Updated on 26.12.2025 @ 8:06 PM

The much-awaited Initial Public Offering (IPO) of LG Electronics India Limited, a household name and the undisputed market leader in India's home appliances and consumer electronics sector, is set to open on October 7, 2025.

This landmark IPO is a 100% Offer for Sale (OFS) by its South Korean parent, LG Electronics Inc.

The price band for the issue has been fixed at ₹1080 to ₹1140 per share, with a minimum lot size of 13 shares.

While the issue is purely an OFS, the company's dominant market position, stellar financial performance, and debt-free status are expected to draw massive investor interest.

In this article, you will find LG Electronics IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

LG Electronics IPO Details

- Price Band: ₹1080 – ₹1140 per share

- IPO Open / Close Dates: October 7, 2025 – October 9, 2025

- Lot Size: 13 Shares

- Issue Size: 10,18,15,859 shares (aggregating up to ₹11,607.01 Crores)

- Fresh Issue / OFS: 100% Offer for Sale

- Registrar: KFin Technologies Limited

- Listing Exchange: BSE & NSE

Check the subscription details:LG Electronics IPO Subscription Status – Day 1, Day 2 & Day 3

LG Electronics IPO GMP Today

You can track the GMP of this and other issues at our GMP hub page.

- GMP is an unofficial indicator and changes frequently based on market sentiment and subscription demand.

Listing updates:

The issue listed at 50% premium.

| Type | Issue Price | Open | Close | Day's High |

| Issue Price Upper Band | 1140 | 1715 | 1689.4 | 1,736.40 |

| Issue Price Lower Band | 1080 |

LG Electronics IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 7, 2025 – October 9, 2025

- Basis of Allotment Date: October 10, 2025

- Refund Initiation Date: October 13, 2025

- Credit of Shares: October 13, 2025

- Listing Date: October 14, 2025

Check the IPO allotment status: LG Electronics IPO Allotment Status – How to Check Online

Objectives of LG Electronics IPO

Since the IPO is a 100% Offer for Sale, the company will not receive any proceeds from the public issue. The primary objectives are:

- To allow the promoter, LG Electronics Inc., to sell a 15% stake and monetize its investment.

- To achieve the benefits of listing on Indian stock exchanges, which will enhance brand visibility and provide liquidity for shareholders.

