ULIP Mistake.

A mistake that taught me personal finance.

It was 2008. I had just completed 8 months working in a company. One day, the company asked all of us to submit our PAN card and investment proof — otherwise our next salary would not be credited.

In a hurry, I applied for a PAN card.

And in another super hurry, I bought a ULIP.

Back then, I couldn’t even recall the full name of ULIP.

This is based on my real-life experience of buying and holding a ULIP at a time when people were hardly talking about mutual funds and investments.

So, let us start now.

Why I Bought a ULIP in 2008 (Without Knowing What I Was Doing)

The Investment Environment in India Around 2008

In 2008, mutual funds were rarely discussed. People hardly invested in them, and at least till that time, I had not met anyone who was investing in mutual funds. Also, there was hardly any quality financial content available to learn from.

To be honest, I was also not very interested in learning about investments back then. But, now learning about mutual funds or new companies which are launching IPOs have been easy, you can check our detailed mutual fund learning platform which answers 100+basic mutual fund queries in easy way and for the IPO related information you can track our regularly updated IPO calendar.

The most known and favoured investment options were Kisan Vikas Patra (KVP), Public Provident Fund (PPF), LIC policies, and fixed deposits (FDs).

People were heavily dependent on agents to make investments. And the agents mostly wanted to get more people to subscribe to their products. They were often over-promising returns to earn handsome commissions and hyping their products over others.

Also, the Sensex had touched 21,000 for the first time, so people looked more confident and believed the agents even more. Nobody wanted to miss the gains. As a result, people started blindly believing whatever the agents said.

What My ULIP Agent Promised Me

The ULIP agent promised me that I would get ₹10 lakh in 10 years, along with tax benefits and life insurance. ₹10 lakh was a huge amount for me back then, and it immediately got my attention. Insurance and tax benefits looked like extra advantages that I felt I should not miss.

He looked very confident and extremely positive. At that time, I couldn’t stop myself from believing him.

My Financial Knowledge Level Back Then

I had almost zero financial knowledge. I did not even know that something called a ULIP existed, forget about understanding how to evaluate it. I had no idea about expense ratios, administrative charges, or asset allocation of funds.

I didn’t know how to read an offer document. In fact, I never even thought of reading it because it was too lengthy, filled with technical English that I could barely understand.

So, no comparison was done. Whatever the agent told me, I simply agreed and signed the documents, making my first-ever investment a ULIP.

What I Thought a ULIP Was vs What It Actually Turned Out to Be

My Assumptions Before Buying a ULIP

I believed whatever the agent told me. And why should I not have believed him? He was promising attractive and seemingly guaranteed returns. Also, he was not just an agent but my colleague too.

At the same time, I did not even know what questions I should ask to properly assess a ULIP.

