IPO Allotment Status – Check Online on NSE, BSE & Registrar Websites

IPO allotment status shows whether you have been alloted the shares of the IPO or not. Because when the issue is open for subscription, you make an application to get the shares of the IPO. But by only applying does not mean you will definitely get the shares. Usually, there is a fixed number of shares for each category, and if the IPO is oversubscribed, the chances of getting the shares are decided through a lottery system as part of the IPO allotment process. So, it is important to check the IPO allotment status after subscription.

And If you successfully get shares, they will be credited to your demat account on a pre-fixed date. And if you don’t get any allotment, your blocked amount will be released/refunded back to your account. So, no allotment simply means you get no shares, and your money is returned.

You can check allotment status of an IPO online a few days after the subscription period ends. You can check the allotment on the NSE or BSE websites, or on the registrar’s websites' page of IPO allotment Link Intime or IPO allotment KFintech page, depending on which registrar is handling the issue. You can find the details of how to check ipo allotment status on these website below.

Updated on: 30.01.2026 |2:28 PM

IPO Name | Issue Price | Date of Allotment | Registrar | Status Link |

|---|---|---|---|---|

₹102 – ₹108 | February 11, 2026 | Bigshare Services Pvt. Ltd | ||

₹83 – ₹88 | February 9, 2026 | Maashitla Securities Pvt.Ltd | ||

₹155 – ₹163 | February 4, 2026 | Bigshare Services Pvt. Ltd | ||

₹73 | February 2, 2026 | Kfin Technologies Ltd. | ||

₹116 – ₹123 | February 2, 2026 | Maashitla Securities Pvt. Ltd | ||

₹52 – ₹55 | February 9, 2026 | Skyline Financial Services Pvt. Ltd | ||

₹61 – ₹64 | January 30, 2026 | Bigshare Services Pvt. Ltd | ||

₹122 – ₹129 | February 2, 2026 | Kfin Technologies Ltd | ||

₹67 – ₹70 | January 28, 2026 | Bigshare Services Pvt. Ltd | ||

₹140 – ₹144 | January 28, 2026 | Kfin Technologies Ltd. | ||

₹98 – ₹104 | January 23, 2026 | Kfin Technologies Ltd. | ||

₹118 – ₹124 | January 23, 2026 | Kfin Technologies Ltd. | Allotment status Check | |

₹128 – ₹135 | January 27, 2026 | Skyline Financial Services Pvt. Ltd | ||

₹40 – ₹47 | January 21, 2026 | Bigshare Services Pvt. Ltd. | ||

₹55 – ₹57 | January 20, 2026 | Skyline Financial Services Pvt Ltd. | ||

₹343 – ₹361 | January 19, 2026 | MUFG Intime India Pvt.Ltd | ||

₹149 | January 16, 2026 | Kfin Technologies Ltd | ||

₹515 | January 16, 2026 | Kfin Technologies Ltd | ||

₹70 – ₹74 | January 14, 2026 | Maashitla Securities Pvt. Ltd | ||

₹100 – ₹105 | January 21, 2026 | Maashitla Securities Pvt. Ltd | ||

₹56 – ₹59 | January 15, 2026 | Integrated Registry Management Services Pvt. Ltd. | ||

₹21 – ₹23 | January 14, 2026 | Kfin Technologies Ltd | ||

₹41 | January 12, 2026 | Maashitla Securities Pvt. Ltd | ||

₹168 – ₹174 | January 12, 2026 | MAS Services Ltd | ||

₹76 – ₹81 | January 9, 2026 | Kfin Technologies Ltd | ||

₹85 – ₹90 | January 5, 2026 | MUFG Intime India Pvt.Ltd | ||

₹164 – ₹174 | December 31, 2025 | MUFG Intime India Pvt.Ltd | ||

₹177 – ₹186 | December 29, 2025 | Maashitla Securities Pvt.Ltd | ||

₹120 – ₹126 | December 29, 2025 | Bigshare Services Pvt.Ltd. | ||

₹123 – ₹130 | December 29, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹81 – ₹86 | December 26, 2025 | Cameo Corporate Services Ltd | ||

