Updated on 24.10.2025 @ 11:15 am

Midwest Limited, India's largest producer and exporter of the premium Black Galaxy Granite, is launching its mainboard Initial Public Offering (IPO) on October 15, 2025. The company aims to raise up to ₹451 crores through an issue that includes a fresh issue of shares to fund its diversification and a significant Offer for Sale (OFS) by its promoters. The price band for the IPO has been fixed at ₹1014 to ₹1065 per share, with a lot size of 14 shares. While the company is a dominant market leader with strong financials, investors must consider the high concentration risks associated with its business. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Midwest Limited IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Midwest Limited IPO Details

- Price Band: ₹1014 – ₹1065 per share

- IPO Open / Close Dates: October 15, 2025 – October 17, 2025

- Lot Size: 14 Shares

- Issue Size: ₹451 Crores (Fresh Issue of ₹250 Cr + OFS of ₹201 Cr)

- Fresh Issue / OFS: Both

- Registrar: Kfin Technologies Ltd.

- Listing Exchange: BSE & NSE

Stay updated with the latest market opportunities through our Upcoming and Live IPOs section.

Midwest Limited IPO GMP Today

- Note: The shares of Midwest Limited are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Midwest Limited IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 15, 2025 – October 17, 2025

- Basis of Allotment Date: October 20, 2025

- Refund Initiation Date: October 23, 2025

- Credit of Shares: October 23, 2025

- Listing Date: October 24, 2025

Listing Update of Midwest Limited IPO:

| Type | Issue Price | Open |

| Lisiting | 1065 | 1165 |

Objectives of Midwest Limited IPO

The company intends to utilise the net proceeds from the Fresh Issue for its strategic growth and diversification:

- Capital Expenditure for Quartz Plant (₹127.05 Crores): To fund the second phase of its new Quartz Processing Plant.

- Capital Expenditure for Machinery (₹25.76 Crores): For the purchase of new Electric Dump Trucks.

- Debt Repayment (₹53.80 Crores): To reduce its outstanding borrowings.

- Capital Expenditure for Solar Energy (₹3.26 Crores): For integrating solar power at its mines to reduce costs.

- Note: The proceeds from the Offer for Sale (OFS) component of ₹201 crores will go directly to the selling promoters and will not be received by the company.

Plan your future investments better with our SIP Calculator and see how small monthly investments can grow over time.

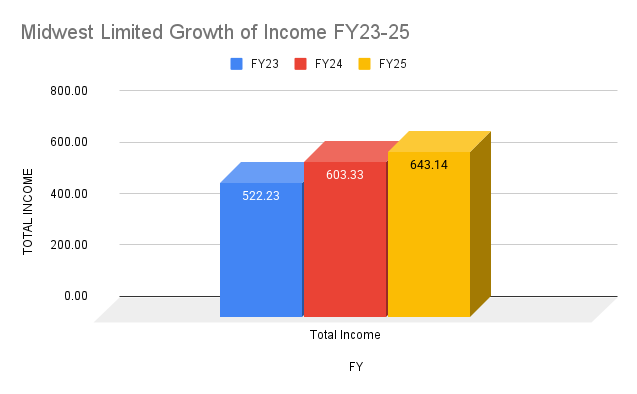

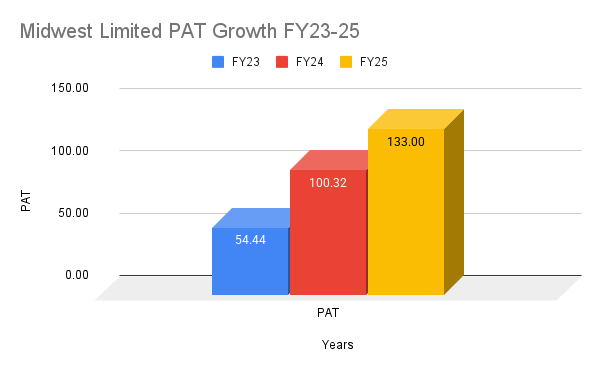

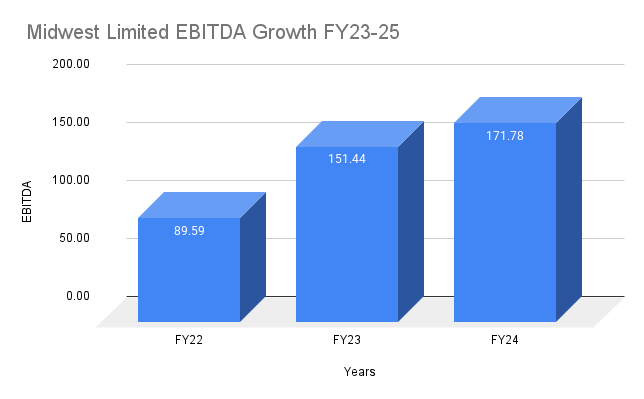

Financial Performance of Midwest Limited

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 1,082.81 | 1,058.70 | 757.12 | 656 |

Total Income | 146.47 | 643.14 | 603.33 | 522.23 |

Profit After Tax | 24.38 | 133.3 | 100.32 | 54.44 |

EBITDA | 38.97 | 171.78 | 151.44 | 89.59 |

NET Worth | 577.03 | 553.69 | 421.93 | 334.92 |

Reserves and Surplus | 625.6 | 602.26 | 484.86 | 408.88 |

Total Borrowing | 270.11 | 236.61 | 120.48 | 149.08 |

Midwest Limited has showcased a strong and consistent financial performance. The company's revenue has grown steadily, but its profitability has been exceptional, with profit after tax (PAT) more than doubling between FY23 and FY25.

