Updated on 02.12.2025 @ 11:30 AM

SSMD Agrotech India Limited, which operates under the popular FMCG brand "House of Manohar" (HOM), is launching its Initial Public Offering (IPO) on the BSE SME platform.

The subscription for this public issue will open on November 25, 2025, and close on November 27, 2025. The company aims to raise up to ₹33.80 crores through a 100% fresh issue of shares.

The price band has been fixed at ₹114 to ₹120 per share, with a minimum lot size of 1,000 shares.

Check all the upcoming and live IPOs at one place

While SSMD Agrotech has demonstrated spectacular growth in its financial performance, investors must be cautious of its very high customer and supplier concentration.

In this article, you will find SSMD Agrotech India IPO GMP today, subscription status, allotment date, price band, and a detailed, unbiased review to help you make an informed decision.

Check all the Grey Market Premium before listing at one place

Briefs of SSMD Agrotech India IPO Details

- Price Band: ₹114 to ₹121 per share

- IPO Open / Close Dates: November 25, 2025 – November 27, 2025

- Lot Size: 1,000 Shares

- Issue Size: 28,17,000 shares (aggregating up to ₹33.80 Crores)

- Fresh Issue / OFS: 100% Fresh Issue

- Registrar: Bigshare Services Pvt.Ltd.

- Listing Exchange: BSE SME

Listing Update.

| Type | Issue Price | Open | Gain/loss |

| Lisiting | 121 | 73 | -39.7 |

What is SSMD Agrotech India IPO GMP Today?

Check the GMP at a single place, GMP hub page.(The Grey Market Premium (GMP) is an unofficial indicator that reflects market sentiment and typically becomes active closer to the IPO opening date.)

What Are The SSMD Agrotech India IPO Dates & Allotment Schedule?

- IPO Open & Close Date: November 25, 2025 – November 27, 2025

- Basis of Allotment Date: November 28, 2025

- Refund Initiation Date: December 1, 2025

- Credit of Shares: December 1, 2025

- Listing Date: December 2, 2025

You can also explore our Mutual Funds Guide to Invest along with IPOs.

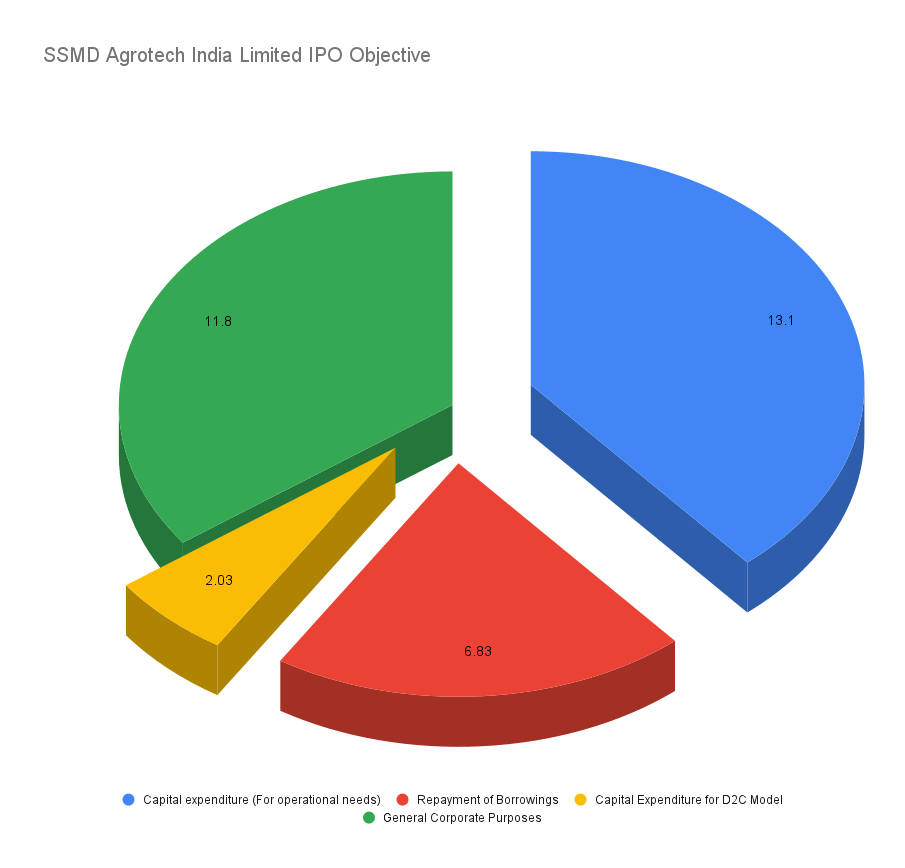

What Are The Objectives of SSMD Agrotech India IPO?