The Reality I Discovered Years Later

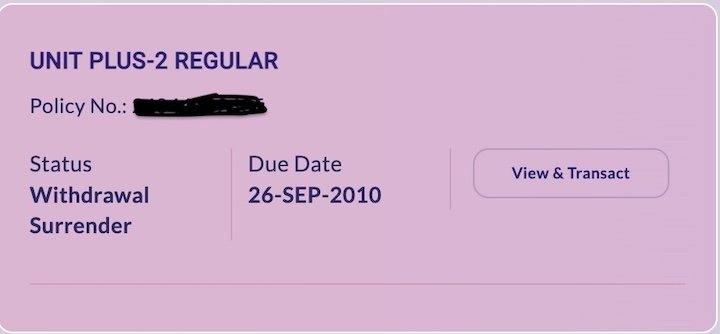

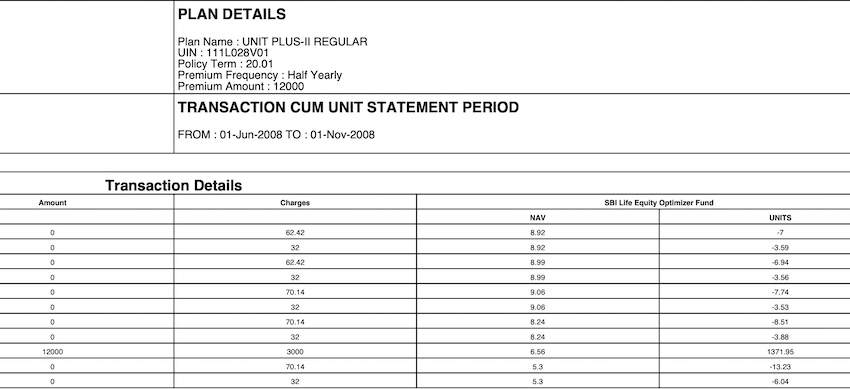

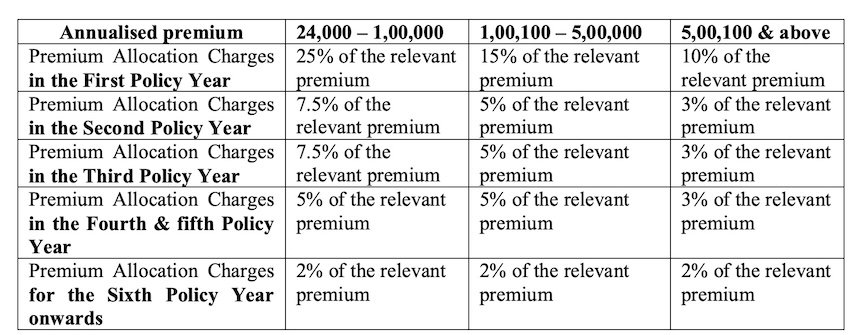

After some time, when I checked the account statement, I noticed something disturbing. While I had paid ₹12,000 as a half-yearly premium, the charges deducted were ₹3,495.26, which was close to 29.13% of the premium paid. The charges included for 24000-100000 Rs premium are:

Screenshot

1. Premium Allocation Charges:

In the 1st policy year, 25% of the premium was deducted.

In the 2nd and 3rd policy years, the charge was 7.5%.

In the 4th and 5th policy years, it reduced to 5%.

From the 6th policy year onwards, the charge was 2%.

2. Policy Administration Charges:

Around 2% per year was deducted as policy administration charges.

3. Fund Management Charges:

1.5% per year, applicable to the equity optimizer fund, which I was invested in.

Apart from these, there were several other charges such as mortality charges, rider charges, switching charges, and even surrender charges.

So, only ₹8,504.74 was actually invested to buy units. When I realised this, it felt unbelievable.

You can see this clearly in the account statement of my first premium. Anyone looking at it can understand what went wrong.

When I finally understood this, the first thought that came to my mind was that I had been cheated. That was when I actually went back and read the policy document — and I was shocked to see the list of charges mentioned there. You can also see these charges in the table below.

Why ULIP Returns Looked Disappointing

While the market was slowly improving, the same was not reflected in my ULIP account statement. Out of my total premium paid of ₹12,000, the value shown was less than ₹8,000.

Most of the money had been eaten up by charges, and some part was also affected by poor fund performance. This was the time when I was emotionally disturbed.

A constant thought kept coming to my mind — why did I not look into this before buying the ULIP?

I did not like the product anymore, and I started planning how to get rid of it.

The Biggest Lesson ULIP Taught Me – Never Mix Insurance With Investment

I learnt a very important lesson from my ULIP purchase.

ULIPs are often advertised as Insurance + Equity or Insurance + Tax Saving products.

But are they really efficient?

I personally found that they were not.

And here is why.

Did My ULIP Fulfil My Insurance Needs?

No. I was getting ₹2.4 lakh of life insurance coverage. Was that enough? Absolutely not.

There are much better plans available that can offer significantly higher insurance coverage with a relatively small premium.