The company boasts strong return ratios, including a Return on Equity (RoE) of 23.78% in FY24, and maintains a low debt-to-equity ratio of 0.29.

Source:SEBI DRHP

Based on its FY25 earnings, the IPO is priced at a P/E multiple of approximately 27x, which appears reasonable for a market leader with a strong growth trajectory.

Explore in-depth insights, guides, and analysis in our Mutual Fund Hub to make informed investment decisions.

Industry Outlook

- Midwest is the undisputed leader in the mining and export of Black Galaxy Granite, a premium natural stone with high global demand.

- The company controls a significant portion of the Indian export market for this product.

- While granite is its core, the company is strategically diversifying into high-growth areas like Quartz processing (for engineered stone and solar glass) and mining other premium stones like Laza Grey Marble.

- The mining industry in India has high barriers to entry due to significant capital investment and stringent regulatory requirements, giving established players like Midwest a strong competitive advantage.

Discover smart Money Saving Tips to optimize your budget and increase your investable surplus.

Strengths and Risks of Midwest Limited IPO

Strengths:

- Market Dominance: The largest producer and exporter of the high-value Black Galaxy Granite.

- Strong Financials: Consistent growth in revenue and profits, high return ratios, and a healthy balance sheet with low debt.

- Integrated Operations: A "mine to distribution" business model provides strong control over the entire value chain.

- Clear Diversification Strategy: Well-defined plans to enter high-growth segments like Quartz and new varieties of marble.

Risks:

- Extreme Product and Geographic Concentration: The business is heavily reliant on a single product, Black Galaxy Granite (72% of revenue), which is mined from a single location in Andhra Pradesh.

- High Customer and Export Market Concentration: The top 10 customers contribute nearly 50% of revenue, and over 50% of the revenue is dependent on China as a major global distribution hub.

- Significant Contingent Liabilities: The company has contingent liabilities of over ₹200 crores, which is a significant amount relative to its size.

- Large Offer for Sale (OFS): A substantial portion of the IPO is an OFS where promoters are cashing out, which can be a point of concern for new investors.

Estimate your post-retirement corpus and plan financially smart using our Retirement Calculator.

Expert Recommendations – Should You Apply?

Subscribe with Caution

The Midwest Limited IPO offers an opportunity to invest in a market leader with a strong financial track record and clear growth plans. However, the investment comes with significant concentration risks.

- For Risk-Averse Investors: The extreme dependence on a single product and geography is a major risk. It would be prudent to wait and see how the company's diversification strategy plays out post-listing.

- For Growth Investors: The company's market leadership, strong financials, and reasonable valuation make it an attractive bet. The diversification into Quartz is a major growth trigger.

- Our View: The IPO is a classic case of a strong business with inherent concentration risks. The valuation is fair, leaving room for potential upside. We recommend a "Subscribe with Caution" rating, suitable for investors with a moderate to high-risk appetite who are comfortable with the business's concentration risks.

Key Takeaways

- IPO Price Band: ₹1014 – ₹1065 per share

- Lot Size: 14 Shares (Minimum Investment: ₹14,910)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 24, 2025.

- Recommendations of experts: A "Subscribe with Caution" recommendation. The company is a market leader with strong financials, but the investment carries significant concentration risks.

FAQs on Midwest Limited IPO

1. What is Midwest Limited IPO price band?

The price band for the IPO is set at ₹1014 to ₹1065 per equity share.

2. What is Midwest Limited IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, October 20, 2025.

3. How to check Midwest Limited IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Midwest Limited IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE and NSE on Friday, October 24, 2025.

5. Should I apply for Midwest Limited IPO?

This is a high-risk, high-reward opportunity. The company is a market leader with strong financials and a reasonable valuation. However, its heavy dependence on a single product and geography is a major risk. A subscription is recommended for investors with a moderate to high-risk appetite.

Disclaimer

The information provided on this page about the Midwest Limited IPO (including GMP, price, dates, allotment, and review) is for educational and informational purposes only. We do not provide any investment advice or recommendations. Investors are advised to read the Red Herring Prospectus (RHP) and consult their financial advisor before making any investment decisions. The GMP (Grey Market Premium) values mentioned are based on external sources and may change without prior notice. We are not responsible for any losses arising from decisions based on the information provided here.