The company intends to utilise the net proceeds from the public offering for its expansion and to strengthen its financial position:

- Funding of Working Capital Requirement (₹13.10 Crores): To support its growing operational needs and manage its inventory and receivables.

- Repayment of Borrowings (₹6.83 Crores): To reduce its debt, which will lower finance costs and improve profitability.

- Capital Expenditure for D2C Model (₹2.03 Crores): To set up 16 new D2C (Direct-to-Consumer) dark store factories in the Delhi/NCR region.

- General Corporate Purposes: The balance amount will be used for other strategic requirements.

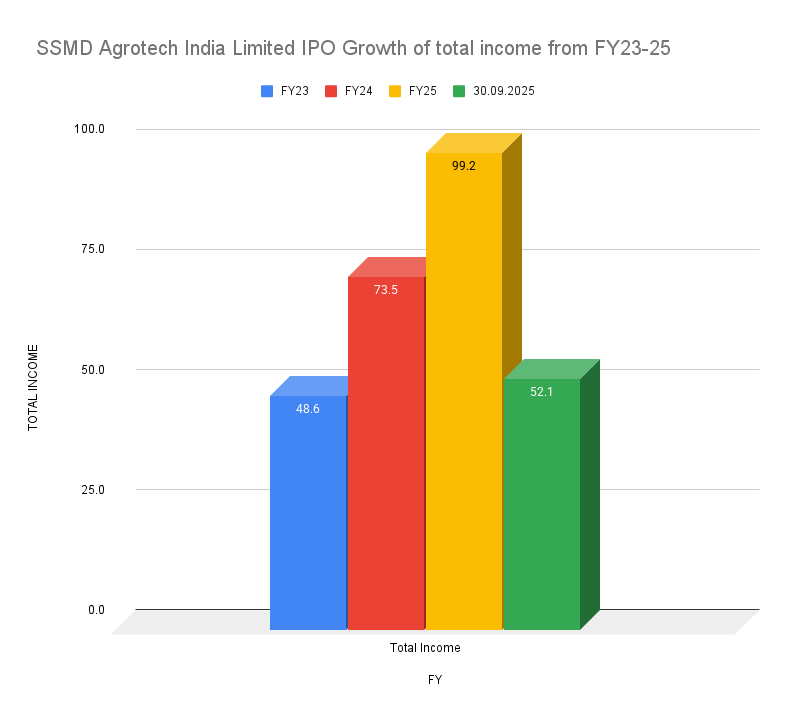

How is The Financial Performance of SSMD Agrotech India?

(Amounts in ₹ Crores)

Particulars | Period Ended 30 Sep 2025 | Financial Year Ended 31 Mar 2025 | Financial Year Ended 31 Mar 2024 | Financial Year Ended 31 Mar 2023 |

