Updated on 24.11.2025 @ 14:57 PM

Ravelcare Limited, a D2C personal care brand operating under the brand name "Ravel," is launching its Initial Public Offering (IPO) on the BSE SME platform.

The subscription for this public issue will open on December 1, 2025, and close on December 3, 2025.

The company aims to raise up to ₹24.10 crores through a 100% fresh issue of shares.

The price band has been fixed at ₹123 to ₹130 per share, with a minimum lot size of 1,000 shares.

Find the information about all upcoming and live IPOs at a place.

Ravelcare has demonstrated explosive growth in its financial performance and is completely debt-free, but investors must be cautious of its recent negative operating cash flow.

In this article, you will find Ravelcare IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

If you're also exploring long-term wealth creation beyond IPOs, check out our Mutual Fund Learning Hub for simple guides and beginner-friendly lessons

Briefs of Ravelcare IPO Details

- Price Band: ₹123 to ₹130 per share

- IPO Open / Close Dates: December 1, 2025 – December 3, 2025

- Lot Size: 1,000 Shares

- Issue Size: 18,54,000 shares (aggregating up to ₹24.10 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Kfin Technologies Ltd.

- Listing Exchange: BSE SME

What is the Ravelcare IPO GMP Today?

- Note: The shares of Ravelcare are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

What Are The Ravelcare IPO Dates & Allotment Schedule?

- IPO Open & Close Date: December 1, 2025 – December 3, 2025

- Basis of Allotment Date: December 4, 2025

- Refund Initiation Date: December 5, 2025

- Credit of Shares: December 5, 2025

- Listing Date: December 8, 2025

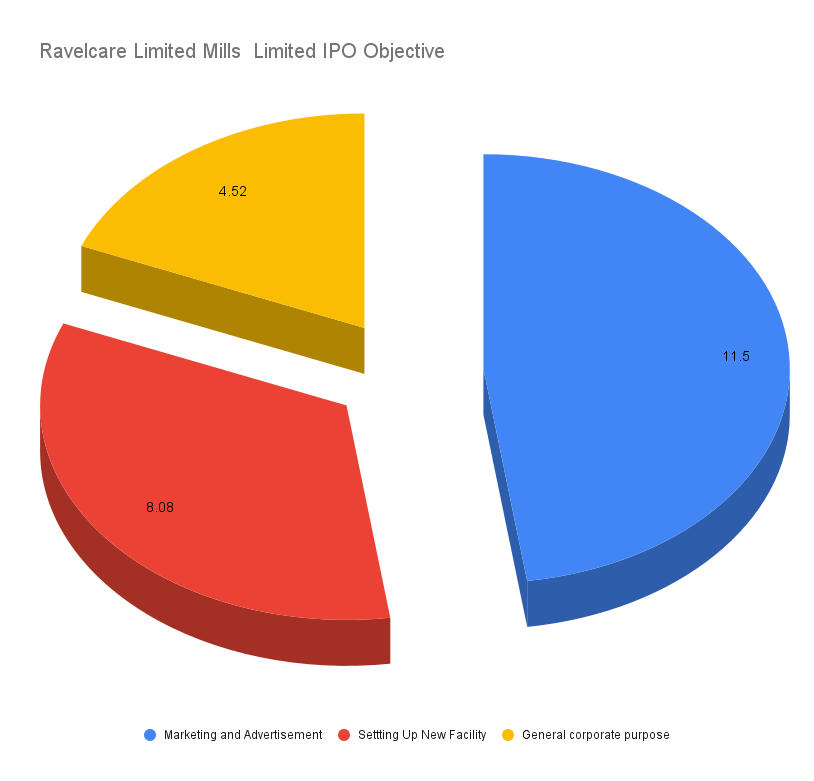

What Are The Objectives of Ravelcare IPO?

The company intends to utilise the net proceeds from the public offering for its brand building and a strategic shift in its business model:

- Marketing and Advertisement (₹11.50 Crores): A significant portion is allocated to enhance brand awareness and visibility to drive sales.

- Setting up a New Manufacturing Facility (₹8.08 Crores): This is a key strategic move. The company, which currently outsources all its manufacturing, plans to set up its own facility to gain better control over production and potentially improve margins.

- General Corporate Purposes: The balance amount will be used for other strategic requirements.

