Updated on 22.11.2025 @ 18:38 PM

Mother Nutri Foods Limited, a B2B manufacturer and exporter of peanut butter, is launching its Initial Public Offering (IPO) on the BSE SME platform.

The subscription for this public issue will open on November 26, 2025, and close on November 28, 2025.

The company aims to raise up to ₹39.59 crores through an issue that includes a fresh issue of shares and a small Offer for Sale (OFS).

Check all the upcoming and live IPOs at a place.

The price band has been fixed at ₹111 to ₹117 per share, with a minimum lot size of 1,200 shares.

While the company has demonstrated spectacular growth in profitability, investors must be cautious of its history of negative operating cash flows.

In this article, you will find Mother Nutri Foods IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review.

Briefs of Mother Nutri Foods IPO Details

- Price Band: ₹111 to ₹117 per share

- IPO Open / Close Dates: November 26, 2025 – November 28, 2025

- Lot Size: 1,200 Shares

- Issue Size: ₹39.59 Crores (Fresh Issue of ₹28.82 Cr + OFS of ₹7.92 Cr)

- Fresh Issue / OFS: Both

- Registrar: Bigshare Services Pvt.Ltd.

- Listing Exchange: BSE SME

What is The Mother Nutri Foods IPO GMP Today?

- Note: The shares of Mother Nutri Foods are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

What are The Mother Nutri Foods IPO Dates & Allotment Schedule ?

- IPO Open & Close Date: November 26, 2025 – November 28, 2025

- Basis of Allotment Date: December 1, 2025

- Refund Initiation Date: December 2, 2025

- Credit of Shares: December 2, 2025

- Listing Date: December 3, 2025

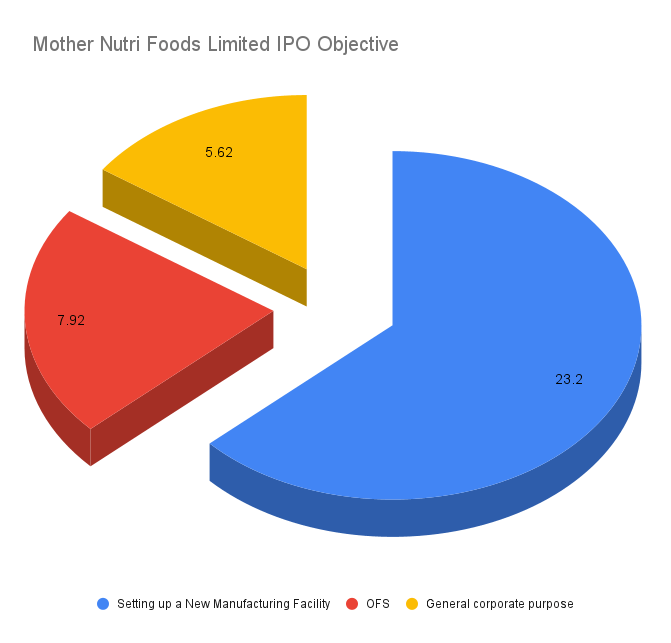

What Are The Objectives of Mother Nutri Foods IPO?

The company intends to utilise the net proceeds from the fresh issue for its ambitious expansion plans:

- Setting up a New Manufacturing Facility (₹23.19 Crores): The majority of the proceeds will be used to establish a new manufacturing plant in Mahuva, Gujarat, to enhance its production capacity.

- General Corporate Purposes: The balance amount will be used for other strategic and operational requirements.

- Note: The proceeds from the Offer for Sale (OFS) of ₹7.92 crores will go to the selling promoter and not the company.

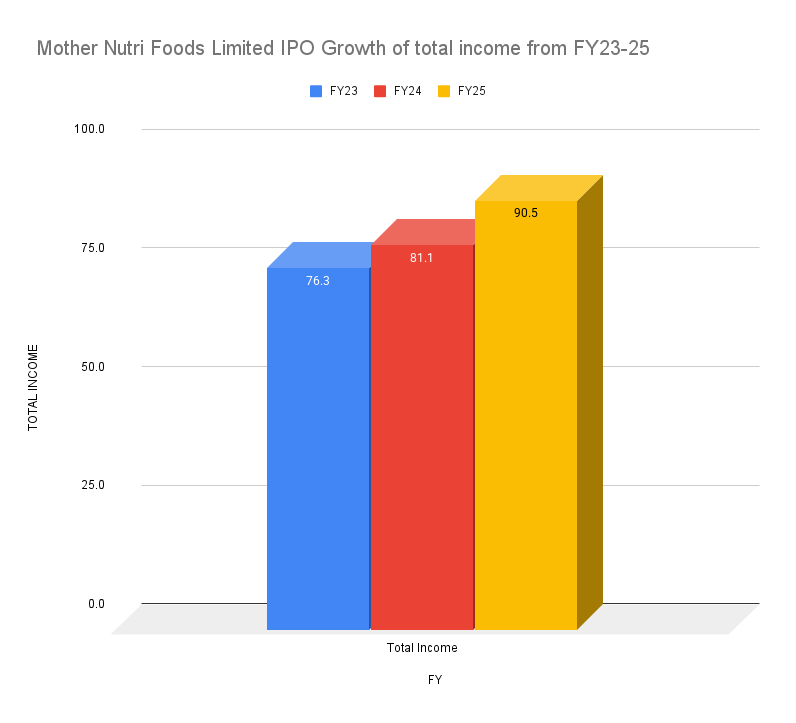

How is The Financial Performance of Mother Nutri Foods?

