Updated on 22.11.2025 @ 19:00 PM

K K Silk Mills Limited, a manufacturer of fabrics and garments, is launching its Initial Public Offering (IPO) on the BSE SME platform.

The subscription for this public issue will open on November 26, 2025, and close on November 28, 2025.

The company aims to raise up to ₹28.50 crores through a 100% fresh issue of shares.

The price band has been fixed at ₹36 to ₹38 per share, with a minimum lot size of 3,000 shares.

Don't miss any IPO, check all the live and upcoming IPOs at a place.

While K K Silk Mills has demonstrated strong profit growth and is attractively priced, investors must exercise extreme caution due to its very high customer concentration.

In this article, you will find K K Silk Mills IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Briefs of K K Silk Mills IPO Details

- Price Band: ₹36 to ₹38 per share

- IPO Open / Close Dates: November 26, 2025 – November 28, 2025

- Lot Size: 3,000 Shares

- Issue Size: 75,00,000 shares (aggregating up to ₹28.50 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE SME

What is K K Silk Mills IPO GMP Today?

- Note: The shares of K K Silk Mills are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

What Are the K K Silk Mills IPO Dates & Allotment Schedule?

- IPO Open & Close Date: November 26, 2025 – November 28, 2025

- Basis of Allotment Date: December 1, 2025

- Refund Initiation Date: December 2, 2025

- Credit of Shares: December 2, 2025

- Listing Date: December 3, 2025

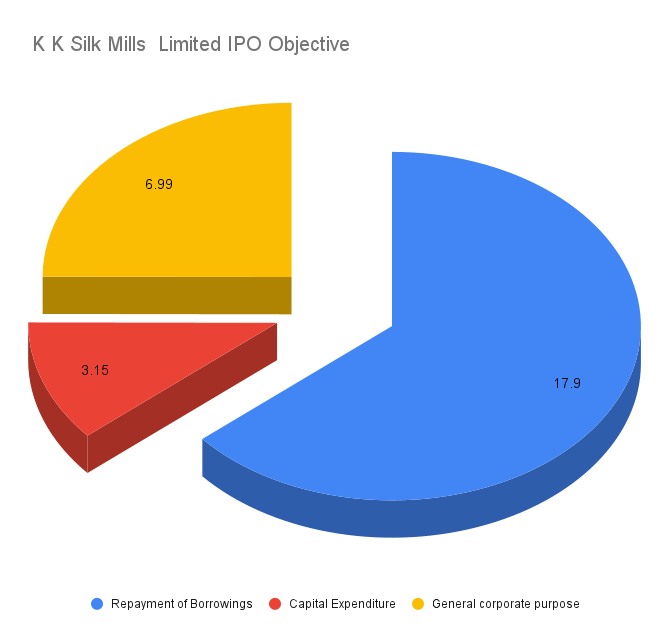

What Are The Objectives of K K Silk Mills IPO?

The company intends to utilise the net proceeds from the public offering for its expansion and to strengthen its financial position:

- Repayment of Borrowings (₹17.86 Crores): A significant portion of the IPO proceeds will be used to reduce its debt, which will lower finance costs and improve profitability.

- Capital Expenditure (₹3.15 Crores): For the purchase of new plant and machinery.

- General Corporate Purposes: The balance amount will be used for other strategic and day-to-day business requirements.

