I bought my first mutual fund in 2010—and yes, it was through SIP.

I’ve already written a detailed post about my journey from a ₹500 SIP to ₹1 crore.

Back then, I invested through my demat account. Buying mutual funds directly from the AMC wasn’t really an option.

If you wanted to invest in mutual funds, you had to go through a distributor or a broker. There was nothing clearly defined as Direct or Regular mutual fund plans—or if it existed, I honestly didn’t know about it.

The first time I heard about Direct Mutual Fund plans was in 2013, when they were officially introduced. In fact, some of my existing schemes were automatically converted to direct plans.

At that time, I had no clue what a direct plan really was, how it worked, or how much difference it could make in the long run.

How I Started Investing in Mutual Funds (Without Knowing Plan Types)

In January 2010, I was working in a company that was going to offer stock options. To be eligible, I needed a demat account. Since the shares were being offered at a much lower price than the issue price, and the company looked good, I believed the stock would increase in value over time. So, I opened a demat account.

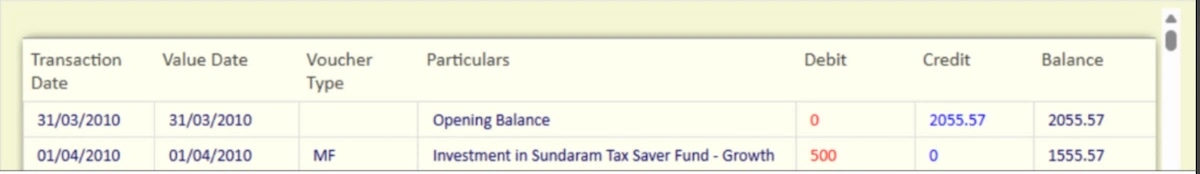

Back then, investing in mutual funds was mainly done through demat accounts. At the same time, I was also looking for ways to save tax. So I started investing in a tax-saving mutual fund — Sundaram Tax Saver Fund.

I chose this fund simply because it had performed very well in the previous year and, if I remember correctly, it was among the top funds in the tax-saving category at that time.

I had no knowledge back then about expense ratios, exit or entry loads, or how mutual fund performance should actually be assessed. I was starting with zero knowledge and without any recommendation from anyone.

I just searched for tax-saving mutual funds online, found a website, checked which fund was on top, and invested.

At that time, there was no awareness for me about regular or direct mutual fund plans. So naturally, they didn’t matter to me then.

Also, unlike today’s account statements where it is clearly mentioned whether a fund is direct or regular, back then my fund name appeared simply as “SUNDARAM TAX SAVER – (OPEN ENDED) – GROWTH.”

As you can see, there was no mention of a direct plan or a regular plan at all.

What Regular Mutual Funds Actually Are?

When I buy mutual funds from agents or intermediaries, and not directly from the AMC, those plans come under the regular mutual fund category.

This is because these plans come with added costs, as AMCs have to pay commissions to agents and intermediaries for selling their schemes.

You can see this difference reflected in the NAV of the scheme. The NAV of a regular mutual fund plan is often lower than the direct plan of the same scheme.

For example, I have Mirae Asset Large Cap Fund – Direct Plan, and the NAV of the scheme on 28.01.2026 was ₹128.5590. The NAV of the regular plan of the same scheme was ₹112.5750.

This difference between the NAV of direct and regular plans is mainly due to commissions paid to agents and distributors, and these commissions are ultimately paid from the pocket of investors.

But often, people still end up buying regular plans because these are the plans that are advertised and recommended by agents and intermediaries.

What Direct Mutual Funds Are and How They Differ?

When I buy mutual funds directly from the AMC, those plans come under direct mutual fund plans. This is because AMCs do not have to pay any commissions to agents or distributors.

Here is an example. I bought a mutual fund scheme directly from Kotak, and the name of the scheme is Kotak Midcap Fund – Direct Plan. It is a direct plan because there is no intermediary involved.

One important thing to note is that there is no difference in the fund composition or holdings between a direct plan and a regular plan. The only difference lies in the expense ratio and the NAV.

For example, the expense ratio of my Kotak Midcap Fund – Direct Plan is 0.37%, while the expense ratio of the regular plan is 1.38%, which is about 1% higher. (As on Dt. 29.01.2026)

If we compare the NAV of both plans:

Direct plan NAV: ₹152.3160

Regular plan NAV: ₹130.8810

Now you can clearly see that the only real difference between direct and regular plans is the charges. Over the long run, this difference can significantly impact the returns of the fund, which I will compare in the coming section.

