18–20 min reading time.

This is a real investing journey that was originally shared on Reddit, where it sparked a detailed discussion among long-term SIP investors. Read the Reddit discussion.

₹500 SIP to ₹1 Crore

Back in 2010, this was only a dream for me. Honestly, I never imagined that a small SIP of just ₹500 could turn into something this big over the years.

This journey was not easy.

It had many ups and downs. It was full of mistakes, slow years, self-doubt, learnings, and confusions. But at the same time, it was also full of experiences that taught me things no book ever could.

This is my real story.

I have lived every moment of it, and it has shaped my financial life in ways I never expected.

Everything shared here is from my own experience.

Let’s start from the beginning.

How My ₹500 SIP Journey Started in 2010

What My Financial Life Looked Like in 2010

Living Paycheck to Paycheck

The first job is very important for anybody, and so it was for me. I got my first job in July 2007 in a steel company in Karnataka. I still remember the excitement when I got my first salary. It was a wow moment.

The total take-home salary was ₹22,000. And it was a large sum for me.

Back then, I only knew one thing: how to spend it as early as possible.

Forget about investing; neither did I have any knowledge about it nor was I interested in it. Also, who cares when you have never earned anything and suddenly your account is filled up with a large amount of money?

By the 20th of the month, all the money was gone, and I had no clue where it had gone.

Again, the same boring days arrived, thinking about when the next pay would come so that I could repeat the same cycle.

The Fear After the 2008 Recession

In the meantime, the great recession of 2008 came. Everybody was losing jobs, and those who still had jobs were in fear of losing them at any time.

And in this cycle, almost 30 months were gone. I got married in 2009, right at the peak of the recession, and 2010 arrived.

I had no investments. And neither I nor any of my friends or colleagues had investments in equity or stocks. We were all very much in fear of losing money because the impact of the recession was so high that nobody was talking about investing in stocks or mutual funds.

I had no long-term plan; in fact, I never thought about long-term financial goals at all. You can learn about basics of mutual funds in our 100+questions and answers segment on mutual funds which answers all the basic questions on mutual funds. You can also learn about key details of IPOs which are another investment vehicles in our IPO calendar which lists out all the upcoming and live IPOs.

The ULIP Mistake

Some money I invested in a ULIP in 2008 eventually became a liability for me. I wanted to get out of it, but it was at a loss, so I decided to wait before I surrendered.

Why I Started SIP With Just ₹500

By now, I had already spent around 2.5 years working. I had no investments. I was married, and soon I was going to be a father. I knew that I was doing very poorly financially.

These things were making me low. I did not know what to do. My colleagues were also not talking about investments, and whenever I talked to them, their responses were always neutral. So, I started searching on Google, trying to find a way out.

Discovering SIP

Finally, I came across some good blogs where I first learnt about SIP.

I learnt the benefits of SIP, and these ideas immediately drew my attention. I started searching for more information and learnt that anyone can accumulate good money if they invest a small sum in a disciplined way for a long time.

So, I laser-focused on SIP.

I planned to start my first SIP with just ₹500 because that was the amount I could easily afford to invest every month without pressure and without needing to cash out.

I opened a demat account (back then, buying directly through AMC websites was not very common, and I wasn’t sure whether I could invest directly or not).

And I started my first SIP in 2010 — the first step toward becoming a crorepati in the next 11 years.

I felt relaxed; it looked like I had done something very important in my life. And today, I can confidently say that starting SIP with only ₹500 was one of the most important steps I took to improve my financial life.

Early SIP Mistakes I Made (That Most Beginners Still Make)

When you start something new, you often make a lot of mistakes. The reason is you’re in the early learning phase. And I too did this. And I think this is common.

But you can always turn those mistakes into your learning experience.

Holding too many funds

I did not know about diversification. So, when I started investing in a fund, it excited me, and I wanted to invest in some more funds. And slowly, I found out that I was investing in more than 8–9 funds.

Back then, I also had a very bad habit of checking NAV daily. Even after investing for a few months, I started tracking the NAV every day. AMFI India became my daily visiting website. Every day after 8 PM, on market days, I was waiting for the NAV to be updated so that I could check my fund holdings.

And soon, I realised that I had too many funds, and I was just wasting my precious time, which I could use in learning rather than just waiting for NAV daily.