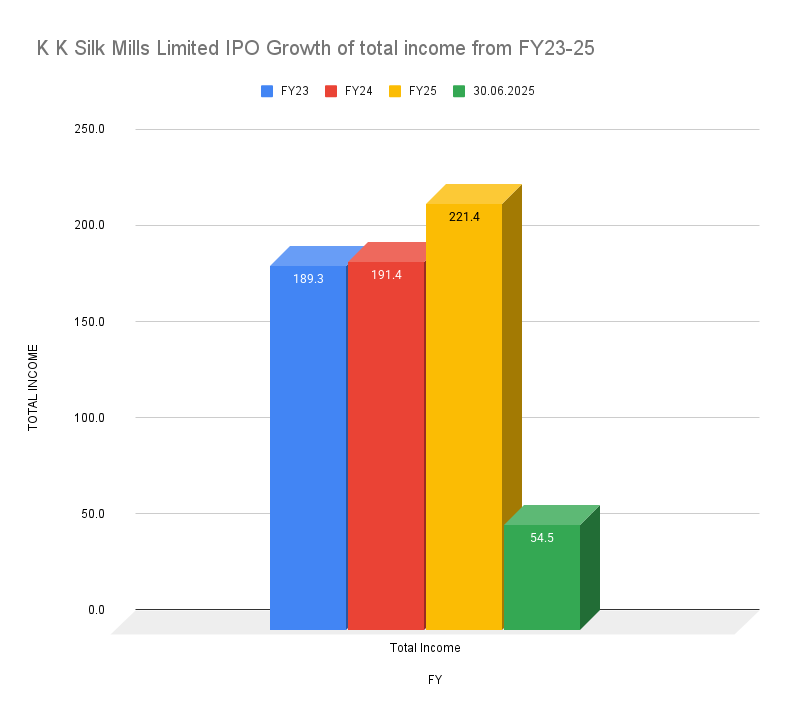

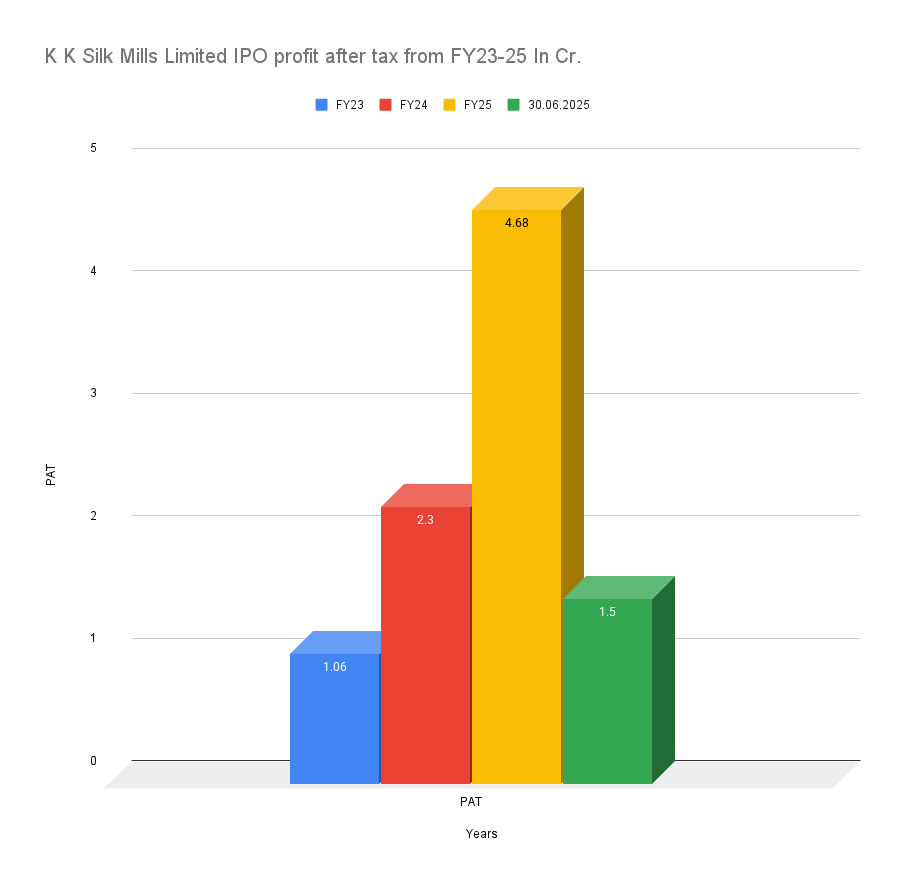

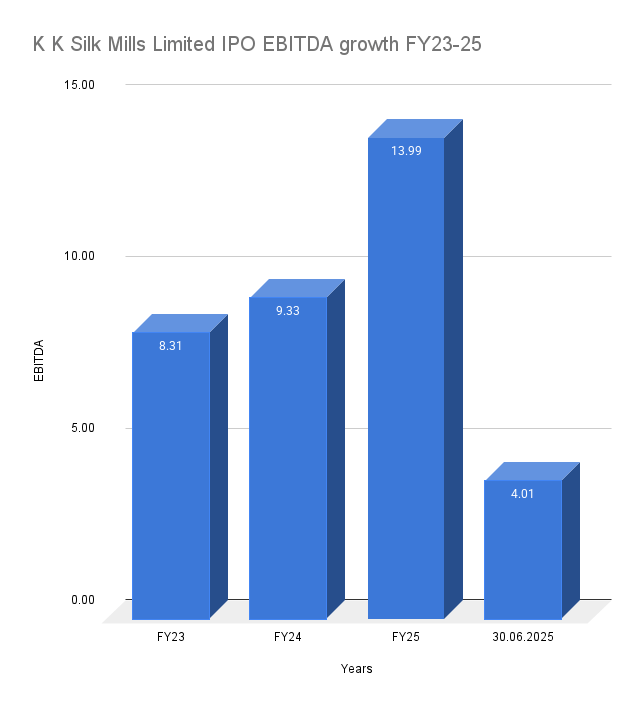

How is The Financial Performance of K K Silk Mills?

(Amounts in ₹ Crores)

Particulars | Period Ended 30 Jun 2025 | Year Ended 31 Mar 2025 | Year Ended 31 Mar 2024 | Year Ended 31 Mar 2023 |

Total Income | 54.51 | 221.43 | 191.37 | 189.28 |

Profit After Tax | 1.51 | 4.68 | 2.26 | 1.06 |

EBITDA | 4.01 | 13.99 | 9.33 | 8.31 |

NET Worth | 41.24 | 39.72 | 35.04 | 32.81 |

Reserves and Surplus | 26.3 | 24.78 | 27.57 | 25.34 |

Total Borrowing | 63.56 | 59.31 | 51.67 | 48.06 |

K K Silk Mills has delivered a strong financial performance.