₹209 – ₹220 | December 29, 2025 | Bigshare Services Pvt.Ltd | ||

₹95 – ₹97 | December 26, 2025 | Bigshare Services Pvt.Ltd | ||

₹227 – ₹239 | December 29, 2025 | Maashitla Securities Pvt.Ltd. | ||

₹100 – ₹102 | December 26, 2025 | Bigshare Services Pvt.Ltd. | ||

₹108 – ₹114 | December 26, 2025 | MUFG Intime India Pvt.Ltd | ||

₹98 | December 23, 2025 | Bigshare Services Pvt.Ltd. | ||

₹88 to ₹93 | December 22, 2025 | Maashitla Securities Pvt.Ltd | ||

₹74 to ₹78 | December 22, 2025 | Kfin Technologies Ltd. | ||

₹65 to ₹70 | December 26, 2025 | Bigshare Services Pvt.Ltd | ||

₹30 | December 17, 2025 | Purva Sharegistry (India) Pvt.Ltd | ||

₹365 to ₹384 | December 19, 2025 | MUFG Intime India Pvt.Ltd | ||

₹83 to ₹88 | December 17, 2025 | Maashitla Securities Pvt.Ltd | ||

₹94 to ₹96 | December 16, 2025 | Purva Sharegistry (India) Pvt.Ltd | ||

₹2,061 – ₹2,165 | December 17, 2025 | Kfin Technologies Ltd. | ||

₹135 to ₹142 | December 17, 2025 | Bigshare Services Pvt.Ltd | ||

₹12 | December 15, 2025 | Cameo Corporate Services Ltd | ||

₹63 to ₹65 | December 15, 2025 | Kfin Technologies Ltd | ||

₹112 to ₹118 | December 16, 2025 | Bigshare Services Pvt.Ltd | ||

₹154 to ₹162 | December 15, 2025 | Kfin Technologies Ltd | ||

₹126 | December 18, 2025 | Bigshare Services Pvt.Ltd | ||

₹438 – ₹460 | December 15, 2025 | Kfin Technologies Ltd | ||

₹227 to ₹239 | December 11, 2025 | GYR Capital Advisors Pvt.Ltd. | Check allotment | |

₹95 to ₹100 | December 11, 2025 | Maashitla Securities Pvt.Ltd | ||

₹131 to ₹138 | December 11, 2025 | MUFG Intime India Pvt.Ltd | ||

₹1008 – ₹1062 | December 11, 2025 | Bigshare Services Private Limited | ||

₹190 to ₹194 | December 10, 2025 | Maashitla Securities Pvt.Ltd | ||

₹185 – ₹195 | December 11, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹101 to ₹107 | December 10, 2025 | MUFG Intime India Pvt.Ltd | ||

₹181 to ₹191 | December 10, 2025 | Bigshare Services Pvt.Ltd. | ||

₹90 | December 8, 2025 | MAS Services Ltd | ||

₹56 | December 9, 2025 | Skyline Financial Services Pvt.Ltd | ||

₹78 to ₹82 | December 9, 2025 | MAS Services Ltd | ||

₹118 – ₹124 | December 8, 2025 | Kfin Technologies Ltd | ||

₹48 - ₹52 | December 8, 2025 | MUFG Intime India Pvt.Ltd | ||

₹105 – ₹111 | December 8, 2025 | Kfin Technologies Ltd | ||

₹110 to ₹118 | December 5, 2025 | Maashitla Securities Pvt.Ltd | ||

₹63 | December 4, 2025 | Bigshare Services Pvt.Ltd. | ||

₹52 to ₹56 | December 4, 2025 | MUFG Intime India Pvt.Ltd | ||

₹93 to ₹98 | December 5, 2025 | MUFG Intime India Pvt.Ltd | ||

₹125 to ₹132 | December 4, 2025 | Bigshare Services Pvt.Ltd | ||

₹80 – ₹85 | December 4, 2025 | Bigshare Services Pvt.Ltd | ||

₹183 to ₹193 | December 3, 2025 | MAASHITLA SECURITIES PRIVATE LIMITED | ||

₹133 to ₹140 | December 3, 2025 | GYR Capital Advisors Pvt.Ltd | Check allotment | |

₹120 to ₹126 | December 3, 2025 | Maashitla Securities Pvt.Ltd | ||

₹123 to ₹130 | December 4, 2025 | Kfin Technologies Ltd | ||

₹111 to ₹117 | December 1, 2025 | Bigshare Services Pvt.Ltd. | ||

₹36 to ₹38 | December 1, 2025 | MUFG Intime India Pvt.Ltd | ||

₹114 to ₹121 | November 28, 2025 | Bigshare Services Pvt.Ltd. | ||

₹563 – ₹593 | November 26, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹142 – ₹150 | November 24, 2025 | Ankit Consultancy Pvt.Ltd. | ||

