Chennai-based logistics specialist Glottis Limited is set to launch its initial public offering (IPO), opening for subscription on September 29, 2025. The company, which has a strong focus on the renewable energy supply chain, aims to raise a total of ₹307 crores. The issue comprises a fresh issue of shares worth ₹160 crores and an Offer for Sale (OFS) of up to ₹147 crores by its promoters. The price band is fixed at ₹120 to ₹129 per share, with a lot size of 114 shares. Initial market buzz is cautious, primarily due to a significant GST notice and a large promoter stake sale.

In this article, you will find Glottis Limited IPO GMP today, subscription status, allotment date, price band, and a detailed review.

Glottis Limited IPO Details

- Price Band: ₹120 – ₹129 per share

- IPO Open / Close Dates: September 29, 2025 – October 01, 2025

- Lot Size: 114 Shares

- Issue Size: ₹307 Crores (Fresh Issue of ₹160 Cr + OFS of ₹147 Cr)

- Fresh Issue / OFS: Both

- Registrar: Kfin Technologies Ltd

- Listing Exchange: BSE & NSE

Also learn about:Initial Public Offers: IPO Reviews of India

Glottis Limited IPO GMP Today

- Note: The Grey Market Premium (GMP) for Glottis Limited has not yet started. GMP is an unofficial market indicator and changes frequently based on market sentiment and subscription figures.

Glottis Limited IPO Dates & Allotment Schedule

- IPO Open & Close Date: September 29, 2025 – October 01, 2025

- Basis of Allotment Date: October 3, 2025

- Refund Initiation Date: October 6, 2025

- Credit of Shares: October 06, 2025

- Listing Date: October 7, 2025

Check : Glottis Limited IPO Subscription Status – Day 1, Day 2 & Day 3

Glottis Limited IPO Allotment Status – How to Check Online

Objectives of Glottis Limited IPO

The net proceeds from the Fresh Issue will be utilised for:

- Capital Expenditure (₹53 Crores): To purchase commercial vehicles, reducing dependency on third-party transport.

- Debt Repayment (₹38 Crores): To become a leaner, more financially robust company.

- General Corporate Purposes (₹69 Crores): To fund working capital needs and other business requirements.

- Note: The proceeds from the Offer for Sale (OFS) component of ₹147 crores will go directly to the selling promoters and will not be received by the company.

Also check: Om Metallogic IPO GMP, Price, Dates, Allotment, Review

Zappfresh IPO GMP, Price, Dates, Allotment, Review

Ameenji Rubber IPO GMP, Price, Dates, Allotment, Review

Financial Performance of Glottis Limited

(Amounts in ₹ Crores)