Chasing Returns of the Funds

I was comparing funds purely based on returns. And one thing I acknowledge is that back then I did not even know what a large-cap fund, mid-cap fund, or small-cap fund was. I was only buying the funds which had delivered good returns in the previous year.

Fearing Market Downs

Every day when the Sensex or Nifty closed below the last closing point, I felt fearful. I just could not see my NAV going down. I was always worried whenever someone even rumoured that the market would go down. I just wanted to get out of my little holdings during those moments.

But later, I realised that NAV going down is actually a good thing because with lower NAVs, I could buy more units.

Self doubt

I was always trying to start conversations with my colleagues about funds and stocks, only to know whether they were investing.

And when I heard that they were not investing because markets are never stable and people always lose their hard-earned money, I always doubted whether I should also park my money elsewhere and not in the market.

My First Emotional Investing Mistake

Leading to self-doubt, I once sold some of the stakes in a fund which I had just started. I did not analyse whether I was doing good or bad. I just sold because for a couple of months it was not yielding good returns and was lagging behind some other funds.

But later, I learnt that if you choose a good fund, you must stick to it for at least 3 years. Short-term ups and downs of the market should not influence investment decisions.

It has been almost 15 years now, and today when I checked, that same fund — although its name has changed — has delivered over 16.25% returns in the last 10 years.

Why I Had to Switch Mutual Funds Multiple Times

I started my first SIP in 2010 through a demat account. And by 2013, direct funds were introduced, so I switched my funds from regular to direct. Direct funds have benefits over regular funds in terms of long-term returns. I will write a separate post on direct vs regular funds.

However, in most cases, I switched funds when the following situations arose:

Performance Not as Expected

You should know that you can’t switch funds from one AMC to another; you can only switch funds within the same AMC. So, as I already mentioned above, when you start investing in a fund after analysing it, you have to stay invested for at least three years.

So sometimes, when a fund did not perform as I expected, or when it was continuously lagging behind its peers, I switched from one fund to another.

High Expense Ratio Compared to Peers

Why should I pay higher expenses when I can get better deals elsewhere? So many times, I changed funds after comparing their performance and expense ratios with those of similar funds in the same category.

One Bad Switch That Cost Me Time

Switching is costly. It is like making a new investment. And the charges that come with first-time investing also apply to switching. So, switching must always be done with thorough analysis and by carefully comparing the pros and cons.

Once, I accidentally switched from a fund that was not performing as per expectations to a regular fund in a hurry, simply because the fund names were similar. So, it is very important that due care is taken while switching. You should always check fund names, category, and type carefully before making a switch.

One Good Switch That Helped Long-Term

Once, I also switched from an ELSS fund that was not performing well. When its units were freed from the three-year lock-in period, I switched those units to a large-cap fund that was performing well. I then stayed invested in that large-cap fund for more than eight years.

That fund has delivered over 15%+ CAGR. While the expense ratio of the fund was slightly higher than the earlier one, considering the returns it delivered, the switch turned out to be a much better long-term decision.

How Salary Hikes & Bonuses Changed My SIP Game

₹500 alone is not going to create a large corpus. This amount is good to test, learn, and build confidence. And once you have gained confidence and learnt how SIPs work, you need to increase your investments. You can calculate how a small investment if done with discipline can yield a good amount in our easy to use SIP calculator.

We get salary raises and bonuses, and these can be fully utilised to increase our investments so that we can retire early or accumulate enough money without falling into debt. If you have been in debt and want to get out of it, then our article on how to get rid of debt can help you out. You can calculate your required retirement corpus at our retirement calculator which is easy to use and let you know how much money you need for a comfortable retirement.

The First Time I Increased My SIP

I increased my SIP amount as soon as I got my first raise after starting SIP. While initially it looked like a risky decision, I compared other investment options and their returns, such as PPF accounts, FDs, ULIPs, Kisan Vikas Patra, and LIC policies, and I found that a good SIP investment can deliver better long-term returns than most of them.

I got a 10% raise that year. That translated to ₹2,200 extra every month, which I could invest comfortably. I also received a 20% bonus, which added over ₹25,000 to my investable amount.

I increased my SIP by ₹2,500. And then this process continued year after year with salary hikes and bonuses.