₹114 – ₹120 | November 24, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹549 – ₹577 | November 19, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹216 – ₹228 | November 18, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹378 – ₹397 | November 17, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹200 – ₹204 | November 14, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹206 – ₹217 | November 14, 2025 | Kfin Technologies Ltd | ||

₹103 – ₹109 | November 14, 2025 | MUFG Intime India Pvt.Ltd | ||

₹108 – ₹114 | November 14, 2025 | Kfin Technologies Ltd | ||

₹210 – ₹221 | November 12, 2025 | Kfin Technologies Ltd | ||

₹114 | November 12, 2025 | Maashitla Securities Pvt.Ltd | ||

₹120 – ₹128 | November 12, 2025 | MUFG Intime India Pvt.Ltd | ||

₹95 – ₹100 | November 10, 2025 | MUFG Intime India Pvt.Ltd | ||

₹140 – ₹142 | November 11, 2025 | Skyline Financial Services Pvt.Ltd. | ||

₹557 – ₹585 | November 4, 2025 | MUFG Intime India Pvt.Ltd | ||

₹382 – ₹402 | November 6, 2025 | MUFG Intime India Pvt.Ltd | ||

₹102 | November 3, 2025 | MUFG Intime India Pvt.Ltd | ||

₹695 – ₹730 | November 3, 2025 | Kfin Technologies Ltd | ||

₹96 – ₹102 | October 31, 2025 | Skyline Financial Services Pvt.Ltd | ||

₹120 – ₹125 | November 10, 2025 | MUFG Intime India Pvt.Ltd | ||

₹116 – ₹122 | October 30, 2025 | Kfin Technologies Ltd | ||

₹1014 – ₹1065 | October 20, 2025 | Kfin Technologies Ltd | ||

₹66 | October 15, 2025 | Bigshare Services Pvt.Ltd | ||

₹100 – ₹106 | October 15, 2025 | Kfin Technologies Ltd | ||

120 - 127 | October 15, 2025 | Maashitla Securities Pvt.Ltd | ||

₹253 – ₹266 | October 14, 2025 | MUFG Intime India Pvt.Ltd. | ||

₹461 – ₹485 | October 14, 2025 | MUFG Intime India Pvt.Ltd | ||

₹136 – ₹143 | October 10, 2025 | Bigshare Services Pvt Ltd | ||

₹1080 – ₹1140 | October 10, 2025 | KFin Technologies Limited | ||

₹615 – ₹648 | October 8, 2025 | MUFG Intime India Private Limited |

How to Check IPO Allotment Status

IPO allotment status can be checked online on the official websites of stock exchanges, for example, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). It can also be checked on the website of the registrar of the issue.

Here is the step by step guide to check at NSE & BSE.

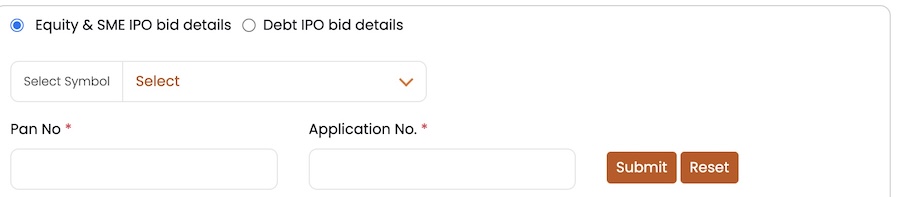

How to Check IPO Allotment Status on NSE

Open the link: https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids

You will find out the screen like below.

Now select the name of the IPO, and then enter your PAN No and Application No and click submit. Once you submit, your allotment status will be shown.

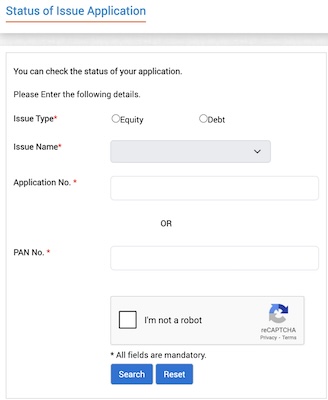

How to Check IPO Allotment Status on BSE

Open the link: https://www.bseindia.com/investors/appli_check.aspx

You will see the following screen.