(Amounts in ₹ Crores)

Particulars | FY Ended 31 Mar 2025 | FY Ended 31 Mar 2024 | FY Ended 31 Mar 2023 |

Total Income | 90.48 | 81.05 | 76.26 |

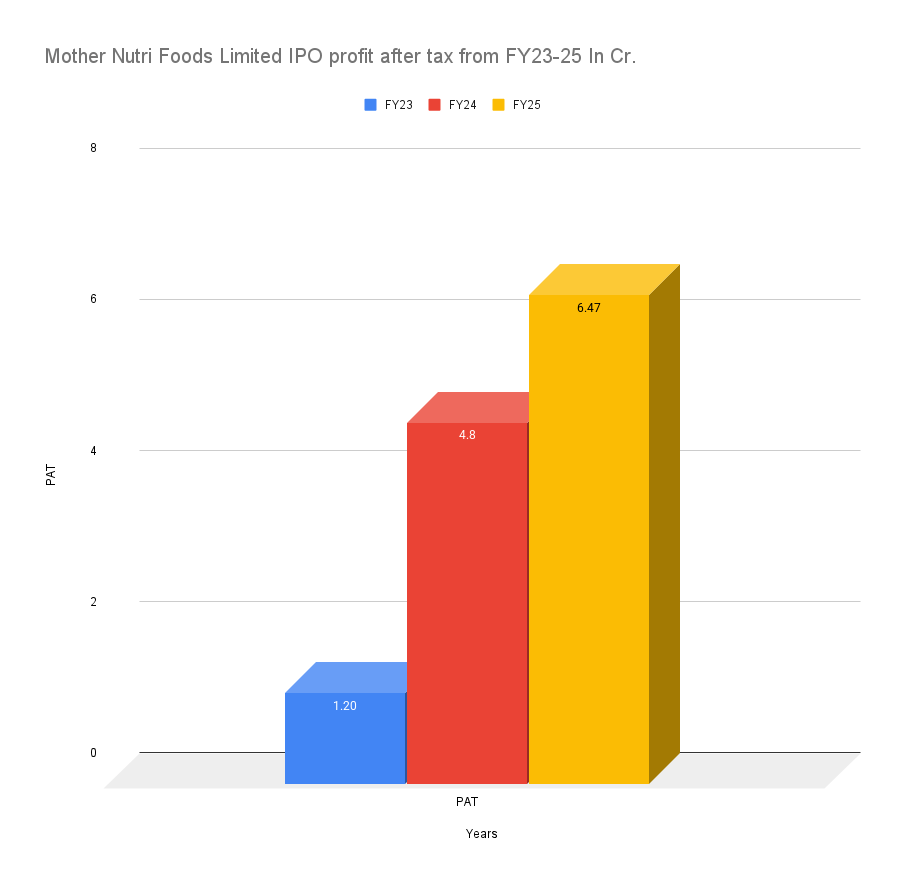

Profit After Tax (PAT) | 6.47 | 4.78 | 1.2 |

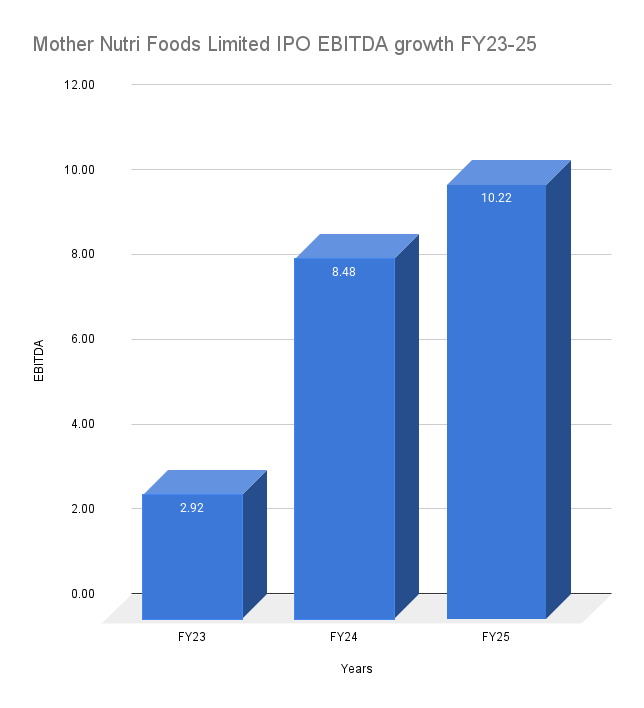

EBITDA | 10.22 | 8.48 | 2.92 |

Net Worth | 24.89 | 10.44 | 5.66 |

Reserves and Surplus | 19.99 | 5.98 | 1.2 |

Total Borrowing | 22.81 | 25.43 | 23.37 |

Mother Nutri Foods has delivered a spectacular financial performance.