Are ULIPs Good Equity Products?

No. At the same time, many mutual funds have delivered better returns.

In fact, if I had continued with my ULIP, I would have earned only around 10.2% CAGR, while my mutual fund portfolio has delivered much better returns over the long term.

Are ULIPs Good Tax-Saving Products?

Not really. Purchasing ULIPs only for tax-saving purposes is not an efficient option.

So, ULIP as a bundled product of insurance, equity, and tax saving does not deliver any of these effectively.

Why Insurance Should Be Pure Protection

I eventually learnt about term insurance plans and how I could get much better coverage along with more flexibility.

This is the reason that after surrendering my ULIP, I purchased a term insurance plan.

Why Investments Need Simplicity and Transparency

Around the same time, I opened a demat account and got access to multiple mutual fund schemes through a single platform. It made investing much easier and less stressful, as I could track, invest, and transact from the same platform.

How This ULIP Mistake Shaped My Future Investment Decisions

While I bought the wrong product — a ULIP, it ended up changing my life.

I realized for the first time that financial knowledge is not optional.

I had to learn it.

I understood the importance of reading product documents so that I could understand a product closely. If I had read the document and asked about the charges, I might not have bought the product in the first place.

I could have gone through various charges like surrender charges, mortality charges, and several other hidden costs. Maybe I would not have understood everything at that time, but I could have asked the agent and at least tried to learn.

After buying the ULIP and slowly learning from that mistake, I decided to plan my finances differently.

Moving to Term Insurance for Risk Coverage

I learnt about term insurance plans which provide much higher insurance coverage at a very low premium.

I eventually purchased a ₹41 lakh term insurance plan for an annual premium of around ₹7,000. It may not sound impressive today, but back then there were limited options, and it felt extremely affordable to me. This single decision gave me a lot of mental relief.

Looking back, I realize that I might not have understood the value of term insurance if I had not gone through my ULIP experience.

Switching to Mutual Funds for Long-Term Wealth Creation

I then started learning about equity mutual funds. I compared returns and found that many funds had delivered 15%+ CAGR over the last 10 years. Compared to ULIPs, mutual funds were simpler to understand and did not come with so many layered charges.

Another important realization was that I could start investing with as little as ₹500 through SIPs, which was not possible with ULIPs.

That is how I started my first SIP with ₹500.

I have already written in detail about this journey, explaining how I turned a ₹500 SIP into a ₹1 crore corpus over 11 years.

ULIP vs Mutual Funds – What I Wish I Knew in 2008

Back in 2008, I neither knew much about ULIPs nor about mutual funds. But when I later learnt about them, I found out that there is a huge difference between the two. Not only in terms of charges, but also in long-term returns.

Some of the noteworthy differences between them are:

- ULIPs come with a number of charges, so the amount you pay as a premium is very different from what actually gets invested. You can see in the above section that while my premium was ₹12,000, only around ₹8,500 was actually invested, and the remaining amount was spent on charges.

- ULIPs come with a lock-in period. You cannot withdraw whenever you want, unlike mutual funds where you can make withdrawals, except ELSS funds which come with a lock-in period.

- Buying ULIPs was not direct back then, while mutual funds could be purchased directly from registrars or through a demat account, making them easier to invest in.

- In mutual funds, you can stop or pause your SIP and restart it whenever you feel comfortable, but in the case of ULIPs, this flexibility is missing. You can calculate how much you can accumulate through SIP investing in our easy sip calculator.

- You can easily track the NAVs of mutual funds through various platforms, unlike ULIPs where tracking and transparency are limited.

- ULIPs have surrender charges, while mutual funds do not have such charges.

- Mutual funds come with direct plans, where charges are even lower than regular plans, while in ULIPs there is no option to reduce charges. I will also cover the benefits of direct plans over regular plans of mutual funds in another detailed post.

Which Is Better for Long-Term Investors: ULIP or Mutual Funds and Why?