How is the Financial Performance of Ravelcare?

Financial Performance Indicators

Particular | Period Ended 31 Mar 2025 (₹ in Crores) | Period Ended 31 Mar 2024 (₹ in Crores) | Period Ended 31 Mar 2023 (₹ in Crores) | |

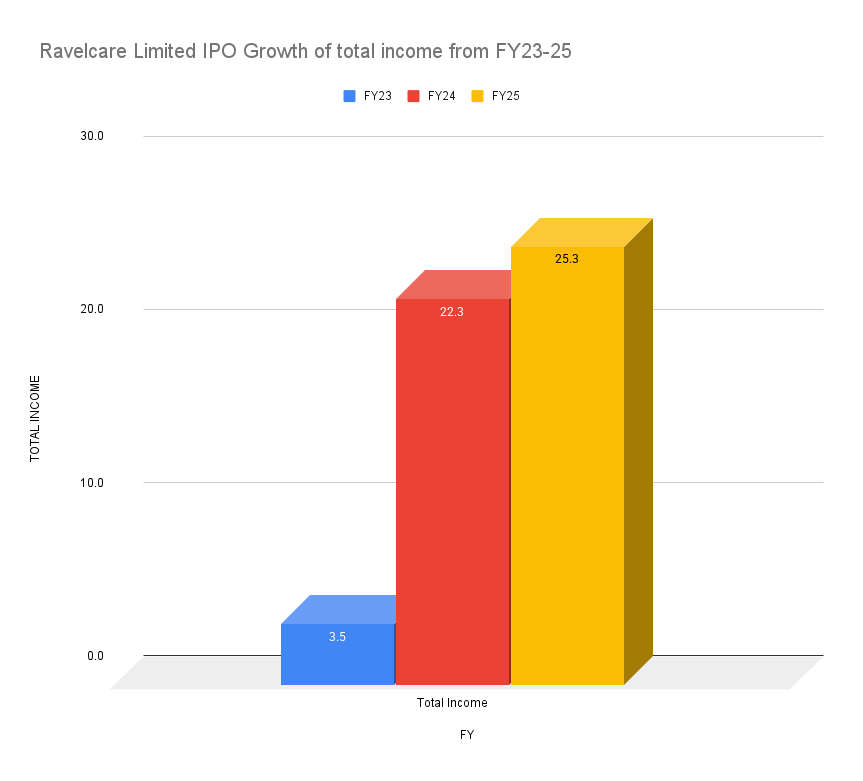

Total Income | 25.30 | 22.28 | 3.49 | |

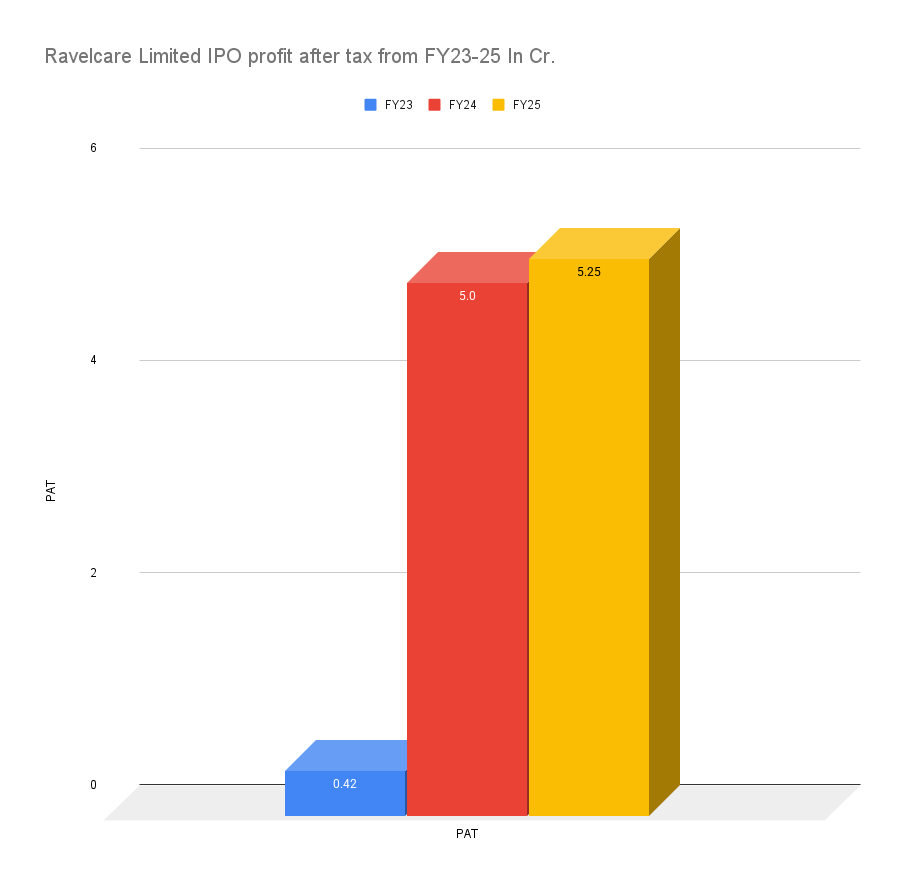

Profit After Tax (PAT) | 5.25 | 5.02 | 0.42 | |

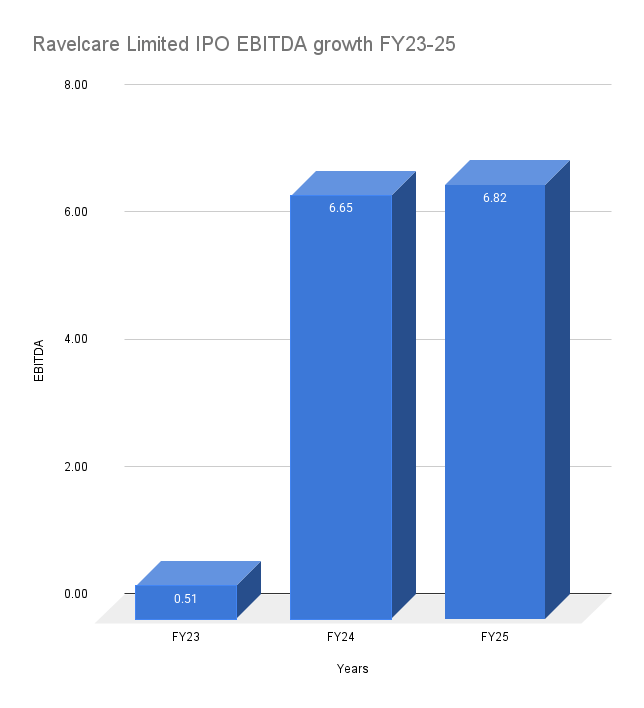

EBITDA | 6.82 | 6.65 | 0.51 | |

