Updated On 26.11.2025 @ 11:15 AM

Excelsoft Technologies Limited is launching its mainboard Initial Public Offering (IPO) on November 19, 2025.

The company aims to raise ₹500 crores through an issue that includes a fresh issue of shares and a large Offer for Sale (OFS) by its corporate promoter.

The price band has been fixed at ₹114 to ₹120 per share, with a lot size of 125 shares. While Excelsoft operates in a niche, high-growth sector, investors must be extremely cautious of its massive dependence on a single client.

Stay ahead in the market with the latest Upcoming and Live IPO Details — track opening dates, subscription status, and allotment updates in real-time.

The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Excelsoft Technologies IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Want to master mutual funds step-by-step? Explore our Mutual Fund Learning Hub with over 100+ expert questions and answers to strengthen your investing foundation.

Briefs of Excelsoft Technologies IPO Details

- Price Band: ₹114 – ₹120 per share

- IPO Open / Close Dates: November 19, 2025 – November 21, 2025

- Lot Size: 125 Shares

- Issue Size: ₹500 Crores (Fresh Issue of ₹180 Cr + OFS of ₹320 Cr)

- Fresh Issue / OFS: Both

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE & NSE

Listing Updates:

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 120 | 135 | 12.5 |

Source: NSE

What is The Excelsoft Technologies IPO GMP Today?

- Note: The shares of Excelsoft Technologies are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

What Are The Excelsoft Technologies IPO Dates & Allotment Schedule?

- IPO Open & Close Date: November 19, 2025 – November 21, 2025

- Basis of Allotment Date: November 24, 2025

- Refund Initiation Date: November 25, 2025

- Credit of Shares: November 25, 2025

- Listing Date: November 26, 2025

Plan your long-term wealth easily with our SIP Calculator — calculate how small monthly investments can grow into a strong corpus over time.

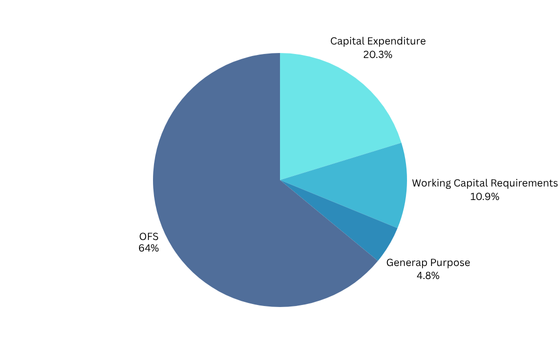

What Are The Objectives of Excelsoft Technologies IPO?

The company intends to utilise the net proceeds from the fresh issue for its expansion and working capital needs:

- Capital Expenditure (₹101.28 Crores): For the purchase of land, construction of a new building, and procurement of IT hardware and software.

- Working Capital Requirements (₹54.64 Crores): To manage its operational cycle and support business growth.

- General Corporate Purposes: The balance amount will be used for other strategic requirements.

- Note: A significant portion of the IPO, ₹320 crores, is an Offer for Sale. This money will go directly to the selling promoter and will not be used for the company's growth.

How is The Financial Performance of Excelsoft Technologies?

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 478.34 | 470.49 | 421.03 | 436.13 |

Total Income | 60.28 | 248.8 | 200.7 | 197.97 |

Profit After Tax | 6.01 | 34.69 | 12.75 | 22.41 |

EBITDA | 1.83 | 3.14 | 54.97 | 68.18 |

Total Borrowing | 37.82 | 26.59 | 76.73 | 118.09 |

Source: SEBI

Prepare for a secure future with our Retirement Calculator — find out how much you need to save today for a stress-free retirement.

Excelsoft's financial performance has been inconsistent. After a flat year in FY24 where revenue barely grew and profits halved, the company has shown a strong recovery in FY25, with revenue growing 17.6% and profit surging by over 170%.

A key positive is that the company has significantly reduced its debt, strengthening its balance sheet. However, the past volatility in its earnings is a point of concern.

