Updated on 27.12.2025 @ 3:05 PM

IPO of Canara Robeco Asset Management Company, India's second-oldest mutual fund house and backed by the might of Canara Bank, is set to launch on October 9, 2025.

This is a pure Offer for Sale (OFS), where the promoters will be offloading their stake.

The price band has been fixed at ₹253 to ₹266 per share, with a minimum lot size of 56 shares.

While the company boasts a stellar financial track record and a strong brand, the fact that the entire issue is an OFS means the company itself will not receive any funds for growth.

In this article, you will find Canara Robeco IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Canara Robeco IPO Details

- Price Band: ₹253 – ₹266 per share

- IPO Open / Close Dates: October 9, 2025 – October 13, 2025

- Lot Size: 56 Shares

- Issue Size: 4,98,54,357 shares (aggregating up to ₹1,326.13 Crores)

- Fresh Issue / OFS: 100% Offer for Sale

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE & NSE

Canara Robeco IPO GMP Today

Check the gmp of this and other important IPOs at our IPO GMP hub page.

Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Canara Robeco IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 9, 2025 – October 13, 2025

- Basis of Allotment Date: October 14, 2025

- Refund Initiation Date: October 15, 2025

- Credit of Shares: October 15, 2025

- Listing Date: October 16, 2025

Listing Update:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 266 | 280.5 | 5 |

Objectives of Canara Robeco IPO

This is the most critical point for investors to understand. The IPO is a 100% Offer for Sale. This means:

- The company, Canara Robeco AMC, will not receive a single rupee from the public issue.

- The entire proceeds of ₹1,326.13 crores will go directly to the selling promoters, Canara Bank and ORIX Corporation Europe N.V., who are monetizing their investment.

Want to explore more investment opportunities? Check our Upcoming & Live IPOs section for the latest listings and subscription updates.

Financial Performance of Canara Robeco

(Amounts in ₹ Crores)

Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

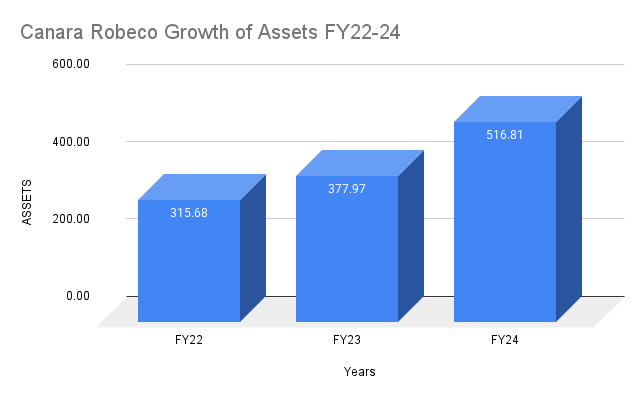

Assets | 616.9 | 516.81 | 377.97 | 315.68 |

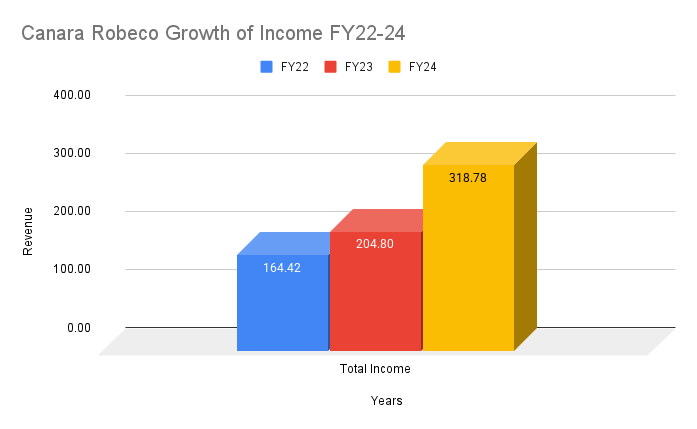

Total Income | 303.05 | 318.78 | 204.8 | 164.42 |

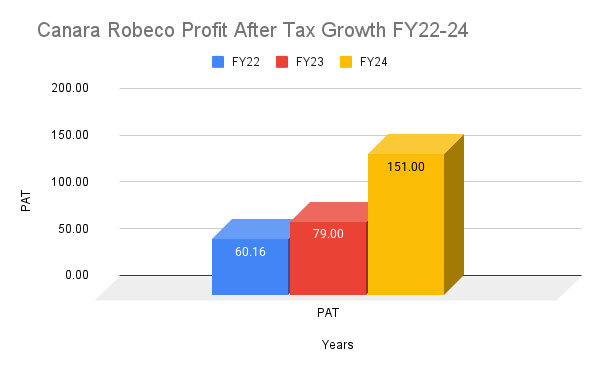

Profit After Tax | 148.98 | 151 | 79 | 60.16 |

Net Worth | 558.35 | 454.49 | 328.55 | 272.19 |

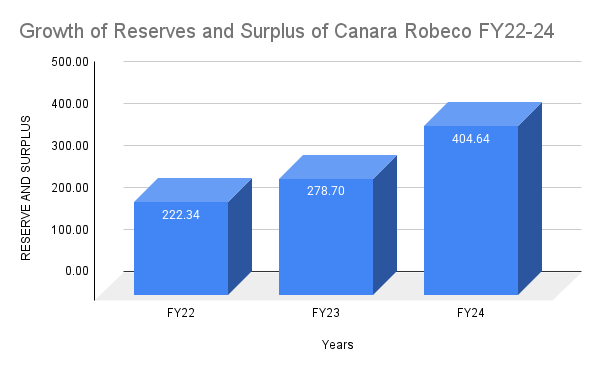

Reserves and Surplus | 358.93 | 404.64 | 278.7 | 222.34 |

Canara Robeco's financial performance has been outstanding. The company is completely debt-free. Its total income has nearly doubled in two years, and its profit after tax has surged by over 150% in the same period.

