Updated on 16.11.2025 @ 6:30 PM

Safecure Services Limited is set to launch its Initial Public Offering (IPO) on the BSE SME platform, opening on October 29, 2025. The company is seeking to raise ₹30.60 crores through a 100% fresh issue of shares. The issue is offered at a fixed price of ₹102 per share, with a minimum lot size of 1,200 shares. Safecure has demonstrated strong financial growth and boasts an attractive valuation, but investors must also consider the risks associated with its customer concentration and significant contingent liabilities. The Grey Market Premium (GMP) is yet to commence trading.

In this article, you will find Safecure Services IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

If you’re tracking multiple upcoming listings, don’t miss our detailed breakdown of the Lenskart Solutions Limited IPO – GMP, Price, Dates, and Allotment Review to compare performance trends and valuations.

Briefs Safecure Services IPO Details

- Price Band: ₹102 per share (Fixed Price)

- IPO Open / Close Dates: October 29, 2025 – October 31, 2025

- Lot Size: 1,200 Shares

- Issue Size: 30,00,000 shares (aggregating up to ₹30.60 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: MUFG Intime India Pvt.Ltd.

- Listing Exchange: BSE SME

You can explore more listings and analysis in our Latest IPO Updates section, where we cover detailed reviews, GMP movements, and allotment trends of ongoing issues.

What is Safecure Services IPO GMP Today ?

- Note: The shares of Safecure Services are not currently trading in the grey market. The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.

Listing Update Safecure Services Limited

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 102 | 81.6 | -20.0 |

What are Safecure Services IPO Dates & Allotment Schedule?

- IPO Open & Close Date: October 29, 2025 – October 31, 2025

- Basis of Allotment Date: November 3, 2025

- Refund Initiation Date: November 4, 2025

- Credit of Shares: November 4, 2025

- Listing Date: November 6, 2025

You may also want to check: Safecure Services LimitedIPO Subscription Status – Day 1, Day 2 & Day 3

What is the Objectives of Safecure Services IPO?

The company intends to utilise the net proceeds from the public offering for its growth and to strengthen its financial position:

- Repayment of Borrowings (₹7.00 Crores): To reduce its debt, which will lower finance costs and improve profitability.

- Working Capital Requirements (₹13.00 Crores): A significant portion is allocated to manage the company's operational needs and support its expanding business.

- General Corporate Purposes: The balance amount will be used for other strategic and day-to-day business requirements.

What is the Financial Performance of Safecure Services?

(Amounts in ₹ Crores)

Period Ended | 30 Jun 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

Assets | 39.9 | 37.33 | 30.89 | 28.8 |

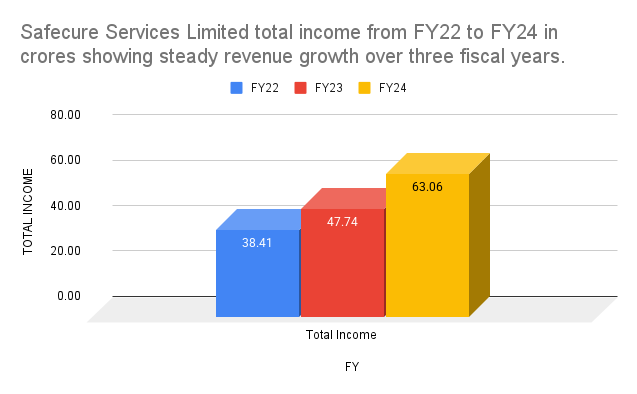

Total Income | 15.51 | 63.06 | 47.74 | 38.41 |

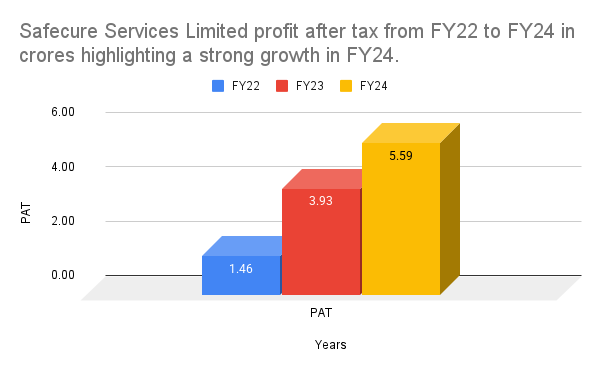

Profit After Tax | 1.52 | 5.59 | 3.93 | 1.46 |

EBITDA | 2.85 | 11.26 | 9.04 | 5.93 |

NET Worth | 16.51 | 15 | 9.33 | 6.9 |

Reserves and Surplus | 9.34 | 7.82 | 5.1 | 7.51 |

Total Borrowing | 15.38 | 14.3 | 11.51 | 12.66 |

Safecure Services has delivered a strong and consistent financial performance. Its revenue has grown at a healthy pace, but the real highlight is its impressive profitability. The company's profit after tax (PAT) has nearly quadrupled between FY22 and FY24. It also boasts high return ratios, with a Return on Equity (RoE) of 37.82% in FY24.

