Updated@ 19:14 PM Dt.16.11.2025

Mittal Sections Limited, a Gujarat-based manufacturer of structural steel products, is set to launch its Initial Public Offering (IPO) on the BSE SME platform, opening on October 7, 2025.

The company is seeking to raise up to ₹52.91 crores through a 100% fresh issue of shares to fund a major capacity expansion. The price band has been fixed at ₹136 to ₹143 per share, with a minimum lot size of 1,000 shares.

While the company's expansion plans are ambitious and its recent profitability has improved, investors must weigh this against significant risks, including outstanding promoter litigation and extreme geographical concentration.

In this article, you will find Mittal Sections IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Mittal Sections IPO Details

- Price Band: ₹136 – ₹143 per share

- IPO Open / Close Dates: October 7, 2025 – October 9, 2025

- Lot Size: 1,000 Shares

- Issue Size: 37,00,000 shares (aggregating up to ₹52.91 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Pvt Ltd

- Listing Exchange: BSE SME

Listing Updated:

The issue was opened 114.40 and closed at 108.7.

| Type | Issue Price | Open | Close | Day's High |

| Lisiting | 143 | 114.4 | 108.7 | 114.40 |

Mittal Sections IPO GMP Today

Check the gmp of all the ipos at our gmp today hub page.

- Note: The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Mittal Sections IPO Dates & Allotment Schedule

- IPO Open & Close Date: October 7, 2025 – October 9, 2025

- Basis of Allotment Date: October 10, 2025

- Refund Initiation Date: October 13, 2025

- Credit of Shares: October 13, 2025

- Listing Date: October 14, 2025

Objectives of Mittal Sections IPO

The company intends to utilise the net proceeds from the public offering for its ambitious growth plans:

- Capital Expenditure (₹20.89 Crores): For land acquisition and setting up a new manufacturing plant in Bavla, Ahmedabad, which will nearly triple its capacity.

- Working Capital Requirements (₹15.00 Crores): To fund its growing operational needs.

- Debt Repayment (₹5.00 Crores): To reduce its borrowings and strengthen the balance sheet.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

Financial Performance of Mittal Sections

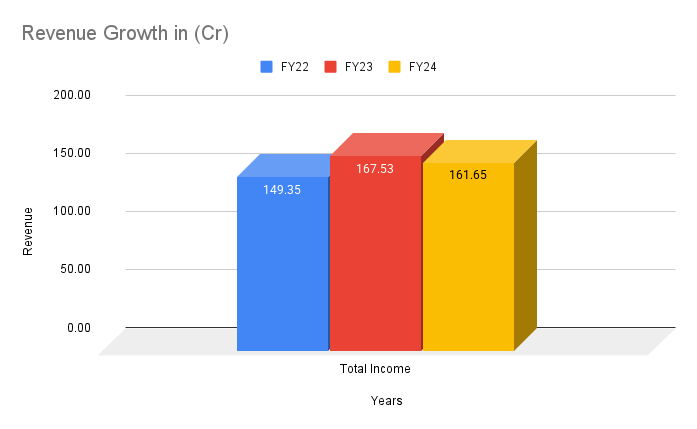

(Amounts in ₹ Crores)

Period Ended | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 35.11 | 29.04 | 33.37 | 32.3 |

Total Income | 68.97 | 161.65 | 167.53 | 149.35 |

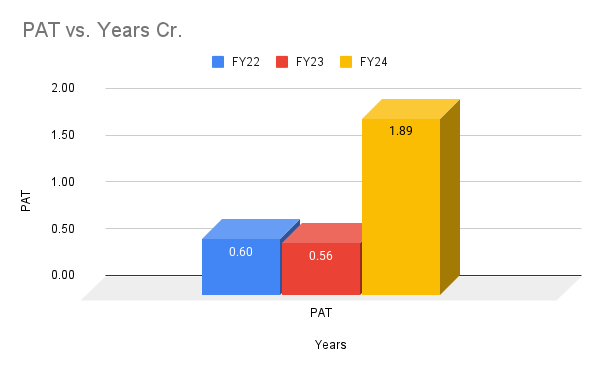

Profit After Tax | 2.41 | 1.89 | 0.56 | 0.6 |

Net Worth | 9.14 | 6.73 | 4.84 | 4.28 |

Reserves and Surplus | 6.52 | 4.11 | 2.21 | 1.66 |

Total Borrowing | 12.99 | 15 | 20.39 | 13.54 |

The company's financials reflect the nature of the steel industry—high volume but very low margins. While revenue dipped slightly in FY24, the company's profitability saw a significant jump, with PAT increasing by over 230%.