Net Worth | 10.34 | 5.10 | 0.07 | |

Reserves and Surplus | 5.34 | 5.09 | 0.07 | |

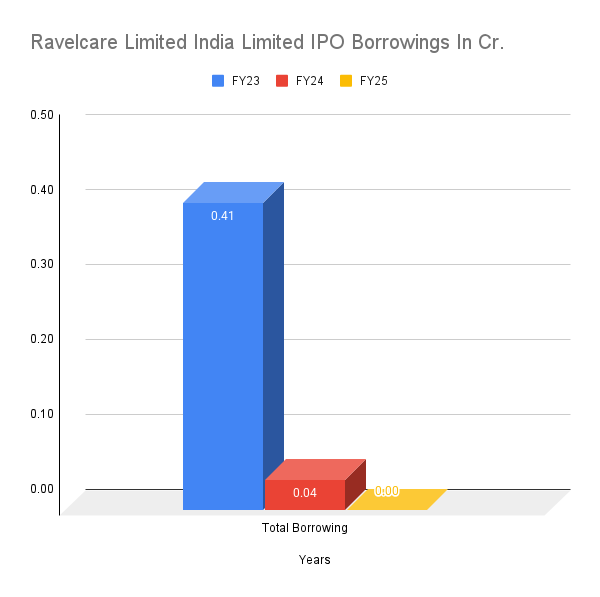

Total Borrowing | - (Nil) | 0.04 | 0.41 |

Source: RHP

Note: Figures may reflect minor rounding differences (figures were converted from amounts originally stated in Lakhs). Total Borrowings for March 31, 2025, are reported as nil.

Ravelcare has delivered an explosive growth story. The company's revenue has surged over 600% in two years.