SEBI Circular That Introduced Direct Mutual Fund Plans (2012)

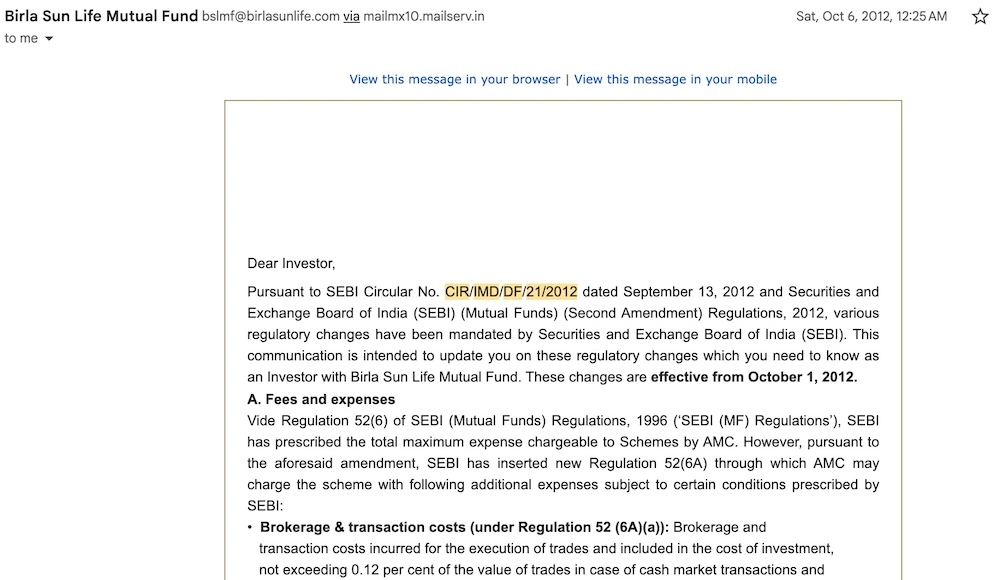

In 2012, one day I received an email from an AMC about significant changes in mutual fund expenses, which directly impacted the outcome of mutual fund returns.

This email mentioned SEBI Circular No. CIR/IMD/DF/21/2012 and the forthcoming changes that all AMCs were required to follow. This circular marked the beginning of Direct Mutual Fund Plans, which were introduced to investors from January 2013.

These regulations led to the creation of two separate NAVs for the same mutual fund scheme—one with intermediary-related charges and the other without them.

This made investing in mutual funds more flexible for investors who could track their investments and buy directly from the AMC.

Below is the exact communication I received from the AMC.

At that time, I did not realise that this email was pointing towards the introduction of Direct Plans in mutual funds. Only now, looking back, can I connect the dots and understand its significance.

How Much Difference Does It Really Make Over the Long Term if You Buy Direct Plan Over Regular Plan

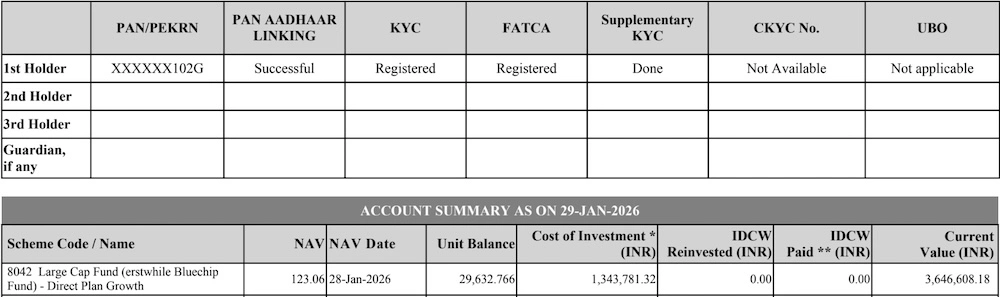

While I do not have any regular plans in my mutual fund portfolio, I will explain here using expense ratio and NAV differences how much I could have lost if I had stayed with a regular plan. I will take an example of the ICICI Prudential Large Cap Fund – Direct Plan, which I have been owning since 2013.

For the regular plan, the NAV is ₹111.7300, and the 10-year return is 15.35%.

For the direct plan, the NAV is ₹123.0600, and the 10-year return is 16.16%.

Now, let us do some simple mathematics using a SIP calculator.