P/E Ratio & Valuation

Based on its Fiscal Year 2025 earnings per share (EPS) of ₹3.47, the IPO is priced at a Price-to-Earnings (P/E) multiple of approximately 34.5x at the upper end of the price band (₹120).

This valuation places the company at a slight premium to the reported industry average P/E of 32.88x.

For a company with such high customer concentration and a volatile earnings history, this valuation appears to be fully priced, leaving little margin of safety for investors on the table.

While IPOs offer active earning opportunities, blogging is a smart passive way to build long-term income online.

Industry Outlook

- Excelsoft is a specialised SaaS player in the global learning and assessment industry.

- It provides the technology backbone for publishers and certification agencies, with its core services revolving around product engineering for digital learning and online testing.

- This is a high-growth sector, as the world rapidly shifts towards digital education and remote proctoring.

- As an established player with deep technical expertise, Excelsoft is well-positioned to benefit from this trend.

Strengths and Risks of Excelsoft Technologies IPO

Strengths:

- Niche Expertise: A strong player in the high-tech vertical SaaS market for education and assessment.

- Long-Standing Client Relationships: Has an average relationship of over 10 years with its top clients, indicating stickiness.

- Strong Financial Recovery: Demonstrated a sharp turnaround in profitability in the most recent fiscal year.

- Deleveraged Balance Sheet: Significantly reduced its debt, improving its financial health.

Risks:

- Extreme Customer Concentration: This is the single biggest red flag. The company is massively dependent on one client, the Pearson Education Group, which accounts for nearly 59% of its revenue. The loss of this single client would be catastrophic for the business.

- Large Offer for Sale (OFS): The OFS is almost double the size of the fresh issue. This suggests that providing an exit to the corporate promoter is a primary motive for the IPO.

- Volatile Financial Track Record: The company's revenue and profit growth have been inconsistent in the past.

- Significant Contingent Liability: The company has provided a corporate guarantee to secure the debt of its promoter, which amounts to nearly 80% of its net worth, a major financial risk.

Expert Recommendations – Should You Apply?

High Risk / Avoid

The Excelsoft Technologies IPO is a high-risk proposition where the red flags are too significant to ignore, despite the company's niche business.

- For Risk-Averse Investors: AVOID. The extreme dependence on a single client is a deal-breaker for any conservative investor. The business's future is tied to the health of its relationship with just one customer.

- For Aggressive Investors: The valuation is also a concern. Based on its FY25 earnings, the IPO is priced at a P/E multiple of around 34.5x, which seems fully priced, leaving little on the table for investors, especially given the high risks.

- Our View: The combination of extreme customer concentration, a large promoter exit via OFS, and a full valuation makes this a very risky bet. We recommend that investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹114 – ₹120 per share

- Lot Size: 125 Shares (Minimum Investment: ₹15,000)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on November 26, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to extreme customer concentration, a large Offer for Sale, and a demanding valuation.

FAQs on Excelsoft Technologies IPO

1. What is Excelsoft Technologies IPO price band?

The price band for the IPO is set at ₹114 to ₹120 per equity share.

2. What is Excelsoft Technologies IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, November 24, 2025.

3. How to check Excelsoft Technologies IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Excelsoft Technologies IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Wednesday, November 26, 2025.

5. Should I apply for Excelsoft Technologies IPO?

This is a high-risk proposition. Given the company's massive dependence on a single client, a large Offer for Sale component, and a full valuation, it is advisable for most retail investors to avoid this IPO.

Useful Links: Excelsoft Technologies IPO RHP

Other Important Resources:

1. Explore detailed IPO Infographics for quick visual insights into company data and financials.

2. Check premium rates at our IPO Grey Market Premium Hub to understand investor sentiment before listing.

Disclaimer:

This article is for informational purposes only and should not be considered as investment advice. IPO investments are subject to market risks. Please read the Red Herring Prospectus (RHP) and consult your financial advisor before making any investment decisions. The data and information provided here are sourced from publicly available documents and official filings.