My First Bonus Lumpsum Mistake

Increasing SIP investments is a good thing. But often, we unknowingly make mistakes, and I did the same with one of my lump-sum investments received as a bonus.

I invested the entire amount at once. After some time, the market started going down.

I later realised that I could have bought more units at the same price if I had preferred SIP over lump-sum investment.

One Boring Bonus Investment That Actually Worked

Once, my lump-sum bonus went into an index fund, which as of now has delivered 14.5% CAGR, and I have been holding that investment for the last 11 years.

However, I have always preferred SIPs over lump-sum investments. And whenever I received a lump sum, I mostly invested it in an index fund and preferred STP instead of investing the entire amount at once.

Over time, my SIP investments have beaten lump-sum investments by a huge margin in most cases.

Market Crashes I Lived Through Without Stopping My SIP

Markets never go up or down in a straight line. And I have learnt this with my experience.

And my experience tells me that when the market goes down, it is actually a good opportunity for someone who invests through SIP, because it gives you a chance to buy the same units at a lower price. This is something I understood only after living through multiple market cycles.

My First Real Market Crash Experience

Well, I had already seen markets at their lowest point in March 2009. And I also saw how the market recovered after that. But when you are investing in the market and everybody around you is not doing it or not recommending it, you also stay in fear—and that is natural. In fact, none of us want to see ourselves in loss.

But when you invest in the market, you must be ready for the ups and downs. In fact, for a couple of years, you may see your portfolio not performing well or even staying in negative. This phase tests your patience more than your knowledge.

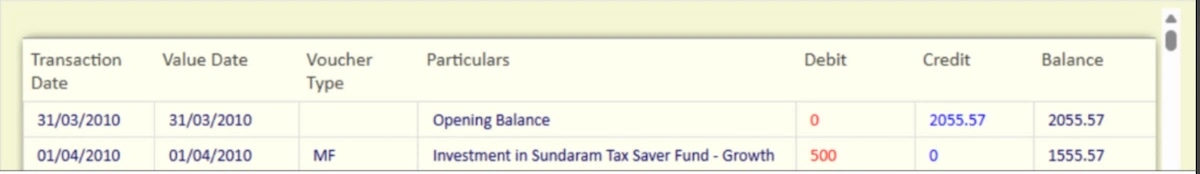

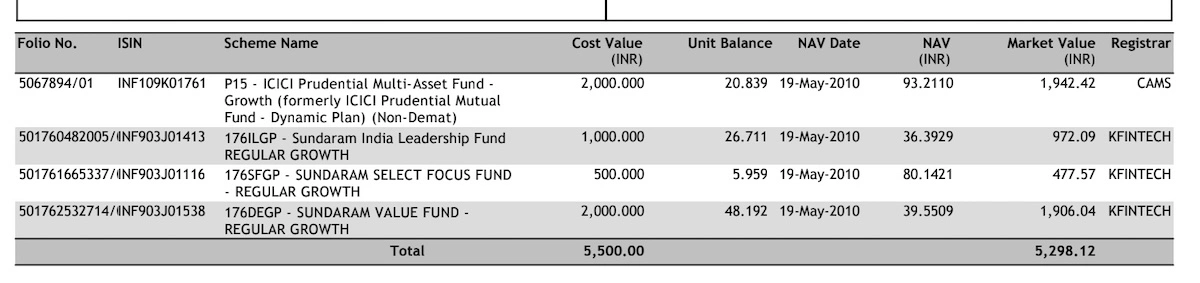

Here is an example when the market went down 2.77% in a single day on 19th May 2010, just a few months after I started investing.

Look at the portfolio below—even after investing for more than a year, my portfolio was running sideways. Such phases often demotivate investors to continue, but they are short-term in nature. This may happen to anyone.

The major crash I witnessed while actively investing came during the COVID period. And that was horrible. The speed and intensity of the fall were something I had never seen before.

For that, I will cover it in a separate post in detail. But I would like to say that seeing your portfolio fall by 30% or more in a single month looks extremely shocking.