The company's revenue has grown steadily, and its profitability has been on a remarkable upward trajectory, with profit after tax (PAT) more than quadrupling between FY23 and FY25.

The company's margins have also shown a healthy improvement, and the IPO funds will be used to significantly deleverage its balance sheet.

Source: RHP

Briefs of P/E Ratio & Peer Comparison

Based on its Fiscal Year 2025 earnings per share (EPS) of ₹3.13, the IPO is priced at a Price-to-Earnings (P/E) multiple of approximately 12.1x at the upper end of the price band (₹38).

P/E Ratio = ₹38 (Price) / ₹3.13 (Earnings Per Share)

P/E Ratio ≈ 12.1x

This valuation appears very attractive when compared to its larger, listed peers in the textile industry.

| Company Name | P/E Ratio | Revenue (FY25, ₹ Cr) | RoNW (%) (FY25) |

K K Silk Mills (at IPO price) | ~12.1x | ₹220.78 Cr | 11.79% |

| Banswara Syntex Ltd | 18.85x | ₹1,307.47 Cr | 3.84% |

| Sangam (India) Ltd | 67.47x | ₹2,862.27 Cr | 2.77% |

| Siyaram Silk Mills Ltd | 16.64x | ₹2,295.62 Cr | 15.43% |

The comparison shows that K K Silk Mills is being offered at a significant valuation discount to its peers, especially considering its superior growth and comparable return ratios. This fair pricing could leave a good upside for investors.

Industry Outlook

- K K Silk Mills operates in the competitive but vast Indian textile and garment industry.

- The company manufactures a wide range of fabrics and apparel for kids, men, and women.

- Its focus on a diversified product portfolio, from suiting and shirting to corporate wear, allows it to cater to a broad customer base.

- With a presence in the export market, the company is also tapping into global demand.

What Are The Strengths and Risks of K K Silk Mills IPO?

Strengths:

- Strong and Consistent Financial Growth: The company has a proven track record of growing revenues and explosive profit growth.

- Attractive Valuation: The IPO is priced at a significant discount to its listed peers, offering a potential valuation upside.

- Debt Reduction: The IPO proceeds will be used to significantly deleverage the balance sheet, reducing financial risk.

- Experienced Promoters: The leadership team has over three decades of experience in the textile industry.

Risks:

- Extreme Customer Concentration: This is the single biggest red flag. The top 10 customers account for over 81% of the company's revenue in the recent period. The loss of a single major client could be detrimental to the business.

- High Geographical Concentration: A majority of the company's revenue is concentrated in Gujarat and Maharashtra, making it vulnerable to regional disruptions.

- High Debt: While the company is repaying a significant portion of its debt from the IPO proceeds, it will still have a notable amount of borrowing on its books.

- SME Segment Risks: The stock will be listed on the BSE SME platform, which typically has lower liquidity and higher price volatility.

What Are TheExpert Recommendations – Should You Apply?

Subscribe with Caution (For High-Risk Investors)

The K K Silk Mills IPO is a classic case of an attractive valuation and strong growth clashing with a massive, underlying risk.

- For Risk-Averse Investors: AVOID. The extreme dependence on a few clients is a deal-breaker for any conservative investor. The business's stability is tied to the health of a handful of key relationships.

- For Aggressive Investors: The financial numbers and valuation are too compelling to ignore. At a P/E of around 12x, the pricing is very attractive for a company with such high growth. This is a high-risk, high-reward bet on the company's ability to retain its major customers.

- Our View: The IPO is a double-edged sword. The growth story is strong, and the pricing is very attractive. However, the concentration risk is equally potent. We recommend a "Subscribe with Caution" rating, strictly for high-risk investors who understand and are comfortable with the company's heavy reliance on its top clients.

Key Takeaways

- IPO Price Band: ₹36 to ₹38 per share

- Lot Size: 3,000 Shares (Note: The minimum application for retail investors is for 2 lots or 6,000 shares, costing ₹2,28,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on December 3, 2025.

- Recommendations of experts: A high-risk issue. Subscribe with caution, suitable only for aggressive investors due to the extreme customer concentration risk, despite the attractive financials and valuation.

FAQs on K K Silk Mills IPO

What is K K Silk Mills IPO price band?

The price band for the IPO is set at ₹36 to ₹38 per equity share.

What is K K Silk Mills IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, December 1, 2025.

How to check K K Silk Mills IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

What is K K Silk Mills IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Wednesday, December 3, 2025.

Should I apply for K K Silk Mills IPO?

This is a high-risk proposition. While the company's financial growth is impressive and the valuation is attractive, its extreme dependence on a few clients is a major risk. A subscription is recommended only for investors with a high-risk appetite.

Link to: RHP

Disclaimer:

The content on this page is for informational purposes only and does not constitute financial, investment, or professional advice. Please do your own research or consult a qualified financial advisor before making any investment decisions related to K K Silk Mills IPO.