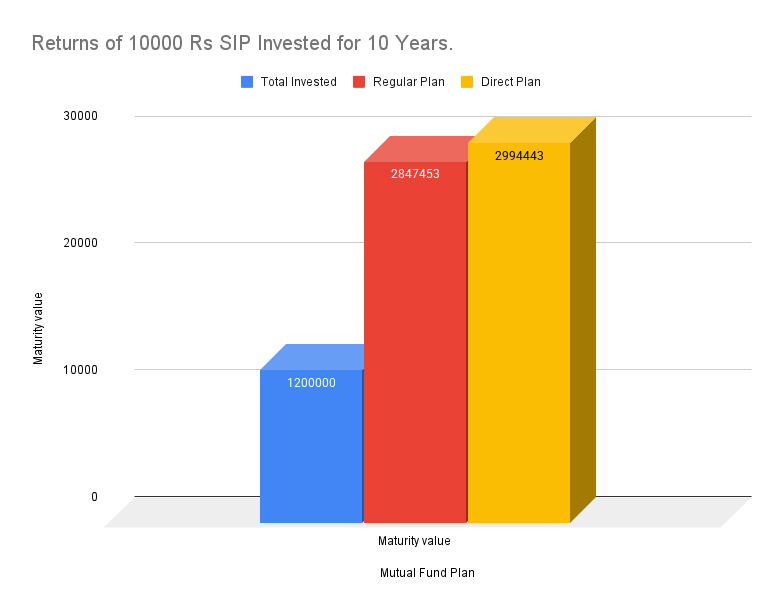

With a ₹10,000 SIP in both the regular plan and the direct plan of ICICI Prudential Large Cap Fund:

Total invested in 10 years: ₹12,00,000

Maturity value of the regular plan: ₹28,47,452.56

Maturity value of the direct plan: ₹29,94,442.68

The difference comes to ₹1,46,990.

So, in 10 years, I could have lost more than ₹1,46,990 to higher charges, which I could have used to fund one full year of travel. Isn’t that significant?

Now imagine this difference over a much longer period, say 30 years of investing. Here are the numbers:

With the direct plan, the maturity value comes to ₹9,21,35,134.30, and with the regular plan, the maturity value comes to ₹7,60,92,233.12. That is a huge difference of ₹1,60,42,901.

And this is with just a ₹10,000 SIP. If you invest more than ₹10,000, the difference will be even larger.

In such cases, a significant part of your returns goes towards commissions, while you continue to take all the investment risk. That is something worth thinking about.

Should Everyone Switch from Regular to Direct Plans?

So you might be thinking now, why should I even have regular plans?

Why should I pay someone to buy a fund which I could easily buy directly from the AMC and earn better returns over time? I felt exactly the same when I first learnt the difference between direct and regular plans.

However, you should carefully analyse whether switching from regular plans to direct plans actually makes sense for you. Switching is treated as selling one fund and investing in another, which means it can attract taxes and other charges.

Also, if you hold ELSS funds, you cannot switch all units immediately, because each investment comes with a lock-in period of three years from the date of purchase.

So, first review your existing funds and understand the charges involved, and only then take a decision that best suits your requirements. That said, owning direct plans will generally be better than owning regular plans of the same fund, provided you are comfortable managing them yourself.

What I Did After Understanding the Difference

When I learnt about the difference, one thing immediately came to my mind — why should I pay higher charges for the same funds when I can buy them directly from the AMCs?

Back then, I was buying my mutual funds through an SBI Cap demat account. Over time, I realised that it did not really guide me in any meaningful way. It frequently sent fund-related messages and mostly came with recommendations to invest in NFOs or other funds, which I did not actually need.

I could not justify even a single reason why I should continue with regular plans instead of direct plans.

So, I started learning more about mutual funds so that I could build my own portfolio of direct plans. I planned the switch carefully, after considering all the charges and tax implications that could apply.

Common Myths About Direct vs Regular Mutual Funds

When I first learnt about direct plans, the following things came to my mind, and I think many new investors may also think the same.

I thought direct plans may be risky because they do not have any agents. I believed that the agent may be responsible for the good performance of the funds. Looking back, this sounds silly.

I also thought if I don’t buy from an agent, then from whom will I buy? I even worried that the units I bought might get lost.

I further thought that buying directly from the AMC would be time-consuming and that I would have to visit offices and talk to people, which would not serve the purpose. I had many similar doubts at that time.

I also thought agents keep tracking the fund and will update me from time to time. In reality, my agent or intermediary was mostly recommending new funds to invest in, which were not aligned with my goals.

Frequently Asked Questions: Direct vs Regular Mutual Funds

1. Is direct Mutual funds better than regular mutual funds?

In my experience, direct plans are better than regular plans because they may yield better returns over the long run due to lower expenses, which are ultimately paid from the investors’ own pockets.

2. Can I switch anytime from one fund to another?

You can switch from one fund to another within the same AMC if it is not an ELSS fund, because ELSS funds come with a lock-in period of 3 years from the date of investment.

3. Do direct plans give higher returns?

As I have already explained in the above example, the returns tend to be better in direct plans. So yes, direct plans give better returns because of lower expense ratios, and this difference is reflected in the NAVs over time.