Check the issue type- Equity (in this case)

And then chose the issue name,

Once you have chosen the issue name, you can either check through the application number or the PAN number. Once you fill up the details correctly and click on search, your allotment status will be shown up on the screen.

Many investors search for IPO allotment status Link Intime because MUFG Link Intime acts as the registrar for a large number of Indian IPOs. Get here step-by-step guide to checking allotment on the Link Intime (MUFG). And for the investors who has to check ipo allotment status at bigshare can followed

IPO allotment status can be checked after the subscription period ends, which is usually 1–3 days after the end of the subscription period.

The registrars for the issues can be different, and therefore, the links to check the allotment status will also be different.

In the above table, the links have been given for each IPOs to check. Below are the guides to check IPO allotment status with different registrars of the issues.

1. Step by step guide to check IPO allotment status at Bigshare

2. Step by step guide to check IPO allotment status at Kfintech

IPO Allotment Timeline

The issue is open for subscription (1–3 days). Once the subscription period is over, the shares are allotted to subscribers after considering the total number of shares available and the total number of applications received category-wise. This usually takes 2–4 working days after the end of the subscription period.

After the allotment, the money is returned to those who did not get the shares. This is usually done the next working day after the allotment. Those who have successfully received shares usually get them credited to their Demat accounts on the same day or the next working day.

Normally, the issue gets listed on the next working day after the shares are credited to the Demat account. However, as per SEBI guidelines, the issue has to be listed within 6 working days from the IPO closing date.

Recent IPO Allotment Trends (Insights)

The market has turned into an IPO frenzy. There are days when more than 2–3 IPOs are opening for subscription. And the good thing is, most of these IPOs are getting a good response from all types of investors.

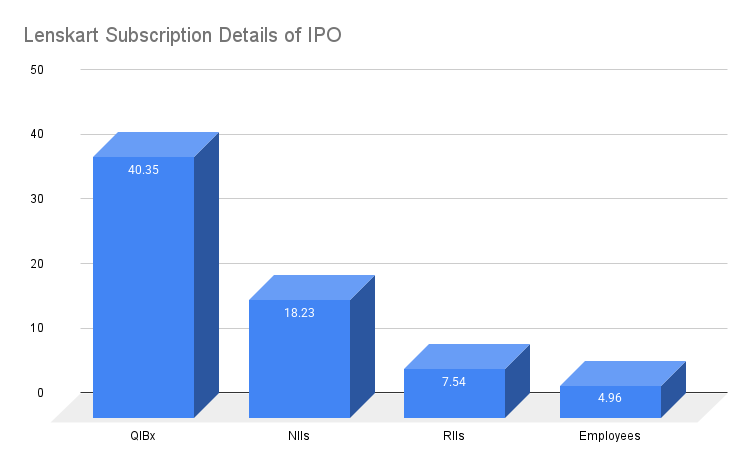

For example, Lenskart IPO was subscribed 28.26x, which means for every 1 share, there were more than 28 applications.

Orkla India Limited IPO got subscribed by 48x, meaning for every share there were more than 48 applications.

Midwest Limited IPO was even subscribed 87.89x — these are some of the mainboard IPOs.

And this subscription trend is not limited to the mainboard IPOs. The SME IPOs are also getting strong subscription rates.

For instance, Shyam Dhani Industries Limited got subscribed by 988x on NSE SME Platform.

So, both mainboard as well as SME IPOs are witnessing strong investor interest despite market corrections.

Here is a quick breakdown of category-wise subscription: For Lenskart IPO

- QIB section: over 40x

- NIIs: over 18x

- Retail investors: 7.54x

Each category has participated well above the issue size, pointing towards a solid response from all types of investors.

But what does that mean? Will everybody get the shares?

Definitely not. With such huge subscription numbers, the chances of getting allotment for each investor are close to nil. But that doesn’t mean you shouldn’t subscribe.

Allotment and Listing Connection

Many people assume that with such high participation, the listing gains will be outstanding — but that’s not always the case.

For example:

Orkla India IPO got over 48x subscriptions but the listing gain was only 2.7%.

Lenskart IPO was subscribed 28x, but it was listed 3% below its issue price.