The growth in profitability has been even more spectacular, with profit after tax (PAT) multiplying over 11 times in the same period.

A major highlight is that the company is completely debt-free. However, this impressive profit growth is countered by a key red flag: the company reported negative cash flow from operations in FY25.

Source: RHP

What is The P/E Ratio & Peer Comparison?

Based on its Fiscal Year 2025 earnings per share (EPS) of ₹10.48, the IPO is priced at a Price-to-Earnings (P/E) multiple of approximately 12.4x at the upper end of the price band (₹130).

A key point for investors is that the company has stated in its prospectus that there are no listed companies in India that are engaged in the same business segment and are of a comparable size.

This makes a direct P/E comparison with peers impossible. However, a P/E of around 12.4x for a debt-free D2C company that has demonstrated such high profit growth appears very attractive on a standalone basis.

Industry Outlook

- Ravelcare is a digital-first D2C brand in India's booming beauty and personal care market.

- The company sells its products, with a focus on haircare, primarily through its own website, which accounts for over 95% of its sales.

- This direct-to-consumer model allows it to have a direct relationship with its customers and control its branding and pricing.

- The IPO funds will be used for aggressive marketing to scale the brand and for a strategic shift from being a pure-play trading company to an integrated manufacturer.

What Are The Strengths and Risks of Ravelcare IPO?

Strengths:

- Explosive Financial Growth: The company has a proven track record of rapidly growing revenues and spectacular profit growth.

- Debt-Free Balance Sheet: A major positive, indicating strong financial health and no interest burden.

- High Profitability and Return Ratios: Exceptionally high PAT margins (over 20%) and RoE (over 67%) indicate a highly efficient and profitable business model.

- Attractive Valuation: The IPO is priced at a very reasonable P/E multiple of around 12.4x.

Risks:

- Negative Operating Cash Flow: This is the single biggest red flag. The company's inability to generate cash from its core operations in the latest fiscal year is a major concern.

- High Product Concentration: The business is heavily dependent on the sale of haircare products.

- Execution Risk: The plan to set up a new manufacturing facility marks a major shift in the business model and comes with significant execution risks.

- Dependence on a Single Contract Manufacturer: Currently, the company relies entirely on one third-party manufacturer, making it vulnerable to supply chain disruptions.

What Are The Expert Recommendations – Should You Apply?

Subscribe with Caution (For High-Risk Investors)

The Ravelcare IPO is a classic high-risk, high-reward proposition. The explosive growth, debt-free status, and attractive valuation are very tempting, but the underlying cash flow issue is a significant risk.

- For Risk-Averse Investors: AVOID. The negative operating cash flow is a fundamental weakness that makes this IPO unsuitable for conservative investors.

- For Aggressive Investors: This is a high-risk, high-reward bet on a D2C growth story. The financial numbers and valuation are too compelling to ignore. Investors would be betting on the company's ability to fix its cash flow problem as it scales.

- Our View: The IPO is a double-edged sword. The growth story is fantastic, and the pricing is very attractive. However, the negative cash flow is a major concern. We recommend a "Subscribe with Caution" rating, strictly for high-risk investors who understand and are comfortable with the company's working capital challenges.

Key Takeaways

- IPO Price Band: ₹123 to ₹130 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,60,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on December 8, 2025.

- Recommendations of experts: A high-risk issue. Subscribe with caution, suitable only for aggressive investors due to the negative operating cash flow, despite the attractive financials and valuation.

FAQs on Ravelcare IPO

What is Ravelcare IPO price band?

The price band for the IPO is set at ₹123 to ₹130 per equity share.

What is Ravelcare IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Thursday, December 4, 2025.

How to check Ravelcare IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

What is Ravelcare IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Monday, December 8, 2025.

Should I apply for Ravelcare IPO?

This is a high-risk proposition. While the company's financial growth is impressive and the valuation is attractive, its recent negative operating cash flow is a major risk.

A subscription is recommended only for investors with a high-risk appetite.

Important Resources:

1. SIP calculator in mutual funds- To get idea of how much you will accumulate over time.

2. Retirement Calculator- To get required retirement corpus.

Disclaimer:

Information on the Ravelcare IPO is for educational purposes only and not investment advice. GMP and details may change. Please do your own research. MrMoneyFrugal is not responsible for any financial decisions or losses.