The PAT margin improved from a razor-thin 0.33% in FY23 to 1.17% in FY24, and this trend has continued into the first half of FY25. Despite the low margins, the company delivered a strong Return on Net Worth (RoNW) of 28.13% in FY24.

Industry Outlook

Mittal Sections is a regional player in India's robust steel sector. As the world's second-largest producer of crude steel, India is witnessing strong domestic demand, projected to grow by 9-10% in FY25. The government's relentless focus on infrastructure development through policies like the National Steel Policy provides a powerful tailwind for the industry.

MSL's planned capacity expansion is timed to capitalize on this growing demand.

If you're exploring IPOs as part of your investment strategy, you might also be interested in our detailed guide on ELSS Mutual Funds — a smart way to save taxes while building long-term wealth.

Don’t forget to check out our Money Saving Tips to make your overall financial plan stronger.

Strengths and Risks of Mittal Sections IPO

Strengths:

- Ambitious Expansion Plan: The company is set to increase its manufacturing capacity from 36,000 MTPA to 96,000 MTPA, positioning it for significant growth.

- Experienced Promoters: The promoters have over 15 years of experience in the steel industry, providing strong operational leadership.

- Improving Profitability: Recent financial performance shows a strong uptick in profits and margins.

- Strategic Location: Based in Gujarat, the company enjoys logistical advantages due to its proximity to suppliers and customers.

Risks:

- Significant Promoter Litigation: This is a major red flag. The promoters are involved in tax proceedings with a potential liability of ₹6.52 crores. For a company raising ₹52 crores, this is a substantial risk.

- Extreme Geographical Concentration: The business is almost entirely dependent on Gujarat, with the state contributing 99.80% of revenue in FY24. Any regional slowdown could severely impact the company.

- Low Margin Business: The company operates on very thin profit margins, making it vulnerable to fluctuations in raw material prices and competition.

- Potential Conflict of Interest: Several promoter-owned entities are engaged in a similar line of business, which could lead to conflicts of interest.

Key Considerations for Investors

High Risk / Avoid

The Mittal Sections IPO is a story of a promising expansion plan overshadowed by significant risks. The valuation also appears stretched.

- For Risk-Averse Investors: AVOID. The combination of promoter litigation, extreme geographical concentration, and a low-margin business model makes this a clear avoid for conservative investors.

- For Aggressive Investors: The valuation is a major concern. Based on FY24 earnings, the P/E ratio is nearly 60x, which is very expensive. Even if we annualize the strong performance of H1-FY25, the P/E is over 23x. Given the substantial risks, this still looks fully priced.

- Our View: The risks, particularly the significant promoter litigation and the demanding valuation, are too substantial to ignore. We recommend that most investors avoid this IPO.

Disclaimer: This article is strictly for educational purposes. Please consult a SEBI-registered investment advisor before making any investment decisions.

Key Takeaways

- IPO Price Band: ₹136 – ₹143 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,86,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on October 14, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to significant promoter litigation, extreme concentration risks, and a stretched valuation.

FAQs on Mittal Sections IPO

1. What is Mittal Sections IPO price band?

The price band for the IPO is set at ₹136 to ₹143 per equity share.

2. What is Mittal Sections IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Friday, October 10, 2025.

3. How to check Mittal Sections IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

4. What is Mittal Sections IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Tuesday, October 14, 2025.

5. Should I apply for Mittal Sections IPO?

This is a high-risk proposition. Given the significant litigation involving the promoters, extreme business concentration, and a demanding valuation, it is advisable for most retail investors to avoid this IPO.

You may have interest in: WeWork India IPO GMP, Price, Dates, Allotment, Review

Disclaimer

The information provided above about the IPO is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to subscribe to or avoid any IPO. Investors are advised to read the Red Herring Prospectus (RHP) and consult with their financial advisor before making any investment decisions.

Market investments are subject to risks, including loss of capital. Past performance is not indicative of future results.