Total Income | 52.13 | 99.18 | 73.45 | 48.62 |

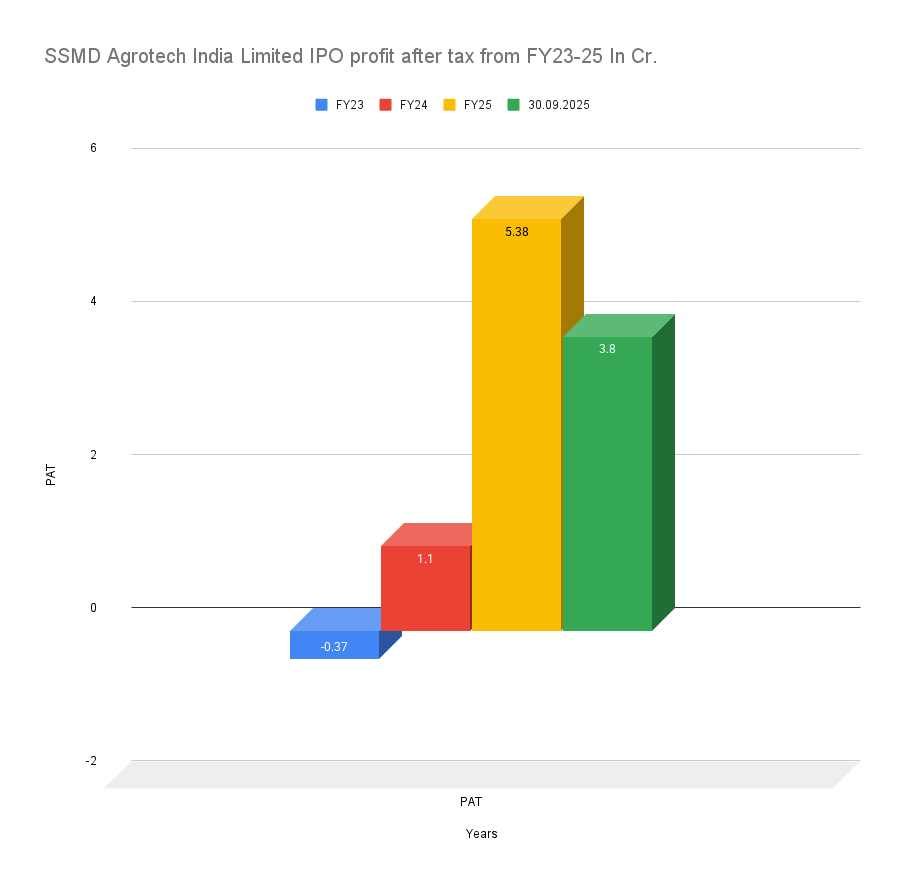

Profit After Tax (PAT) | 3.84 | 5.38 | 1.10 | (-0.37) (Loss) |

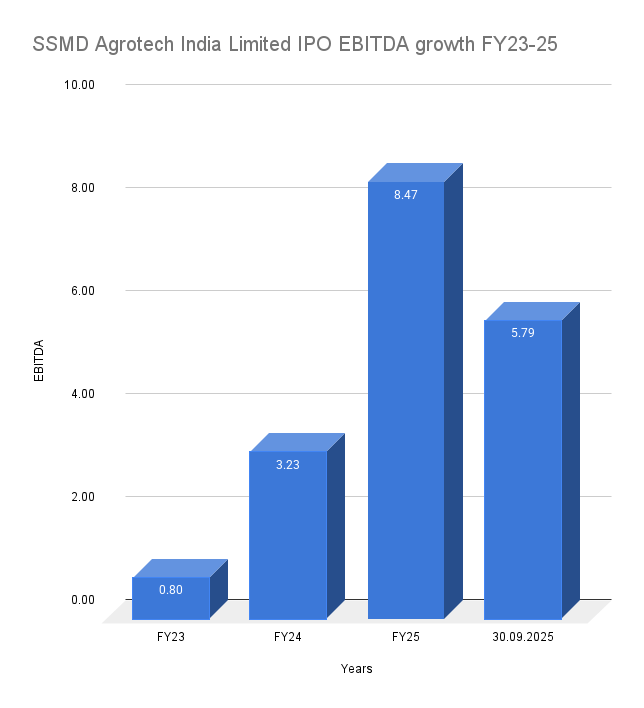

EBITDA | 5.79 | 8.47 | 3.23 | 0.80 |

NET Worth | 10.76 | 6.92 | 1.33 | 0.66 |

Reserves and Surplus | 4.91 | 6.39 | 0.02 | 0.00 |

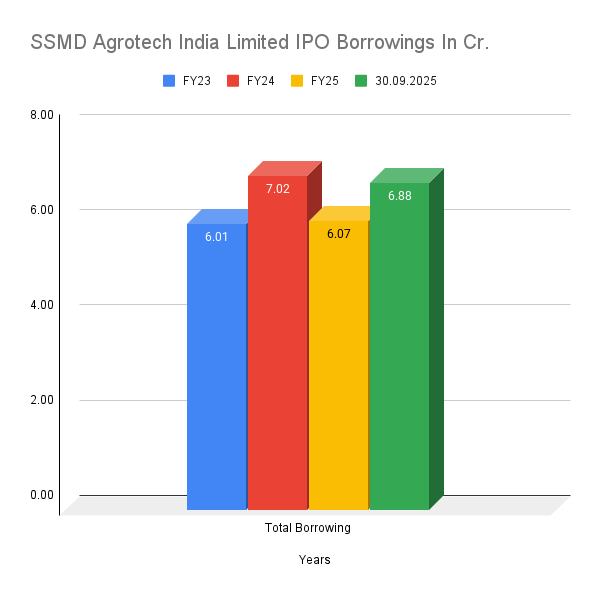

Total Borrowing | 6.88 | 6.07 | 7.02 | 6.01 |

SSMD Agrotech has delivered a spectacular financial turnaround and growth story.