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 156.1 | 81.72 | 72.08 |

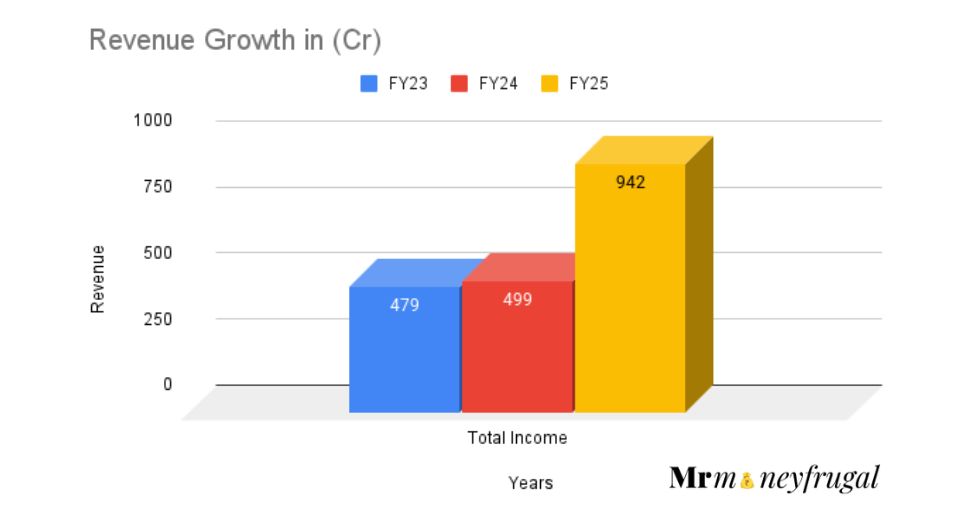

Total Income | 942.55 | 499.39 | 478.77 |

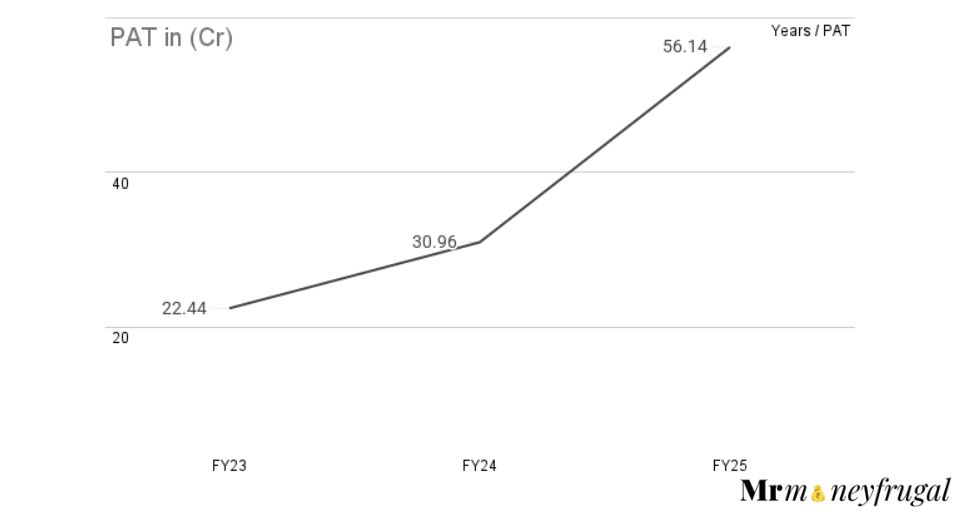

Profit After Tax | 56.14 | 30.96 | 22.44 |

EBITDA | 78.45 | 40.36 | 33.47 |

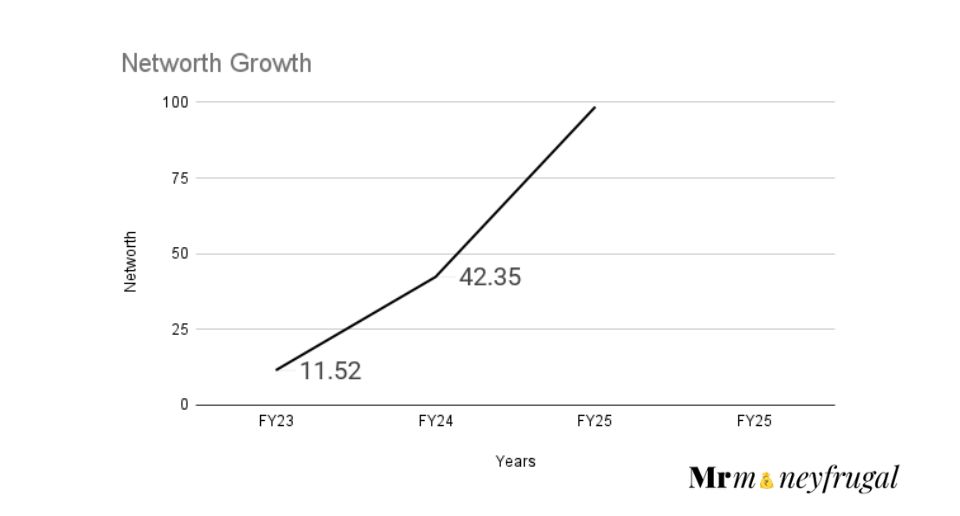

NET Worth | 98.53 | 42.35 | 11.52 |

Reserves and Surplus | 82.53 | 41.35 | 10.52 |

Total Borrowing | 22.14 | 8.08 | 30.61 |

Glottis Limited's financials tell a story of volatility and recent recovery. Profit after tax (PAT) for the fiscal year ending March 31, 2025, compared to the fiscal year ending March 31, 2024, was 81% higher for Glottis Ltd., while revenue was up 89%.