For long-term investors, or for any investor, mutual funds are a far better option than ULIPs. In my personal experience, ULIPs do not justify themselves as a product to build long-term wealth, fulfil insurance needs, or even meet tax-saving requirements.

They are heavy on charges and complex in nature, and they are also not flexible in terms of entry and exit from the scheme. I do not see any tangible benefit of being a ULIP subscriber.

Personally, I celebrate my exit from my ULIP, and that is the reason I call it my ULIP mistake.

Common ULIP Mistakes First-Time Investors Still Make Today

I still see a lot of people who have ULIPs, and most of them don’t appreciate having them. Those who are neutral are usually the ones who have not gone through the ULIP documents or are unaware of the charges and returns compared to mutual funds.

Here are a few common mistakes which I think most new investors still make:

Not reading the offer document of the ULIP plan.

Even if they read it, they do not read it carefully.

Believing agents blindly and buying based on promises without second thoughts.

Not knowing about other flexible investment options like term insurance, equity mutual funds, and tax-planning products.

Not spending time improving financial knowledge and relying only on relatives and colleagues.

Not checking or comparing the performance of the ULIP.

Taking prompt decisions after learning the reality of ULIPs.

Not doing basic mathematics of returns. I was told that I would get ₹10 lakh on maturity, but I did not calculate how much premium I would pay or what the actual return would be.

These are the common mistakes based on my own experience of buying a ULIP and surrendering it after 3 years.

Should You Continue, Exit, or Avoid ULIPs Today?

When you learn the reality of a ULIP, there is no need to take any decision in a hurry. You should go through the offer document, understand the charges, and compare the returns with mutual funds. You should also think about why you bought it in the first place.

If you bought it just on the recommendation of relatives, you already know what to do. If you bought it for tax planning or insurance needs, then you should invest in better products that actually fulfil those requirements.

What New Investors Should Do Instead of ULIPs

If you have reached here without buying a ULIP, then you have narrowly escaped. There are better products available.

For insurance, you can choose a term insurance plan which gives much better coverage.

For long-term wealth creation, you can analyse and invest in equity mutual funds.

For tax saving, you can choose ELSS mutual funds or other options based on your needs.

This is exactly what I did after exiting my ULIP. I bought a term insurance plan with ₹41 lakh coverage. I started investing in mutual funds through SIPs and chose ELSS funds for tax saving. This helped me significantly improve my financial life.

I believe you now have a better idea of whether ULIPs suit you or not. If you have doubts, you can reflect on your own situation and experiences.

Frequently Asked Questions About ULIP Mistakes

Is ULIP a Bad Investment?

I can’t say that ULIPs are bad investments. But they did not fit my requirements. I found them complex in nature. They try to provide tax saving, equity investing benefits, and insurance in a single product, but in my experience they fail to deliver any one of these efficiently.

Can ULIPs Help in Long-Term Wealth Creation?

Based on my own experience, ULIPs did not work well for long-term wealth creation when compared with mutual funds.

When I reviewed my ULIP plan, even if I continued it until 2025, the expected return would be around 10.2% CAGR. In the same period, my mutual fund portfolio generated over 17% CAGR.

For example; An investment of ₹1,000 in a ULIP in 2008 would have grown to approximately ₹5,200 by 2025. However, the same ₹1,000 invested in mutual funds during the same period could have grown to around ₹14,400.

Is ULIP Better Than Mutual Funds?

ULIP and mutual funds are two different products. One primarily provides participation in equity, while the other tries to do three things at once. It may depend on individual requirements.

However, if we compare the charges associated with both, ULIPs lag behind mutual funds. And if we compare returns, many mutual funds have delivered far better returns than ULIPs over the long term.

So, if you want an all-in-one product that offers tax saving, equity exposure, and insurance with low to moderate returns, you may choose a ULIP. But if your goal is to generate higher long-term returns and you are willing to take some risk, mutual funds offer a better option.