The Phase When I Truly Wanted to Stop My SIP

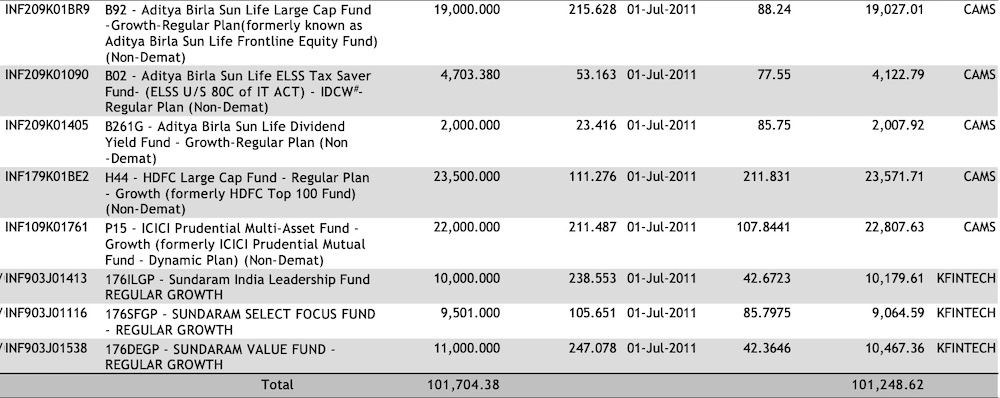

Look at the portfolio below—even after investing for more than one year, my portfolio was in the negative.

- Total investment: ₹1,01,704.38

- Portfolio value: ₹1,01,248.62

And in such moments, when you read articles saying that during the same period FDs or other investment products have given good returns, you start doubting your own investments. You begin to question whether you made the right choice.

Such moments truly provoke us to stop investing. This is where most investors exit and regret later.

Why I Continued Even When Nothing Looked Good

After investing for over a year, I learned that NAV goes up and down, and this is normal. But when I compared long-term market behavior, I found that if I continued investing, then when the market or the economy booms, the overall market would jump and give me good returns.

I also formed a habit of investing, and daily checking of NAV made the journey more engaging. Over time, discipline became more important than emotions.

Also, my long-term goal of retiring rich motivated me to continue—even when nothing looked like it was working.

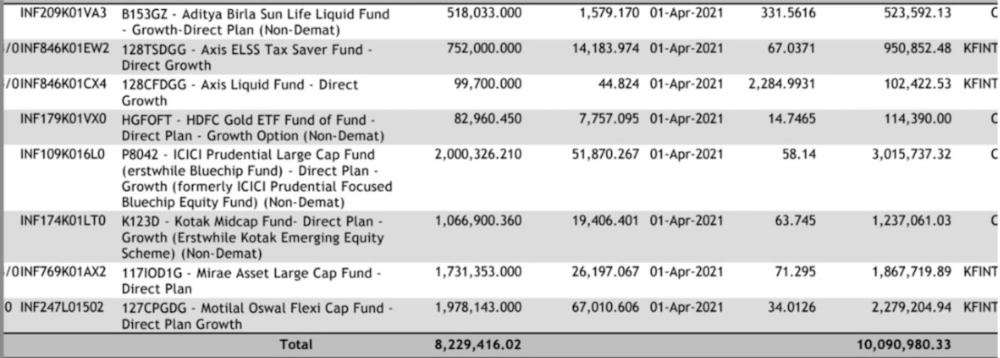

When My Portfolio Finally Crossed ₹1 Crore (April 2021)

The exact moment I saw ₹1,00,00,000.

And now the day came for which I had been waiting for the last 11 years. Finally, I became a crorepati by investing through SIPs.

Date: 01.04.2021

Total portfolio value: ₹1,00,90,980.33

It was truly a wow moment for me. Being a crorepati was a big achievement for me personally, and I think it is the same for all of us who start small and try to improve our financial life through discipline and patience.

What made this moment special was not just the number, but the journey behind it.

Why This Was Not a Sudden Jump

This milestone came with many ups and downs of the market. There were times when I wanted to quit. There were times when I wanted to stop my SIPs and withdraw whatever I had invested. Fear, doubt, and frustration were all part of this journey.

But finally, with determination, staying invested, and the magic of compounding, I reached a place where many of us only dream of reaching. This did not happen overnight—it happened slowly, quietly, and consistently.

Why My “Total Invested” Looks Higher Due to Switching

Why My Statement Shows ~₹82 Lakh Instead of Actual ~₹36 Lakh

In the account statement, you may notice that the total invested amount appears to be around ₹82 lakh.