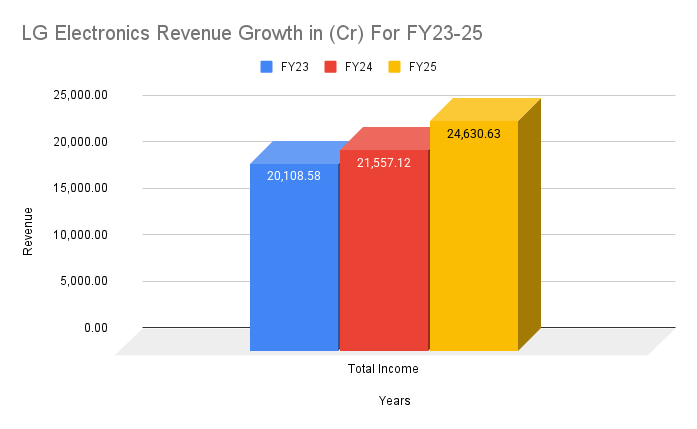

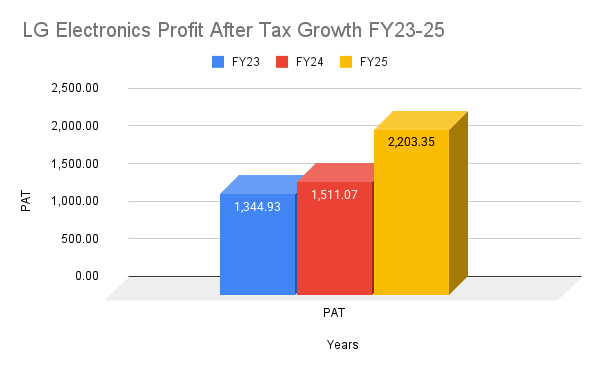

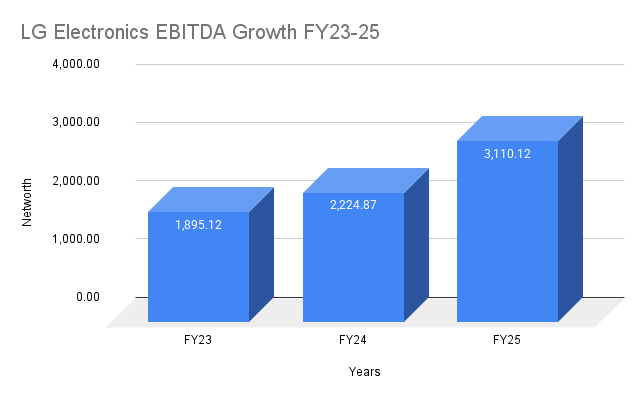

Financial Performance of LG Electronics India

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 11,516.44 | 11,517.15 | 8,498.44 | 8,992.12 |

Total Income | 6,337.36 | 24,630.63 | 21,557.12 | 20,108.58 |

Profit After Tax | 513.26 | 2,203.35 | 1,511.07 | 1,344.93 |

EBITDA | 716.27 | 3,110.12 | 2,224.87 | 1,895.12 |

NET Worth | 6,447.85 | 5,933.75 | 3,735.82 | 4,319.82 |

Reserves and Surplus | 5,805.50 | 5,291.40 | 3,659.12 | 4,243.12 |

Total Borrowing | 0 | 0 | 0 | 0 |

- LG Electronics India's financial report card is nothing short of spectacular.

- The company is completely debt-free and has demonstrated robust and consistent growth.

- In FY25, its revenue grew by 14% and profit after tax surged by an impressive 46%.

- The company boasts exceptional return ratios, with a Return on Net Worth (RoNW) of over 40% and a Return on Capital Employed (RoCE) of 45% in FY24, placing it at the top of its peer group.

- Based on its FY25 earnings, the IPO is priced at a P/E multiple of approximately 35x, which appears fair for a market leader of its calibre.

Industry Outlook

- LG India is the undisputed king of the Indian home appliances and consumer electronics market, a position it has held for 13 consecutive years.

- The company dominates key categories like washing machines, refrigerators, TVs, and air conditioners. This market is projected to grow at a strong CAGR of 12% to reach over ₹10 lakh crore by 2028, driven by rising disposable incomes, increasing electrification, and a consumer shift towards premium products.

- As the market leader, LG is perfectly positioned to capture this growth.

“If you’re interested in improving your financial knowledge, you might also enjoy our article on the benefits of reading books and how consistent learning can enhance investment decisions.”

Strengths and Risks of LG Electronics IPO

Strengths:

- Unrivaled Market Leadership: A dominant #1 position in a large and growing market.

- Powerful Brand Equity: "LG" is one of India's most trusted and recognized brands.

- Stellar Financials: A debt-free company with high growth, strong profitability, and excellent return ratios.

- Extensive Distribution Network: One of the largest sales and service networks in the country, reaching every corner of India.

- Innovation and R&D: Backed by the technological prowess of its global parent.

Risks:

- 100% Offer for Sale (OFS): This is the biggest point of consideration. The company is not raising money for its own growth; the entire ₹11,607 crores will go to the South Korean parent company.

- Dependence on Promoter: The Indian entity is heavily reliant on its parent for the brand, technology, and product innovation.

- Litigation and Contingent Liabilities: The company is involved in significant tax litigation and has a contingent liability related to royalty payments, which investors should be aware of.

- Intense Competition: The consumer electronics market is highly competitive, with pressure from both established rivals and new-age brands.

If you’re new to stock market investing, you can first check out our detailed guide on what are IPOs and how they work before diving into this analysis.

Expert Recommendations – Should You Apply?

Subscribe for Long-Term

The LG Electronics India IPO is a rare opportunity for Indian investors to own a piece of a blue-chip, market-leading multinational company. Despite being a complete Offer for Sale, the underlying business is exceptionally strong.

- For All Investors: This is a "core portfolio" stock. It offers a combination of stability, growth, and strong governance. The debt-free status and high profitability make it a fundamentally sound investment.

- Listing Gains vs. Long-Term: While the strong brand may attract healthy subscriptions, investors should not expect a blockbuster, multi-bagger listing. The issue is large, and the pricing is fair. The real wealth creation opportunity lies in holding this stock for the long term.