The IPO is attractively priced, with a P/E multiple of approximately 12.65x based on its FY24 earnings, which is a significant discount compared to its listed peers.

Source: BSE India

Investors often balance IPO allocations with mutual fund investments — check our Mutual Fund Hub to learn how SIPs and equity funds complement IPO investing.

Industry Outlook

- Safecure operates in the growing security and facility management industry in India.

- With increasing urbanization, a rising number of commercial and residential complexes, and a growing focus on safety and security, the demand for organized players in this sector is on the rise.

- Safecure’s diversified service portfolio, which includes physical security, e-surveillance of ATMs, and facility management, positions it well to cater to a wide range of clients, from banks and corporates to educational and healthcare institutions.

What are the Strengths and Risks of Safecure Services IPO?

Strengths:

- Strong Financial Growth: The company has a proven track record of robust revenue growth and a spectacular jump in profitability.

- Attractive Valuation: The IPO is priced at a significant discount to its listed peers, offering a potential valuation upside.

- High Return Ratios: Excellent RoE and RoCE indicate efficient use of capital and shareholder funds.

- Experienced Promoter: The company is led by a promoter with over 11 years of experience in the security services industry.

Risks:

- High Customer Concentration: This is a key risk. The top 10 customers contributed nearly 59% of revenue in the recent period, making the business highly dependent on a few large clients.

- Significant Contingent Liabilities: The company has contingent liabilities of approximately ₹4.36 crores, primarily related to tax and provident fund disputes. For a company of this size, these potential liabilities are substantial.

- Manpower-Intensive Business: Employee costs are the largest expense, and any significant increase in wages could impact profitability.

- SME Segment Risks: The stock will be listed on the BSE SME platform, which typically has lower liquidity and higher price volatility compared to the mainboard.

For more insights on how IPOs fit into broader wealth-building strategies, explore our Articles section — where we share guides on saving, investing, and growing money smartly.

What are the Expert Recommendations – Should You Apply?

Subscribe

The Safecure Services IPO presents a compelling investment opportunity, primarily due to its strong financial performance and very attractive valuation. While there are risks, the potential rewards appear to outweigh them.

- For Value Investors: The low P/E multiple of around 12.65x, which is a steep discount to peers like SIS and Krystal Integrated Services (trading at P/Es of 28x and 17.5x respectively), makes this a very attractive proposition.

- For Growth Investors: The company's impressive profit growth and high return on equity make it a strong candidate for investors seeking growth at a reasonable price.

- Our View: The combination of strong fundamentals and a bargain valuation is hard to ignore. Despite the risks, the IPO is well-priced and offers a good margin of safety. We recommend "Subscribe" for potential listing gains and long-term holding.

Planning your post-IPO investments? Try our SIP Calculator to estimate how consistent investing can help you grow wealth over time.

Key Takeaways

- IPO Price: ₹102 per share (Fixed Price)

- Lot Size: 1,200 Shares (Note: The minimum application for retail investors is for 2 lots or 2,400 shares, costing ₹2,44,800, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on November 6, 2025.

- Recommendations of experts: A "Subscribe" recommendation. The IPO offers a strong growth story at a very attractive valuation compared to its peers.

FAQs on Safecure Services IPO

1. What is Safecure Services IPO GMP today?

Currently, the GMP for the Safecure Services IPO is ₹0, as it has not yet begun trading in the grey market.

2. What is Safecure Services IPO price?

The issue price for the Safecure Services IPO is fixed at ₹102 per share.

3. What is Safecure Services IPO allotment date?

The allotment of shares is tentatively expected to be finalized on Monday, November 3, 2025.

4. How to check Safecure Services IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

5. What is Safecure Services IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Thursday, November 6, 2025.

6. Should I apply for Safecure Services IPO?

This is a recommended IPO. The company has demonstrated strong financial growth and is offered at a very attractive valuation compared to its listed peers, making it a compelling opportunity for both listing gains and long-term investment.

You may also want to check: Orkla India IPO GMP, Price, Dates, Allotment, Review

Disclaimer:

The information provided on this page about upcoming and ongoing IPOs, including GMP (Grey Market Premium), price band, allotment status, and other details, is for educational and informational purposes only.

mrmoneyfrugal.com does not provide investment advice or stock recommendations. Investors should conduct their own research or consult a qualified financial advisor before making any investment decisions.

While we strive to ensure the accuracy and timeliness of data, we do not guarantee completeness or reliability. Market conditions and figures (such as GMP or valuations) may change frequently.

mrmoneyfrugal.com and its team are not liable for any financial losses arising from investment decisions based on information presented here.