While revenue has grown steadily, the company's profitability has seen explosive growth, with profit after tax (PAT) surging by over 400% between FY23 and FY25.

Source: DRHP

The company's margins have expanded significantly, and it has successfully deleveraged its balance sheet, with the debt-to-equity ratio dropping from 4.13 to a much healthier 0.92 in two years.

What about P/E Ratio & Peer Comparison?

Based on its Fiscal Year 2025 earnings per share (EPS) of ₹7.07, the IPO is priced at a Price-to-Earnings (P/E) multiple of approximately 16.5x at the upper end of the price band (₹117).

A key point for investors to note is that the company has stated in its prospectus that there are no listed companies in India that are engaged in the same business segment. This makes a direct P/E comparison with peers impossible. Investors will have to evaluate the valuation based on the company's own financial metrics and growth prospects.

A P/E of 16.5x for a company that has demonstrated such high profit growth appears reasonable on a standalone basis.

Industry Outlook

- Mother Nutri Foods operates in the growing global market for peanut butter.

- The company has a strong B2B model, supplying to a mix of domestic and international clients, including hypermarkets and retail chains in the UK, US, and Canada.

- A significant portion of its business comes from private labelling.

- The IPO funds will be used to set up a new manufacturing plant to cater to this rising demand and also to strengthen its own brand, "Spread & Eat."

What Are The Strengths and Risks of Mother Nutri Foods IPO?

Strengths:

- Explosive Profit Growth: The company has a proven track record of rapidly growing profits and expanding margins.

- Strong Client Relationships: Long-term relationships with a mix of domestic and international clients provide a stable revenue base.

- Experienced Promoters: The leadership team has about 10 years of experience in the food processing industry.

- Deleveraged Balance Sheet: A significant improvement in the company's debt-to-equity ratio.

Risks:

- History of Negative Operating Cash Flow: This is the single biggest red flag. The company has reported negative cash flow from operations for all of the last three financial years. This indicates that despite being profitable on paper, its core operations are burning cash.

- Raw Material Price Volatility: The business is highly dependent on the price of peanuts, which is a volatile agricultural commodity.

- Execution Risk: A large part of the IPO proceeds is for a new manufacturing facility, which comes with inherent execution and timeline risks.

- SME Segment Risks: The stock will be listed on the BSE SME platform, which typically has lower liquidity and higher price volatility compared to the mainboard.

What Are the Expert Recommendations – Should You Apply?

High Risk / Avoid

The Mother Nutri Foods IPO is a high-risk proposition where the impressive profit numbers are at odds with the alarmingly weak cash flow statement.

- For Risk-Averse Investors: AVOID. The chronic negative operating cash flow is a fundamental weakness that makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: While the valuation appears reasonable for a high-growth company, the underlying business is not generating cash. Betting on a turnaround in this fundamental metric is a very high-risk strategy.

- Our View: A company that is consistently profitable but burns cash is a risky investment. The disconnect between reported profits and actual cash generation is a major red flag that overshadows the attractive growth story. We recommend that investors avoid this IPO.

Key Takeaways

- IPO Price Band: ₹111 to ₹117 per share

- Lot Size: 1,200 Shares (Note: The minimum application for retail investors is for 2 lots or 2,400 shares, costing ₹2,80,800, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on December 3, 2025.

- Recommendations of experts: A high-risk issue. Best to avoid due to chronic negative operating cash flows, despite the attractive profitability numbers and reasonable valuation.

FAQs on Mother Nutri Foods IPO

What is Mother Nutri Foods IPO price band?

The price band for the IPO is set at ₹111 to ₹117 per equity share.

What is Mother Nutri Foods IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, December 1, 2025.

How to check Mother Nutri Foods IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

What is Mother Nutri Foods IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Wednesday, December 3, 2025.

Should I apply for Mother Nutri Foods IPO?

This is a high-risk proposition. Given the company's consistent inability to generate cash from its core operations, it is advisable for most investors to avoid this IPO, despite its strong profit growth.

Useful Links: Mother Nutri Foods DRHP

Disclaimer:

The information provided here is for general informational purposes only and should not be considered as financial advice. Please do your own research or consult a professional before making any investment decisions.