Related IPO RESOURCES

1. Check the IPO calendar for all the upcoming, live, closed and listed IPOs at a place.

2. Check the grey market premium (unofficial and unregulated) price at our gmp hub page.

3. Check the subscription status of all the IPOs at a single place in our subscription hub page.

4. Learn about mutual funds in our mutual fund learning platform.

5. Explore IPOs in explainer form at our infographic hub page.

FAQ for IPO Allotment

1. What is IPO allotment and how does it work?

IPO allotment means issuing shares to the people who have applied for the IPO when it was open for subscription. But applying does not guarantee shares. In IPO allotment, shares are issued based on category-wise subscription. If there are more subscribers than the available shares, then the allotment is done through a lottery system.

2. How to check IPO allotment status online?

You can check IPO allotment status online at the websites of NSE or BSE or on your respective registrar's website. The details of how to check at NSE and BSE are already given above.

3. When is IPO allotment status usually declared after issue close?

It is usually declared after the subscription period ends. Generally, it comes within 1–3 days after the subscription end date. For example, Fujiyama Power Systems Limited IPO subscription will close on 17th November 2025, and the allotment date is on 18th November 2025.

4. What details are required to check IPO allotment status (PAN, Application Number, DP ID)?

You may need any one of the PAN, Application Number, or DP ID, depending on where you are checking. So keep all of them handy.

5. Why am I not getting IPO allotment even after applying?

Only applying for IPO does not ensure that you will get allotted shares. IPO allotment is done based on subscription status. If an issue is subscribed multiple times, then in such cases the allotment follows a lottery system to allot the shares. So, you may or may not get shares even when you apply for it.

6. What happens after IPO allotment is finalized?

After IPO allotment is finalized, you get your shares in your demat account. Once the shares are listed on the stock exchange on the listing day, you can either hold them for the long term or sell them.

7. How to check IPO allotment status on Link Intime website?

Link Intime is now operating as MUFG. You can visit the Link Intime website and check the IPO allotment status after filling out the required details on the platform.

8. How to check IPO allotment status on KFintech website?

You can check the IPO allotment status on KFintech website by visiting the link https://ipostatus.kfintech.com/. Once you are on the KFintech platform, fill up the PAN and company name and check the allotment status. It is that simple.

9. Can I check IPO allotment status on NSE or BSE site?

Yes you can check IPO allotment status on NSE or BSE website by visiting following links, https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids and https://www.bseindia.com/static/investors/application_statuschecksystem.aspx respectively.

10. How many days does it take for shares to be credited after IPO allotment?

It usually takes 1 working day, and in most cases the shares are credited to your Demat account the next day after the allotment. However, sometimes it may take up to 2-3 days depending on processing.

For example, Fujiyama Power Systems Limited IPO's allotment date is 18th November 2025, the credit of shares is expected on 19th November 2025, and the listing date of the issue is 20th November 2025.

11. Do I need to make payment again after getting IPO allotment?

No, you don't need to make any payment after IPO allotment. The amount you had blocked while applying (through ASBA/UPI mandate) will be automatically debited if you get the allotment. If you don’t get the allotment, the blocked amount will be released back to your bank account.

12. How to increase chances of IPO allotment in oversubscribed issues?

There is fixed lot size and number of application you can make against a PAN CARD. So,if you want to increase your chances of getting allotment you can increase your applications by asking your friends or colleagues to apply by their PAN numbers. This way you can increase applications with unique PAN which may increase chances of getting shares.

13. What is the refund process if I don’t get IPO allotment?

If you don't get IPO allotment, your blocked fund is refunded to your account within 1-2 days.

14. Can I check IPO allotment using my PAN number?

Yes, you can check IPO allotment status using your PAN number.

15. What is the difference between registrar IPO allotment status and exchange IPO allotment status?

There is no difference. You can check IPO allotment status at the exchange and at the registrar website. But the registrar publishes the data earlier than the exchange. So, you can check the allotment status earlier on the registrar website than on the exchange.

Other Important Resources:

1. Check our detailed guide on how to get rid of debt to focus more on investing and building real wealth.

2. You can't invest if you don't have money, find out our free course on blogging to make money from your hobbies and things you love to do.

Copyright @ 2025 MrMoneyFrugal

Know Us

Legal & Compliance

Reach Us

Disclaimer: For informational purposes only. Not investment advice. Please do your own research or consult a SEBI-registered advisor.