- Our View: The only significant drawback is the 100% OFS structure. However, the business itself is of such high quality that it merits a strong recommendation. We recommend a "Subscribe for Long-Term" rating.

Key Takeaways

- IPO Price Band: ₹1080 – ₹1140 per share

- Lot Size: 13 Shares (Minimum Investment: ₹14,820)

- GMP Today: ₹40 (around 4% premium)

- Allotment & Listing Dates: Tentative listing on October 14, 2025.

- Recommendations of experts: A strong "Subscribe" recommendation for long-term investors looking to add a quality market leader to their portfolio.

FAQs on LG Electronics IPO

1. What is LG Electronics IPO GMP today?

Currently, the GMP for the LG Electronics IPO is ₹40, suggesting a potential listing premium of around 4-5% over the issue price.

2. What is LG Electronics IPO price band?

The price band for the IPO is set at ₹1080 to ₹1140 per equity share.

3. What is LG Electronics IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Friday, October 10, 2025.

4. How to check LG Electronics IPO allotment status?

You can check the allotment status on the website of the IPO registrar, KFin Technologies Limited, after the basis of allotment is finalized.

5. What is LG Electronics IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Tuesday, October 14, 2025.

6. Should I apply for LG Electronics IPO?

Yes, this is a highly recommended IPO for long-term investment. Despite being a 100% Offer for Sale, the company's market leadership, debt-free status, and strong financial performance make it a quality addition to any investment portfolio.

Expert Recommendations – Should You Apply?

Subscribe for Long-Term

The LG Electronics India IPO is a rare opportunity for Indian investors to own a piece of a blue-chip, market-leading multinational company. Despite being a complete Offer for Sale, the underlying business is exceptionally strong.

- For All Investors: This is a "core portfolio" stock. It offers a combination of stability, growth, and strong governance. The debt-free status and high profitability make it a fundamentally sound investment.

- Listing Gains vs. Long-Term: While the strong brand may attract healthy subscriptions, investors should not expect a blockbuster, multi-bagger listing. The issue is large, and the pricing is fair. The real wealth creation opportunity lies in holding this stock for the long term.

- Our View: The only significant drawback is the 100% OFS structure. However, the business itself is of such high quality that it merits a strong recommendation. We recommend a "Subscribe for Long-Term" rating.

Key Takeaways

- IPO Price Band: ₹1080 – ₹1140 per share

- Lot Size: 13 Shares (Minimum Investment: ₹14,820)

- GMP Today: ₹40 (around 4% premium)

- Allotment & Listing Dates: Tentative listing on October 14, 2025.

- Recommendations of experts: A strong "Subscribe" recommendation for long-term investors looking to add a quality market leader to their portfolio.

FAQs on LG Electronics IPO

1. What is LG Electronics IPO GMP today?

Currently, the GMP for the LG Electronics IPO is ₹40, suggesting a potential listing premium of around 4-5% over the issue price.

2. What is LG Electronics IPO price band?

The price band for the IPO is set at ₹1080 to ₹1140 per equity share.

3. What is LG Electronics IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Friday, October 10, 2025.

4. How to check LG Electronics IPO allotment status?

You can check the allotment status on the website of the IPO registrar, KFin Technologies Limited, after the basis of allotment is finalized.

5. What is LG Electronics IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Tuesday, October 14, 2025.

6. Should I apply for LG Electronics IPO?

Yes, this is a highly recommended IPO for long-term investment. Despite being a 100% Offer for Sale, the company's market leadership, debt-free status, and strong financial performance make it a quality addition to any investment portfolio.

You May also want to check these important IPOs: Rubicon Research IPO GMP, Price, Dates, Allotment, Review

Important Resources:

1. Visit our mutual fund learning hub to learn about mutual fund basics.

2. Visit here to find out upcoming and live IPOs.

3. Learn here how to make passive income through blogging course.

Disclaimer

The information provided about the IPO, including GMP, price, dates, and allotment details, is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to subscribe to any IPO. Investors are advised to carefully read the Red Herring Prospectus (RHP) and consult their financial advisor before making any investment decision. Market data such as GMP may fluctuate and should not be solely relied upon for investment purposes.