After posting a marginal loss in FY23, the company has pivoted to strong profitability, with its profit after tax (PAT) surging to ₹5.38 crores in FY25. Its revenue has also more than doubled in the same period.

The company's margins have expanded significantly, and it has successfully deleveraged its balance sheet, with the debt-to-equity ratio improving dramatically.

What is The P/E Ratio and Who're It's Peers?

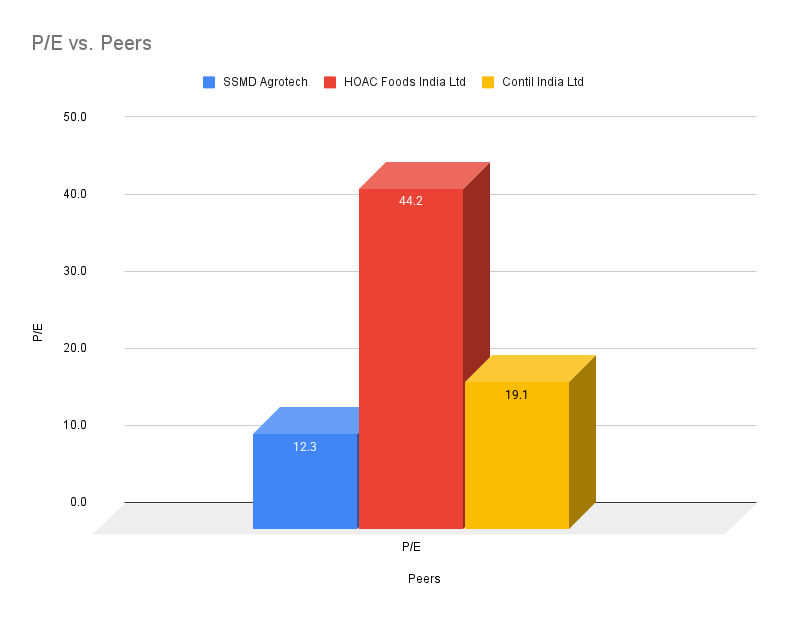

Based on its Fiscal Year 2025 earnings per share (EPS) of ₹9.74, the IPO is priced at a Price-to-Earnings (P/E) multiple of approximately 12.3x at the upper end of the price band (₹120).

P/E Ratio = ₹120 (Price) / ₹9.74 (Earnings Per Share)

P/E Ratio ≈ 12.32x

To understand if this valuation is attractive, we need to compare it to what the market is paying for similar listed companies. The company's prospectus identifies a few peers in the same industry.

| Company Name | P/E Ratio | Revenue (FY25, ₹ Cr) | RoNW (%) (FY25) |

SSMD Agrotech (at IPO price) | ~12.3x | ₹99.18 Cr | 78% |

| HOAC Foods India Ltd | 44.2x | ₹24.68 Cr | 21.82% |

| Contil India Ltd | 19.1x | ₹32.57 Cr | 18.16% |

(Note: Another peer, Jetmall Spices, was excluded from the main comparison as it is a loss-making company with negative ratios, making it an irrelevant benchmark.)

Analysis for Investors:

The comparison clearly shows that the SSMD Agrotech IPO is being offered at a significant valuation discount to its profitable listed peers.

- P/E Discount: Its P/E of ~12.3x is substantially lower than that of HOAC Foods (44.2x) and Contil India (19.1x), suggesting that the IPO is priced much more reasonably.

- Superior Performance: This discount becomes even more compelling when we consider that SSMD's financial performance is much stronger. Its Return on Net Worth (RoNW) at 78% is multiples higher than its peers, and it operates at a much larger revenue scale.

This combination of superior financial metrics at a lower valuation is the core reason why the IPO is considered attractively priced, providing a potential margin of safety for investors willing to take on the business risks outlined in the main article.

Industry Outlook

- Operating under the "House of Manohar" brand, SSMD Agrotech is a player in the resilient Indian FMCG sector.