Despite a flat revenue in FY24, the company's profit grew by a strong 40%, indicating better cost management. A major positive is the significant reduction in debt, which has strengthened its balance sheet considerably.

Industry Outlook

- The company operates in the Indian freight forwarding market, a sector poised for strong growth.

- According to a company-commissioned report, the market is expected to grow from $10.1 billion to $17.0 billion by FY29, a CAGR of nearly 11%.

- This growth is fueled by India's infrastructure push, the 'Make in India' initiative, and the National Logistics Policy.

- Glottis's specialisation in the renewable energy sector places it in a high-growth niche within this larger industry.

Strengths and Risks of Glottis Limited IPO

Strengths:

- Niche Market Leader: Strong positioning in the high-growth renewable energy logistics segment.

- Asset-Right Model: Allows for scalability and capital efficiency without heavy investment in assets.

- Improved Balance Sheet: Significant debt reduction has de-risked the company's financials.

- Improving Margins: Profitability has shown a positive trend despite revenue volatility.

Risks:

- Major GST Litigation: The company faces a massive GST demand notice of ₹127.37 crores. This is a huge red flag, as an adverse ruling could cripple the company's finances.

- High Customer Concentration: The top 10 customers account for nearly 44% of revenue, making the business vulnerable to losing a key client.

- Large Promoter OFS: The promoters are selling a stake worth ₹147 crores, which is almost as large as the fresh issue. This can be seen by investors as promoters cashing out at a high valuation.

- Cyclical Business: Revenue is heavily dependent on volatile global freight rates and the cyclical nature of the renewable energy sector.

Want to explore other investment options? Check out our detailed guide on ELSS Mutual Funds to diversify your portfolio

Expert Recommendations – Should You Apply?

High Risk / Avoid

The Glottis Limited IPO comes with serious red flags that are hard to ignore. While the business operates in a promising sector and has improved its profitability, the risks are substantial.

- For Risk-Averse Investors: AVOID. The ₹127 crore GST notice is a major Sword of Damocles hanging over the company. This, combined with the high valuation (P/E of ~38x) and the large promoter stake sale, makes it unsuitable for conservative investors.

- For Aggressive Investors: APPLY WITH EXTREME CAUTION. Only investors with a very high-risk appetite, who believe the GST issue will be resolved favourably and are confident in the long-term story of renewable energy logistics, should consider this IPO. The valuation appears rich compared to established peers.

- Our View: The risks, particularly the GST litigation, far outweigh the potential rewards at this valuation. A "wait and watch" approach is the most prudent strategy.

Key Takeaways

- IPO Price Band: ₹120 – ₹129 per share

- Lot Size: 114 Shares (Minimum Investment: ₹14,706)

- GMP Today: ₹0 (Not trading)

- Allotment & Listing Dates: Allotment on Oct 3, Listing on Oct 7, 2025.

- Recommendations of experts: High Risk. Best to avoid for most retail investors due to the massive GST notice and rich valuation.

FAQs on Glottis Limited IPO

1. What is Glottis Limited IPO GMP today?

As of now, the Grey Market Premium (GMP) for the Glottis Limited IPO is ₹0, as it has not yet begun trading.

2. What is Glottis Limited IPO price band?

The price band for the IPO is set at ₹120 to ₹129 per equity share.

3. What is Glottis Limited IPO allotment date?

The tentative date for the allotment of shares is Wednesday, October 3, 2025.

4. How to check Glottis Limited IPO allotment status?

You can check the allotment status on the official website of the IPO registrar once the basis of allotment is finalised.

5. What is Glottis Limited IPO listing date?

The shares are expected to be listed on the BSE and NSE on Monday, October 7, 2025.

6. Should I apply for Glottis Limited IPO?

Given the significant red flags, including a ₹127 crore GST demand notice, a high valuation, and a large promoter stake sale, it is advisable for most retail investors to avoid this IPO. It is a high-risk proposition.

IPO Disclaimer:

"The information provided in this article is for informational purposes only and does not constitute financial advice or an investment recommendation. All IPO details, including Grey Market Premium (GMP), expected listing price, and subscription data, are estimates based on publicly available information and market trends. Investors should conduct their own research and consult a qualified financial advisor before making any investment decisions. The website or author is not responsible for any gains or losses incurred from investing in the IPO."