Canara Robeco Growth of Income FY22-24

The company has a strong Return on Net Worth (RoNW) of 33.22% for FY24, which is among the best in the industry.

CANARA ROBECO ASSET MANAGEMENT COMPANY LIMITED Growth of Reserve and Surplus FY22-24

Based on its FY24 earnings, the IPO is priced at a P/E multiple of approximately 35x, which appears reasonable for a high-growth, debt-free financial services company.

Along with IPO investments, explore our Money Saving Tips to build smarter financial habits.

CANARA ROBECO ASSET MANAGEMENT COMPANY LIMITED Growth of Assets FY22-24

Canara Robeco financial performance FY22-23: Source: DRHP SEBI

Planning to invest in IPOs and mutual funds? Use our SIP Calculator to estimate potential returns and plan smarter.

Industry Outlook

- The Indian mutual fund industry is a direct proxy for the country's economic growth and the increasing financialization of savings.

- With a growing middle class, rising financial literacy, and the massive popularity of Systematic Investment Plans (SIPs), the Assets Under Management (AUM) of the industry are poised for strong growth.

- As an established player with a strong brand and a focus on retail investors, Canara Robeco is well-positioned to ride this wave.

Thinking long-term beyond IPO investments? Try our Retirement Calculator to plan a secure financial future

Strengths and Risks of Canara Robeco IPO

Strengths:

- Strong Parentage: Backed by Canara Bank, providing immense brand trust and a wide distribution network.

- Stellar Financials: A debt-free company with high growth, strong profitability, and excellent return ratios.

- Consistent Investment Performance: Many of its long-term equity schemes have consistently beaten their benchmarks.

- Strong Retail and SIP Focus: A high concentration of retail investors and a large SIP book provide a stable and sticky AUM base.

Risks:

- 100% Offer for Sale (OFS): This is the biggest red flag. The promoters are cashing out, and the company is not raising any capital for its own growth.

- Dependency on Brand Licenses: The company does not own the "Canara" and "Robeco" trademarks and operates on license agreements that will require a brand transition plan in the future.

- High Equity Concentration: With over 93% of its AUM in equity schemes, the company's revenue is highly susceptible to stock market downturns.

- Reliance on Distributors: A significant portion of its business comes from third-party distributors, and any disruption in these relationships could impact AUM growth.

Expert Recommendations – Should You Apply?

Subscribe for Long-Term

The Canara Robeco IPO is a mixed bag. On one hand, you have a fundamentally strong, high-growth, debt-free business with a great brand. On the other hand, you have an IPO where the promoters are taking all the money home.

- For Risk-Averse Investors: The 100% OFS is a significant concern. If you are uncomfortable with the promoters cashing out, it's best to wait and watch the company's performance post-listing.

- For Growth Investors: This is a pure play on the Indian asset management theme. The business itself is excellent and growing fast. If you are willing to look past the OFS structure and bet on the company's continued performance, this is a strong candidate for your portfolio.

- Our View: The business fundamentals are too strong to ignore. While the OFS is a drawback, the company itself is a quality asset. We recommend a "Subscribe for Long-Term" rating, with the clear understanding that this is a bet on the business's future performance, not on the promoters' need for funds.

Key Takeaways

- IPO Price Band: ₹253 – ₹266 per share

- Lot Size: 56 Shares (Minimum Investment: ₹14,896)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 16, 2025.

- Recommendations of experts: A "Subscribe for Long-Term" recommendation for investors who are positive on the AMC sector and are willing to overlook the 100% OFS structure.

FAQs on Canara Robeco IPO

1. What is Canara Robeco IPO price band?

The price band for the IPO is set at ₹253 to ₹266 per equity share.

2. What is Canara Robeco IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Tuesday, October 14, 2025.

3. How to check Canara Robeco IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Canara Robeco IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Thursday, October 16, 2025.

5.Should I apply for Canara Robeco IPO?

This is a high-quality business coming to the market. However, the entire issue is an Offer for Sale. It is recommended for long-term investors who believe in the growth story of the Indian mutual fund industry and are comfortable with the promoters monetizing their stake.

IPO Disclaimer:

"The IPO details, including price band, dates, allotment status, and Grey Market Premium (GMP), are sourced from publicly available information and are subject to change. We do not provide any investment recommendations. Investors are advised to do their own research or consult a financial advisor before investing in any IPO. We are not liable for any loss or damage arising from reliance on the information provided here."