But this figure is shown after consolidation, and it can be misleading if you don’t understand how mutual fund statements work.

Whenever I switched funds, changed funds, or sold one fund and reinvested the proceeds into another fund, each such transaction is treated as a fresh investment in the statement. This inflates the “total invested” number over long periods.

However, the actual money invested by me during this entire period was around ₹36 lakh, which roughly translates to an average SIP of about ₹27,000 per month, starting from just ₹500 per month initially.

The overall CAGR achieved is approximately 17%, which clearly shows the power of long-term SIP investing combined with compounding.

I received many queries on Reddit where people were confused after seeing the invested amount of ₹82 lakh. Some of them even felt that the returns were not very rewarding at first glance. This confusion is very common among long-term investors who actively rebalance their portfolios.

But when they came to know that this journey started with a ₹500 SIP, which gradually increased to around ₹27,000 per month, and that the actual invested amount was much lower, they felt genuinely excited.

For example, I had investments in ICICI Prudential Dynamic Fund – Direct Plan, which I later switched to ICICI Prudential Large Cap Fund.

Similarly, I had invested in HDFC Top 200 Fund, which I sold and reinvested the proceeds into Mirae Asset Large Cap Fund and Kotak Mid Cap Fund.

And every time such proceeds were reinvested, they were counted as a fresh investment in the statement. This is the reason why long-term investors who rebalance their portfolios often see a much higher “total invested” figure than their actual cash outflow.

What My 11-Year SIP Journey Taught Me (Real Lessons Only)

Here are some of the best lessons I have learned—and they are not from any books, but from my own experience.

- Investing in mutual funds through SIP is one of the best ways to participate in the equity markets because it provides the flexibility to start investing with a very small amount. This makes SIP suitable even for beginners.

- In the short term, when you look at SIP returns, you may often feel, “Why am I even doing this?” But in the long run—I mean 8+ years—you will either feel that you should have started much earlier or you will thank yourself for staying consistent.

- Don’t emotionally buy or sell your mutual funds. Give them at least 3 years to perform. Markets need time to reward patience.

- Don’t blindly follow star ratings from third-party websites. Often, they reflect short-term performance and do not capture how a fund behaves in the long run.

- Don’t sell when you see a sudden drop in the market. In fact, if you have selected good funds, buying during market dips can be rewarding over time.

- If you’re not comfortable with equity mutual funds, you can start with index funds. They are also good options to participate in equity markets with relatively less decision-making.

- Learn about mutual funds—how they work and how to choose them. Once you understand this, it becomes much easier to make confident decisions.

- Always do your own research. Never rely completely on anybody else for your investments. Conviction matters more than opinions.

- Keep increasing your SIP amounts whenever you get opportunities to do so. Income growth should translate into investment growth.

- Don’t invest money that you can’t spare, or else you will be forced to cash out during emergencies, which will defeat the purpose of long-term investing.

- Keep learning.

FAQ on ₹500 SIP to ₹1 Crore in 11 Years

1. Can a ₹500 SIP really grow into ₹1 crore?

Yes, if you start with a ₹500 SIP and keep increasing it gradually whenever your income rises, and if you select good mutual funds, then this small amount can grow into ₹1 crore. It does not happen in a lifetime, but much earlier than most people expect.

I am a living example of this journey. I started small, stayed invested through market ups and downs, and consistently increased my SIP over time.

2. How long did it take to reach ₹1 crore through SIP?

I achieved it in 11 years. However, this timeline can vary. If you invest more over time and choose good mutual funds, you may reach this amount earlier than I did.

What was your average monthly SIP amount over these 11 years?

It was approximately ₹27,000 per month. This is an average figure, as I started with a very small SIP of ₹500 and gradually increased it over the years as my income grew.

3. What CAGR did you achieve in this journey?

It was approximately 17.2%.

4. Did you ever stop or pause your SIP during market crashes?

No, I did not completely stop my SIPs. However, I did pause SIPs in some funds after comparing their performance and finding that other funds were performing better under the same economic conditions.

5. Is switching mutual funds bad for long-term SIP investors?

It depends on the fund. If you observe that a fund is consistently underperforming for 3 years or more, while other comparable funds are performing well under the same economic conditions, then switching can be a reasonable decision.

The article is based on my personal experience. It is not any investment advice.