansion.

- The company leverages its established brands, "News24" for news and "E24" for entertainment, to capture a wide audience.

- The strategy to focus on regional and sports content aligns well with current market trends.

Strengths and Risks of B.A.G. Convergence IPO

Strengths:

- Stellar Financial Growth: The company has a proven track record of rapidly growing profits and expanding margins.

- Established Brands: "News24" and "E24" are well-recognized brands in the news and entertainment segments, providing a strong competitive advantage.

- Experienced Promoter: The company is led by Anuradha Prasad Shukla, a veteran with over three decades of experience in the media industry.

- Attractive Valuation: The IPO is priced at a reasonable P/E of around 16x, which looks attractive given the high growth and profitability.

You may also want to check: Initial Public Offers: IPO Reviews of India

Risks:

- Extreme Customer Concentration: This is the single biggest red flag. For the period ended July 2024, the top 10 clients accounted for a staggering 96.95% of total income. The loss of even one or two of these key clients could severely impact the business.

- Litigation: Group companies are involved in indirect tax cases amounting to over ₹9.21 crores, which could pose a financial risk.

- High Related Party Transactions: The company has significant transactions with promoter-related entities, particularly for expenses like rent, which requires careful scrutiny from a governance perspective.

- Intense Competition: The digital media space is highly competitive, with numerous players vying for audience attention and advertising revenue.

Interested in more ways to grow your wealth beyond IPOs? Explore our other money making ways from ChatGPT.

Expert Recommendations – Should You Apply?

Subscribe with Caution

B.A.G. Convergence IPO presents a very attractive growth story at a reasonable price. However, the investment comes with a very significant risk that cannot be ignored.

- For Risk-Averse Investors: The extreme customer concentration is a major deterrent. It would be prudent to wait and see if the company can diversify its client base post-listing.

- For Aggressive Investors: The combination of high growth, strong margins, an experienced promoter, and an attractive valuation makes this a compelling proposition. Investors with a high-risk appetite could consider applying, but they must be fully aware that their investment is heavily dependent on the stability of a handful of key client relationships.

- Our View: The IPO's financial metrics are too strong to ignore at this valuation. However, the concentration risk is equally potent. We recommend a "Subscribe with Caution" rating, suitable for high-risk investors who are comfortable with the business's dependency on its top clients.

Key Takeaways

- IPO Price Band: ₹82 – ₹87 per share

- Lot Size: 1,600 Shares. (Note: The minimum retail application is for 2 lots or 3,200 shares, amounting to ₹2,78,400, which falls into the sHNI category, not the typical retail category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 8, 2025.

- Recommendations of experts: Subscribe with Caution. A high-growth, attractively priced IPO but with an extremely high customer concentration risk.

FAQs on B.A.G. Convergence IPO

1. What is B.A.G. Convergence IPO price band?

The price band for the IPO is set at ₹82 to ₹87 per equity share.

2. What is B.A.G. Convergence IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, October 6, 2025.

3. How to check B.A.G. Convergence IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is B.A.G. Convergence IPO listing date?

The company's shares are tentatively scheduled to be listed on the NSE SME platform on Wednesday, October 8, 2025.

5. Should I apply for B.A.G. Convergence IPO?

This is a high-risk, high-reward opportunity. The company has stellar financials and is offered at a reasonable valuation. However, its heavy dependence on a few clients is a major risk. A subscription is recommended only for investors with a high-risk appetite.

You may also want to check some other prime IPOs: Fabtech Technologies IPO GMP, Price, Dates, Allotment, Review

Glottis Limited IPO GMP, Price, Dates, Allotment, Review

Useful links: B.A.G. CONVERGENCE LIMITED