- The company manufactures and trades essential food items like gram flour, pulses, puffed rice, and spices.

- A key part of its future strategy is the rollout of a "10-Minute Delivery Model" through its own D2C dark store factories, a move aimed at capturing the rapidly growing quick commerce market in urban areas like Delhi/NCR.

What Are The Strengths and Risks of SSMD Agrotech India IPO?

Strengths:

- Spectacular Financial Turnaround: The company has a proven track record of shifting from losses to explosive profit growth.

- High Profitability and Return Ratios: Exceptionally high RoNW (78% in FY25) indicates a highly efficient and profitable business model.

- Attractive Valuation: The IPO is priced at a very reasonable P/E multiple of around 12x, which looks attractive for a high-growth FMCG company.

- Innovative D2C Strategy: The plan to launch a quick commerce model through dark stores is a forward-looking move to capture modern consumer trends.

Risks:

- Extreme Customer and Supplier Concentration: This is the single biggest red flag. The top 10 customers contribute nearly 70% of the company's revenue, and the top suppliers account for over 76% of its purchases.

- Geographical Concentration: A majority of the company's sales are concentrated in Delhi and Uttar Pradesh, making it vulnerable to regional disruptions.

- Negative Cash Flows: The company has a history of negative cash flows from operations, indicating potential stress in its working capital management.

- Execution Risk: The success of the new D2C dark store model is unproven and comes with significant execution risks.

What Are The Expert Recommendations – Should You Apply?

Subscribe with Caution (For High-Risk Investors)

The SSMD Agrotech India IPO presents a classic dilemma: spectacular growth and attractive valuation versus a massive, underlying risk of business concentration.

- For Risk-Averse Investors: AVOID. The extreme dependence on a few clients and suppliers is a deal-breaker for any conservative investor.

- For Aggressive Investors: The financial numbers and valuation are too compelling to ignore. At a P/E of around 12x, the pricing is very attractive for a company with such high growth and margins. This is a high-risk, high-reward bet on the company's ability to retain its major customers and successfully execute its D2C strategy.

- Our View: The IPO is a double-edged sword. The growth story is fantastic, and the pricing is attractive. However, the concentration risk is equally potent. We recommend a "Subscribe with Caution" rating, strictly for high-risk investors who understand and are comfortable with the company's heavy reliance on its top clients and suppliers.

Key Takeaways

- IPO Price Band: ₹114 – ₹120 per share

- Lot Size: 1,000 Shares (Note: The minimum application for retail investors is for 2 lots or 2,000 shares, costing ₹2,40,000, which falls into the sHNI category).

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Tentative listing on December 1, 2025.

- Recommendations of experts: A high-risk issue. Subscribe with caution, suitable only for aggressive investors due to the extreme customer and supplier concentration risk, despite the attractive financials and valuation.

FAQs on SSMD Agrotech India IPO

What is SSMD Agrotech India IPO price band?

The price band for the IPO is set at ₹114 to ₹120 per equity share.

What is SSMD Agrotech India IPO allotment date?

The allotment of shares is tentatively expected to be finalised on Thursday, November 27, 2025.

How to check SSMD Agrotech India IPO allotment status?

You can check the allotment status on the website of the IPO registrar once the basis of allotment is finalized.

What is SSMD Agrotech India IPO listing date?

The company's shares are tentatively scheduled to be listed on the BSE SME platform on Monday, December 1, 2025.

Should I apply for SSMD Agrotech India IPO?

This is a high-risk proposition. While the company's financial growth is impressive and the valuation is attractive, its extreme dependence on a few clients and suppliers is a major risk. A subscription is recommended only for investors with a high-risk appetite.

Important Links:

1. Calculate how much money you need in your retirement through our easy to use retirement calculator.

2. Check our IPO Infographics page to learn more about IPOs in visuals and graphs.

3. How much your SIP can yield, calculate it through our SIP calculator.

4. Learn about how to make money passively through our blogging course.

5. Are you using AI to make money in 2025 and beyond, if not you're missing this opportunity, learn in this post how to make money through ChatGPT.

Disclaimer:

All information presented on this website, including IPO details, GMP, financial data, and analysis, is for general informational purposes only. While we strive for accuracy, we do not guarantee the completeness or reliability of the information. This content does not constitute investment advice. Always perform your own research or consult a SEBI-registered financial advisor before making investment decisions.